Expected price developments for palm oil, soybean oil, rapeseed oil, and sunflower oil of the 22/23 crop year.

Vegetable oils remain a key ingredient in the food industry and are the biggest feedstock for biodiesel production. The ongoing search for sustainable ways to power vehicles and machinery, are expected to drive up vegetable oil demand to 213,8M metric tons in 22/23, according to the latest outlook published by the US Department of Agriculture (USDA). Despite higher demand compared to last year, it is likely that the overall predicted increase in global production for all vegetable oils will cover global demands.

Shortly after the invasion of Ukraine on 24 February 2022, one of the world’s major producers of sunflower oil, prices for palm oil, soybean oil, rapeseed oil, and sunflower oil began to rise. The rapid price increase of these oils was partly caused by the uncertainty about sunflower oil supplies from Ukraine; some manufacturers started substituting sunflower oil with others. The war, together with climatic events such as La Niña left countries in fear of their own vegetable oil supply so badly that Indonesia imposed an export ban on palm oil, which was lifted only one month later.

The increase in vegetable oil prices sparked the attention of manufacturers, who didn’t want to miss out on the opportunity of producing and selling vegetable oils at high prices. Now, despite the war and extreme weather conditions influencing crops, a record-high global output is expected. Let’s walk through these products together and see where the expected higher outputs are coming from.

Palm Oil

Global palm oil production is expected to rise modestly to 78,22 million MT, a total increase of 2,23 million MT compared to last year’s production, according to the USDA. Even though the total production is higher compared to last year’s, the labour shortages for the third consecutive year in Malaysia are constraining the potential for a higher growth rate. The expected production for 22/23 crop of Malaysia is 18.8 million MT according to the USDA, a total increase of 0.298 million MT. Excessively wet weather conditions currently taking place in Malaysia may have a negative impact on palm oil production until the first quarter of 2023. It however might lead to higher palm oil production in the second and third quarters of 2023, because the soil then has the right humidity, see Vesper’s production forecast below.

Tip: Make sure to read our 2024 global outlook for the Oils and Fats industry.

Indonesia’s expected production is looking more promising with 45.3 million MT, an increase of 1.8 million MT compared to last year’s 21/22 crop. Naturally, if these expectations hold, it will lead to a plummeting effect on palm oil prices, assuming demand will not increase hugely, which partly depends on COVID restrictions in China. Price fluctuations are also largely dependent on the evolution of the biofuel mandates implemented by Indonesia and Malaysia. May these countries decide to increase the percentage of palm oil mixed into the biodiesel, prices will naturally follow.

Soybean Oil

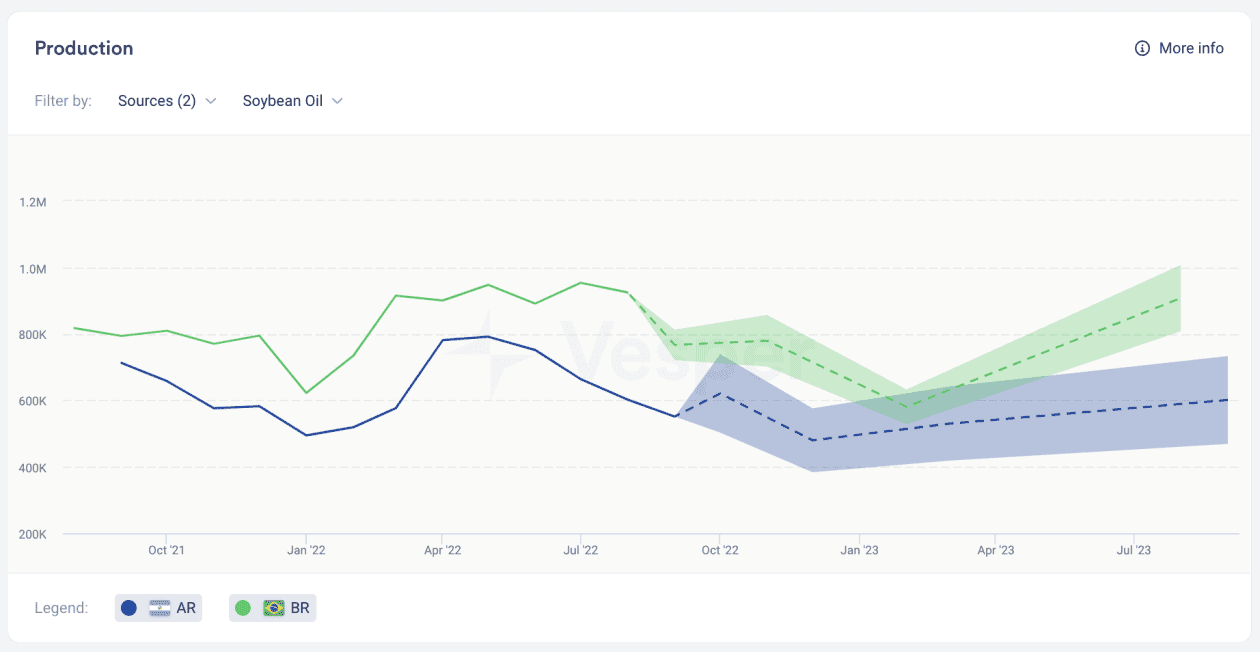

Global soybean oil production could hit a new record and is expected to rise to 219.8 million MT, a total increase of 8.3 million MT compared to last year’s 21/22 crop. The anticipated soybean production record is chiefly underpinned by a markedly higher output expected in Brazil, assuming normal weather conditions. In contrast, production in the United States of America could fall slightly because of lower yields. Also, Argentina’s soybean crop has been suffering. The third year of drought is expected to influence soybean production of crop 22/23 to decrease 1.5 million MT tons compared to last year’s production. Because of the drought, planting season has been delayed, production thus depends hugely on how the weather will evolve in the upcoming months.

Strong production has the potential to bring down the price; price fluctuations, however, are largely dependent on some recent development. The US Environmental Protection Agency for example has proposed higher biofuel blending mandates for the next three yeas, which may lead to higher demands. Also, if China lifts its zero covid policy in 2023, higher demands from China may take place.

Rapeseed Oil

International rapeseed production is predicted to rise significantly, thanks to favourable outlooks across Australia, Canada and the European Union. Unexpectedly abundant yields and high oil contents for 22/23 crop are expected to increase rapeseed production to 84.4 million MT, an increase of 1 compared to the previous crop year. The favourable weather conditions in Australia make them one of the biggest drivers of the expected rapeseed oil production, and have caused a price decrease that is expected to continue in 2023.

Sunflower Oil

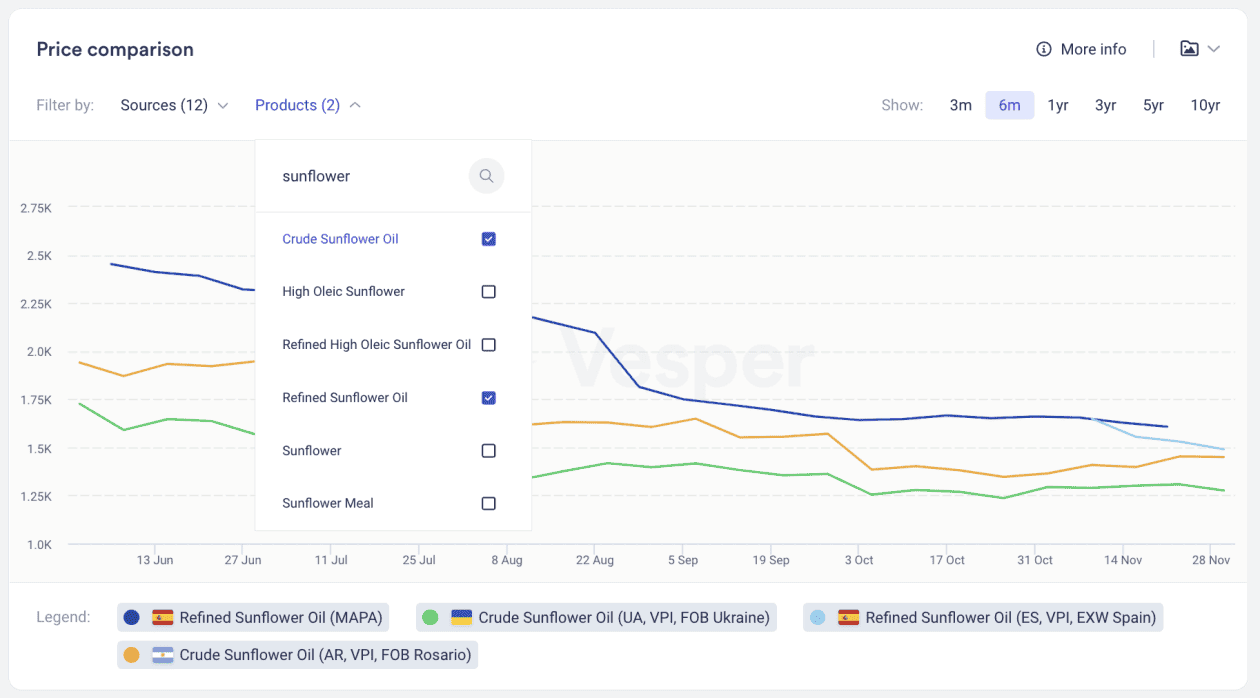

Ukraine’s supply will probably shrink by one-third due to the continuing war and decline in the sunflower sowing area. In the rest of Europe, production is expected to increase slightly from January 2023, reaching approximately 300 thousand MT in September. The total production will be close to adequate, but not enough to offset the decreased production in Ukraine.

For the short term, it is expected to be enough sunflower oil available, which has a soothing effect on the sunflower oil price. Also, prices have reacted downwards immediately to the re-opening of the Black Sea Grain Corridor. However, prices are not likely to fall down much lower, as Europe is not eager to accept products from Russia, and crops have been damaged by the war.

Our latest Oil & Fats articles

La Niña triple-dip: will it impact next year’s soybean and palm markets?