Global sugar markets are under pressure as factors like a strong U.S. dollar, fluctuating crude oil prices, and shifts in production levels impact both futures and prices. Key producing regions are facing supply issues, with Brazil extending its milling season and challenges in India and Europe further complicating the outlook.

Pressure on Global Prices Persists

The global sugar market is feeling the strain as New York’s raw sugar futures have declined, with a 32-point drop last week. The strong U.S. dollar and fluctuating crude oil prices have contributed to the bearish sentiment. In Brazil, mills in the Center-South region are extending their milling operations into late 24/25, hoping for a larger cane crush to ease supply concerns. The indication of extending milling operations in CS Brazil adds more pressure to prices declining, contributing to the bearish sentiment.

Meanwhile, in India, disease outbreaks and production challenges are casting doubt on the country’s ability to maintain its export prospects for the 24/25 season. The challenges in Brazil and India, combined with global economic factors, continue to pressure sugar prices.

Chart 1: White Premium in USD/mt

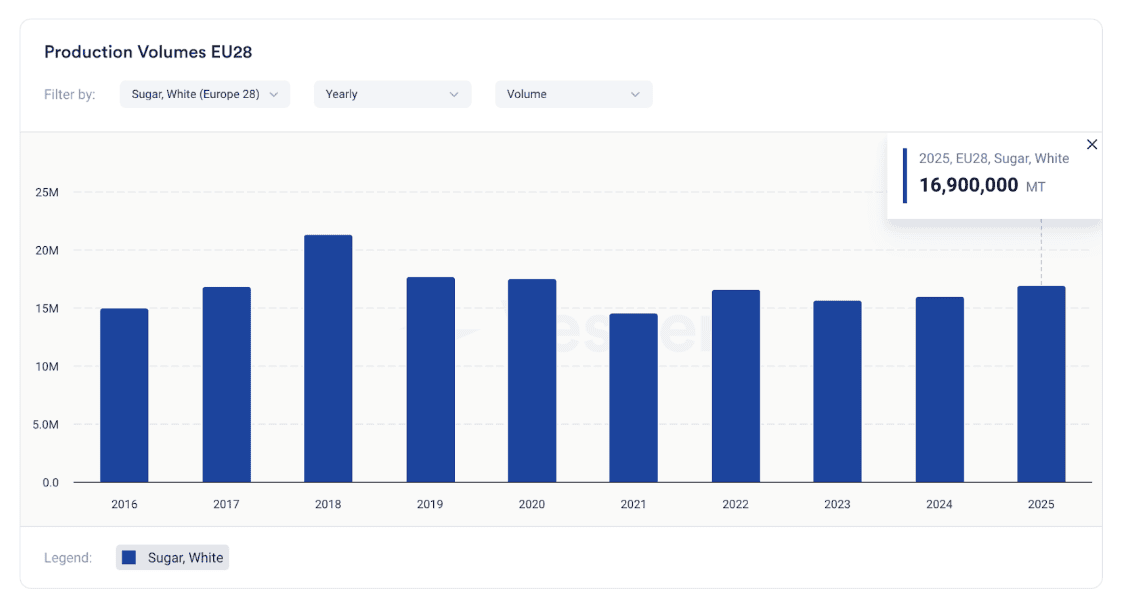

EU Production Forecast Revised Down

In Europe, the sugar production forecast for the 2024/25 season has been revised downward to 16.9 million metric tons (MMT) from 17.3 MMT. Disease outbreaks and lower sucrose content, especially in France and Germany, are contributing to the downgrade. Additionally, EU producers are projecting a 5-10% reduction in beet plantings for 2025 in an effort to stabilize prices. However, there is skepticism in the market about whether these cuts will fully materialize, leaving uncertainty for the year ahead.

The French production estimate has dropped to 4.6 MMT, while Germany’s output is down by 200,000 tonnes due to flooding in the southern regions. Poland’s production has also been revised down to 2.5 MMT, and the UK estimate now stands at 1.1 MMT. These reductions reflect a broader contraction in EU production.

Chart 2: EU28 sugar production forecast for 24/25 in mt

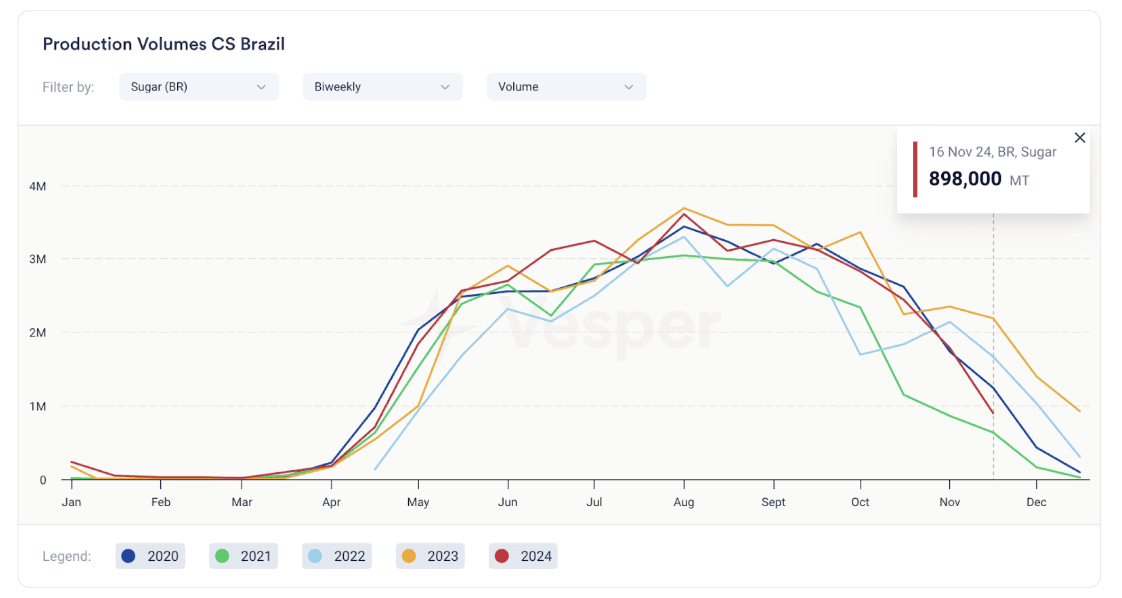

Brazil’s Challenges: Lower Production and Exports

In Brazil, the sugar market faces significant challenges. The Center-South region’s sugarcane crush in the first half of November was 16.5 million metric tons (MMT), reflecting a sharp 52.8% decrease compared to last year. The sugar mix has fallen to 43%, a 7 percentage point decline, leading to a 59.1% decrease in sugar production, which totals just 898,000 MT for the first half of November.

This lower production is compounded by a decrease in exports, which dropped by 2% in the first 14 working days of November, totaling 2.5 MMT. While Brazil has extended its milling season to process more cane, adverse weather conditions continue to disrupt harvesting and may limit supply through the first quarter of 2025.

Chart 3: CS Brazil’s biweekly production in MT

Outlook: Market Uncertainty and Price Pressure

The 2024/25 sugar crop in Brazil continues to face challenges from unfavorable weather conditions, leading to lower production. While accumulated exports are 32% higher than last year, they did start to be impacted in November. With ethanol production showing slight growth and sugar production in decline, global sugar prices remain under pressure.

Looking ahead, Brazil’s 2025/26 sugar production is projected to recover, but much of this recovery depends on better weather conditions and the outcome of the cane crushing season. While the outlook appears optimistic, supply chain disruptions and weather uncertainties will likely keep sugar prices volatile in the coming months.

For insights into global sugar price forecasts and market developments, start your free trial at Vesper.