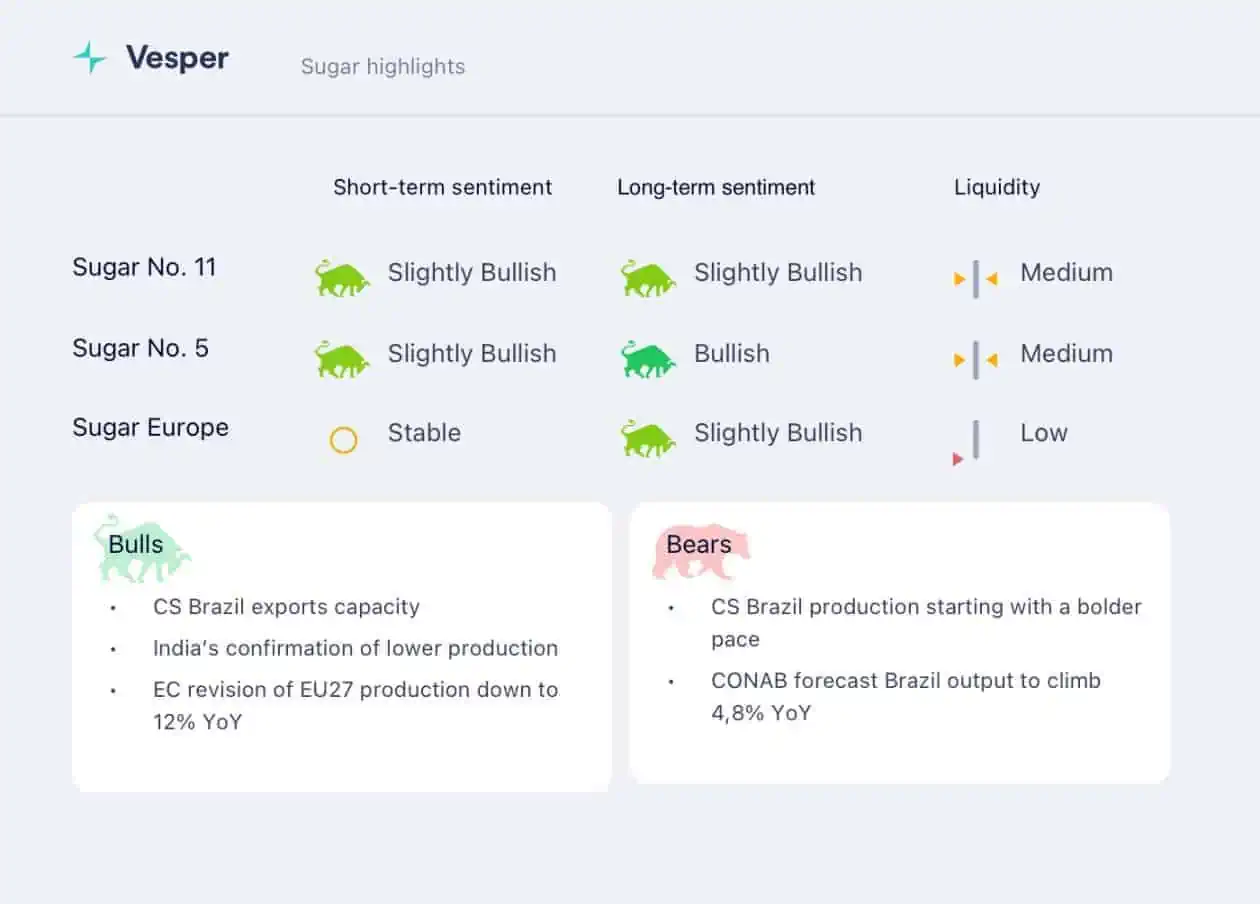

After 5 weeks of hiking sugar prices, it seems that the market was expecting further confirmation on the first production numbers from Center-South Brazil, together with a very optimistic supply forecasted by CONAB released last week with a sugar production climb of 4,8% on year to 38,8 MMT.

Another bearish factor is the Brent crude oil prices that went down over the last week, which undercuts ethanol prices and makes sugar more interesting for the producing mills.

Tip: download our Sugar Buyer’s Guide for new insights!

On the other hand, the market is more pessimistic about the supply surplus for 2022/23 due to disappointing production from regions such as Europe, India, and Thailand. Over the last months, the market has been decreasing its estimate of global surplus to around 1,1 MMT compared to 4 MMT, estimated at the end of last year.

Start a free trial to access the full weekly Vesper Highlights on the global sugar market.