EU outright biodiesel prices decreased (see Figure 1) due to better supply and slower demand. The market buzzes about cheap SME volumes from Argentina arriving in the EU, which puts pressure on local biodiesel prices. As a reminder, according to the agreement between Argentina and the EU, Argentina is allowed to export into the EU a maximum of 1.2 mmt of biodiesel per year.

Figure : Vesper Spot Outright Biodiesel Prices (USD/mt)

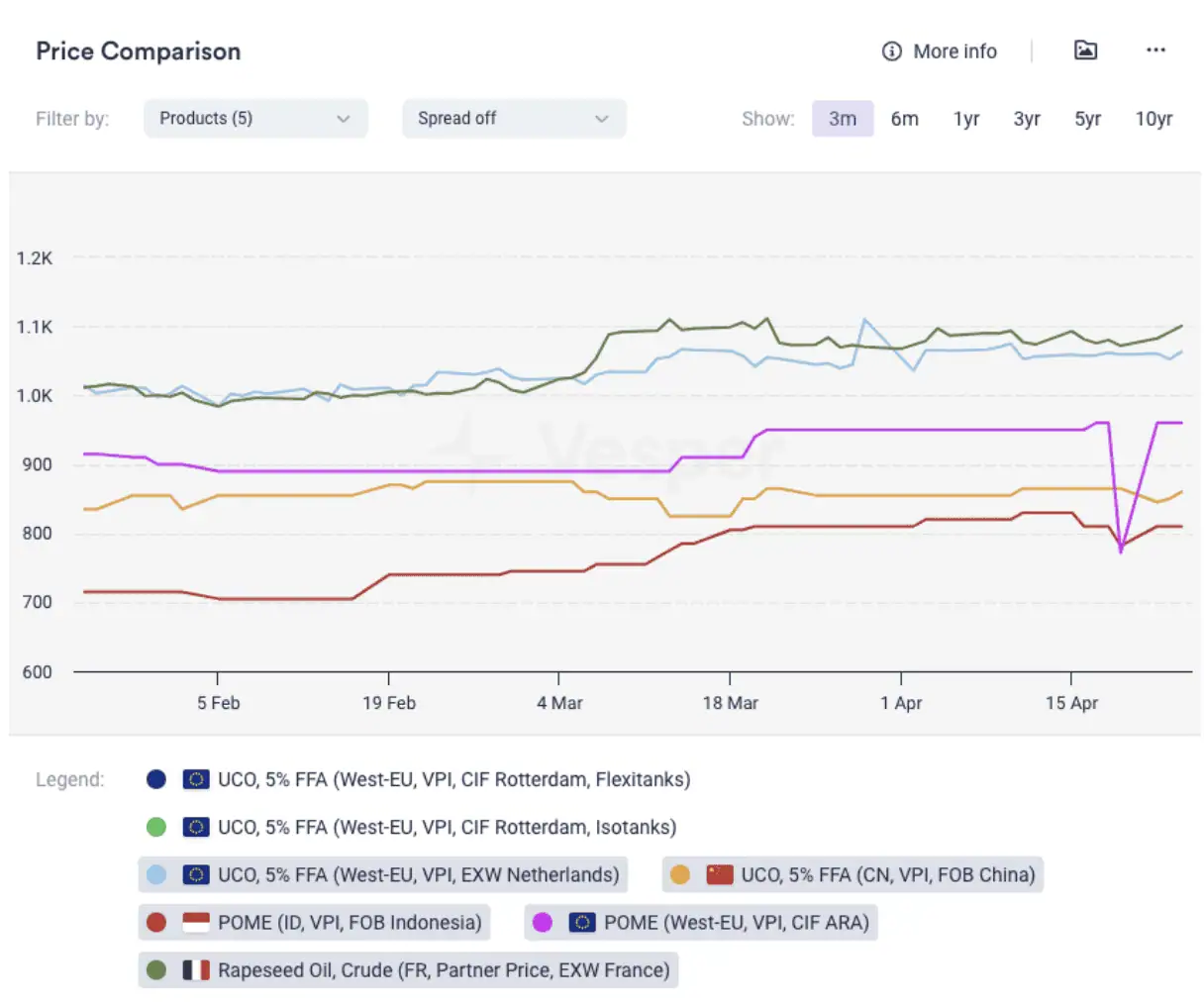

Feedstock prices stayed more stable, with rapeseed oil even increasing (see Figure 2). Market players in Europe and at origins said the demand for UCO from the EU cooled down a bit recently, which was reflected in the prices. “In Asia, the vessel rotation from oil majors has been fulfilled. The cargo has been picked up. More ships will arrive in Asia in a month or so. Normally, prices increase when vessels from oil majors arrive,” said one source. “Big players seem to be well covered for now in terms of UCO,” said another source. CIF ARA offers for UCO in flexi bags was heard around $990-1030 / mt. POME price stabilized as well on the cool down of the CPO benchmarks and the resumption of the collection in Indonesia after Ramadan. Offers at $800-840 / mt FOB Indonesia were heard.

Figure 2: Vesper Biodiesel Feedstock Prices (USD/mt)

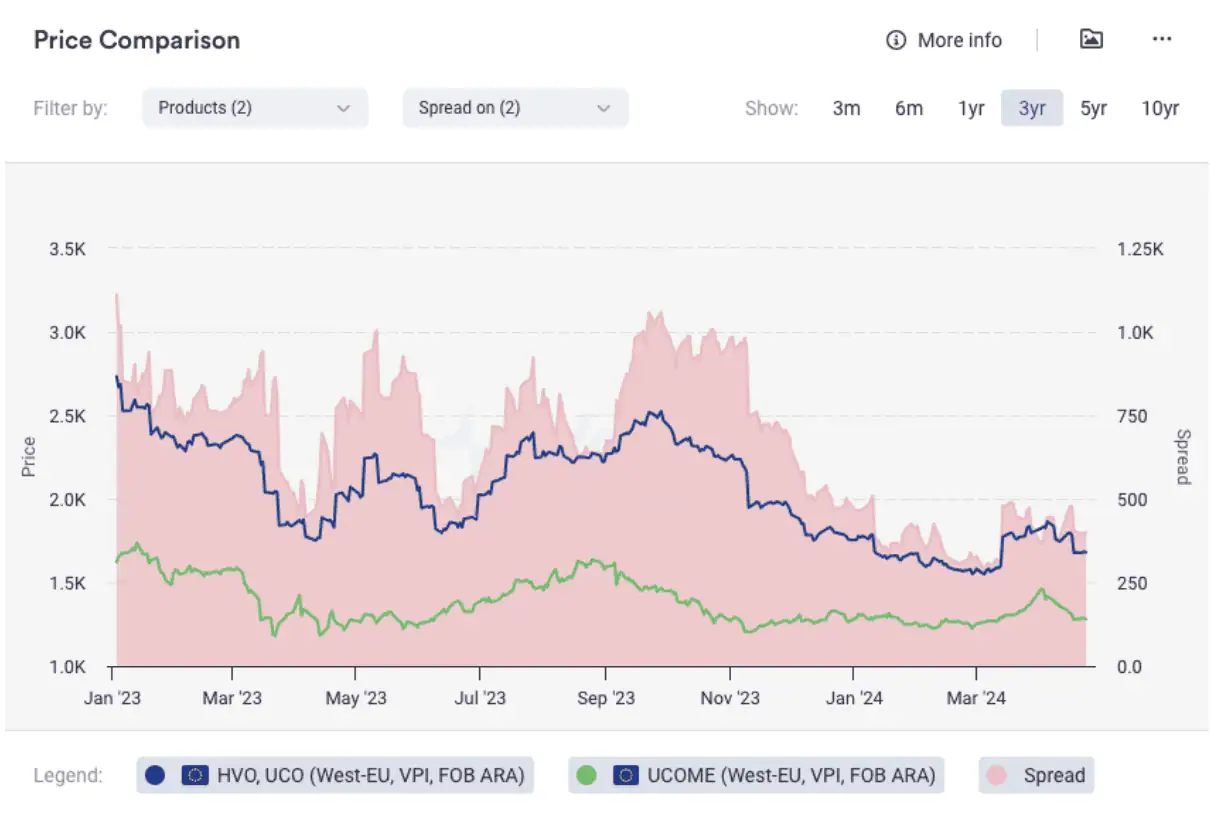

UCOME-UCO spread is currently at $219 / mt vs. $400 / mt at the beginning of April. “We are back to the poor margin territory,” said one UCOME producer. “UCOME is struggling to compete against HVO,” said one player. HVO(UCO) – UCOME spread dropped to $399 / mt from $478 over the last seven days. Overall, in Q1, we see that the spread is historically low (see Figure 3). The spot RME-RSO spread at $138 / mt, signalling poor processing margins as well.

Figure 3: HVO(UCO) – UCOME spread (USD/mt)

For more insights into the global biodiesel market, download our latest highlights.