The global market for palm oil and palm kernel oil has witnessed a notable decrease in prices, primarily influenced by reduced export numbers from Malaysia, as reported by the Malaysian Palm Oil Board (MPOB) and various surveying companies. This decline is further compounded by the week-over-week fall in Brent Crude Oil prices, although the weaker Malaysian Ringgit (MYR) has somewhat cushioned these losses.

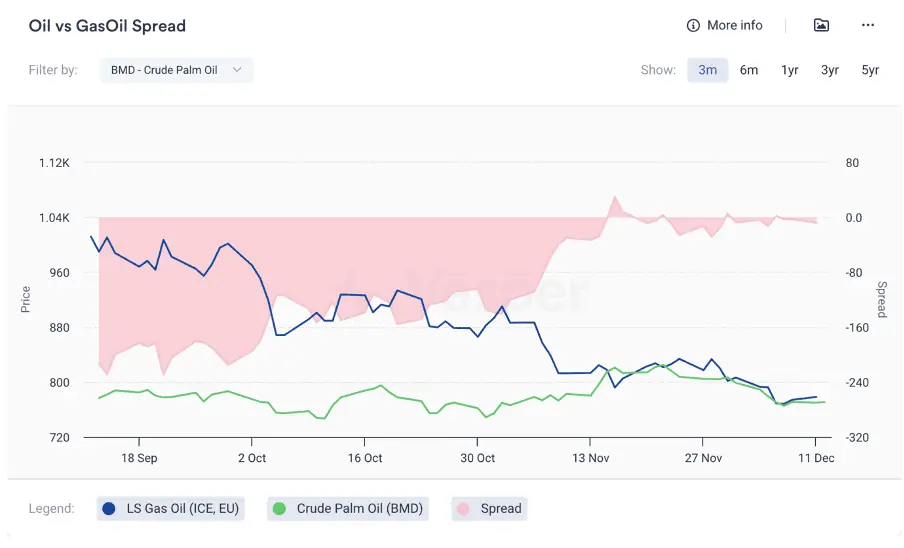

On December 12, 2023, Brent Crude Oil (for February 24 delivery) dropped to $76 per barrel, down from $77 per barrel in the same period last week. This reduction reflects growing concerns about the global energy demand. In light of these developments, the spread in the Palm Oil-Gas Oil (POGO) has remained close to positive, as illustrated in Figure 1.

Figure 1: Spread between LS Gas Oil (ICE, EU) and Crude Palm Oil (BMD)

This trend has had a ripple effect on the prices of both palm and palm kernel oil, as indicated by our Forward Vesper Price Index, depicted in Figure 2.

Figure 2: Forward Vesper Price Index for Crude Palm Kernel Oil and Crude Palm Oil for West-EU

Key price movements include:

- Crude Palm Oil on the BMD (December 2023 contract) settled at a price of €716 | $771 per metric tonne (mt) on December 12, 2023, a decrease from €725 | $789 per mt in the same period last week.

- The Vesper West EU Forward Price Index for Crude Palm Oil on December 12, 2023, stayed more or less the same and slightly decreased to €885 | $953 per mt (CIF Rotterdam, for February delivery), down from €881 | $955 per mt in the same period last week.

- The Vesper West EU Forward Price Index for Crude Palm Kernel Oil on December 12, 2023, declined to €892 | $960 per mt (CIF Rotterdam, for January-February delivery), from €914 | $990 per mt in the same period last week.

Important Market Figures:

Malaysia’s palm oil exports for December 1-10 compared to November 1-10 showed mixed results, with varying figures reported by different agencies:

- SGS reported exports of 429,593 mt for December 1-10, up 6.32% from 404,074 mt in the previous month.

- Amspec’s figures showed a decline of 4.09%, with exports at 386,986 mt compared to 403,505 mt.

- ITS reported exports of 368,990 mt, a decrease of 7.38% from 398,375 mt.

The USD/MYR exchange rate closed at 4.6810, slightly higher than the 4.6665 rate in the same period last week.

MPOB’s November figures revealed several key insights:

- Production was recorded at 1,788,870 mt, marking a 7.66% decrease.

- Imports stood at 39,696 mt, a 16.53% reduction.

- Exports were at 1,396,721 mt, down 4.73%.

- Domestic consumption increased by 19.5% to 458,485 mt.

- Ending stocks were at 2,420,398 mt, a slight decrease of 1.09%.

These figures indicate that production and ending stocks were largely in line with market expectations, while exports were more bearish than anticipated.

For more palm and palm kernal oil prices, visit the Vesper platform.