Remarkable news from China this week. The country, with steady economic growth over the past years, presented its economic plans. Li Keqiang, China’s outgoing prime minister, confirmed a GDP growth target of “around 5%”. Analysts are somewhat surprised by the lack of ambition that emerges from this plan, and the global economy responded quickly. According to the Financial Times, copper, crude oil, and iron ore led global commodity markets lower on Monday due to fears of “uncertain times.” China is the world’s largest consumer of raw materials and vegetable oils.

Last year, the commodity market generated record-high gross profits of more than $115 billion from trading activities, driven by wildly fluctuating energy prices as a consequence of the conflict in Ukraine. According to recent research by Oliver Wyman, a consulting firm, independent trading houses like Trafigura, Vitol, and Glencore were the biggest winners.

Many influential people from the palm oil industry will be in Malaysia until Wednesday during the final days of the Palm Oil Conference (POC). Unlike last year, there may be a little less price action in the next few weeks although it can never be ruled out when someone will throw another bat in the wind.

Tip: Use our free Oils & Fats calculators to make various calculations, such as determining the biodiesel blend rate.

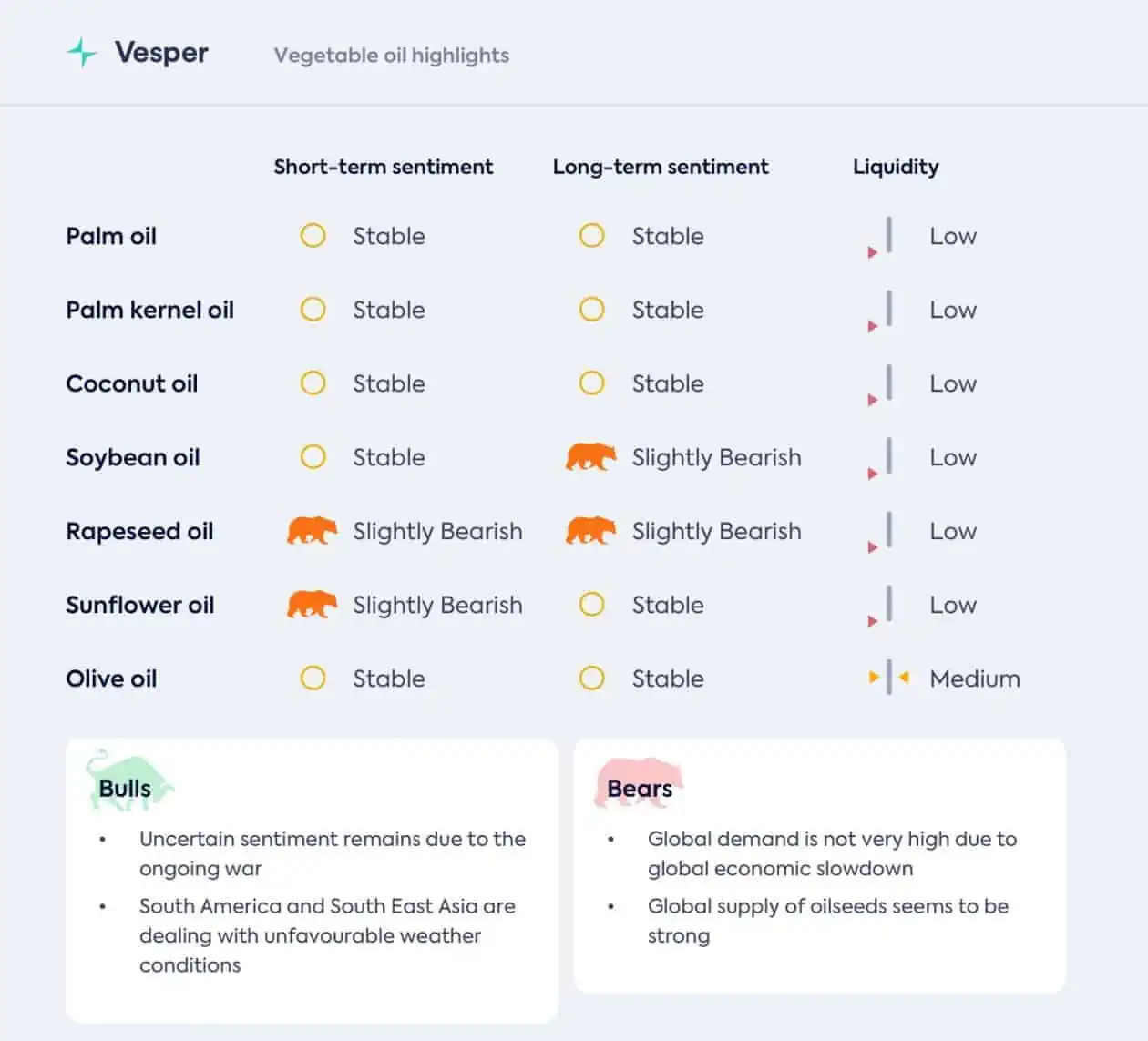

Start a free trial to access the full bi-weekly Vesper Highlights on the Oils & Fats Market.