As we near the end of the 2023/2024 production season, the EU sugar production forecast remains a critical focus, with several German and UK mills still operational. The season has seen Poland conclude with a production of 2.34 MMT, the Netherlands at 1.12 MMT, Germany on target for 4 MMT of sugar and ethanol, and the UK estimated at 1 MMT. The EU sugar production forecast for the 2023/2024 crop year is projected to reach a total of 16 MMT.

Looking towards the 2024/2025 growing season, the EU sugar production forecast is influenced by a 4% increase in beet cultivation area, up from the earlier forecast of 2-2.5%. This adjustment follows a recent untick in beet seed sales, indicating a robust outlook for the upcoming season.

The decision to expand beet cultivation areas comes in the wake of permission to utilize set-aside land for beet planting and to replace winter crops like oilseed rape, which have suffered from adverse weather conditions. France, in particular, is expected to witness a significant 6% increase in beet acreage, translating to about 400,000 hectares.

Assuming favorable weather conditions from March onwards, this expansion is expected to elevate the EU28 sugar production to 17.7 MMT for the year, representing a 10.6% year-over-year increase. However, to ensure market equilibrium, processors are planning to adjust beet prices for farmers and manage exports carefully.

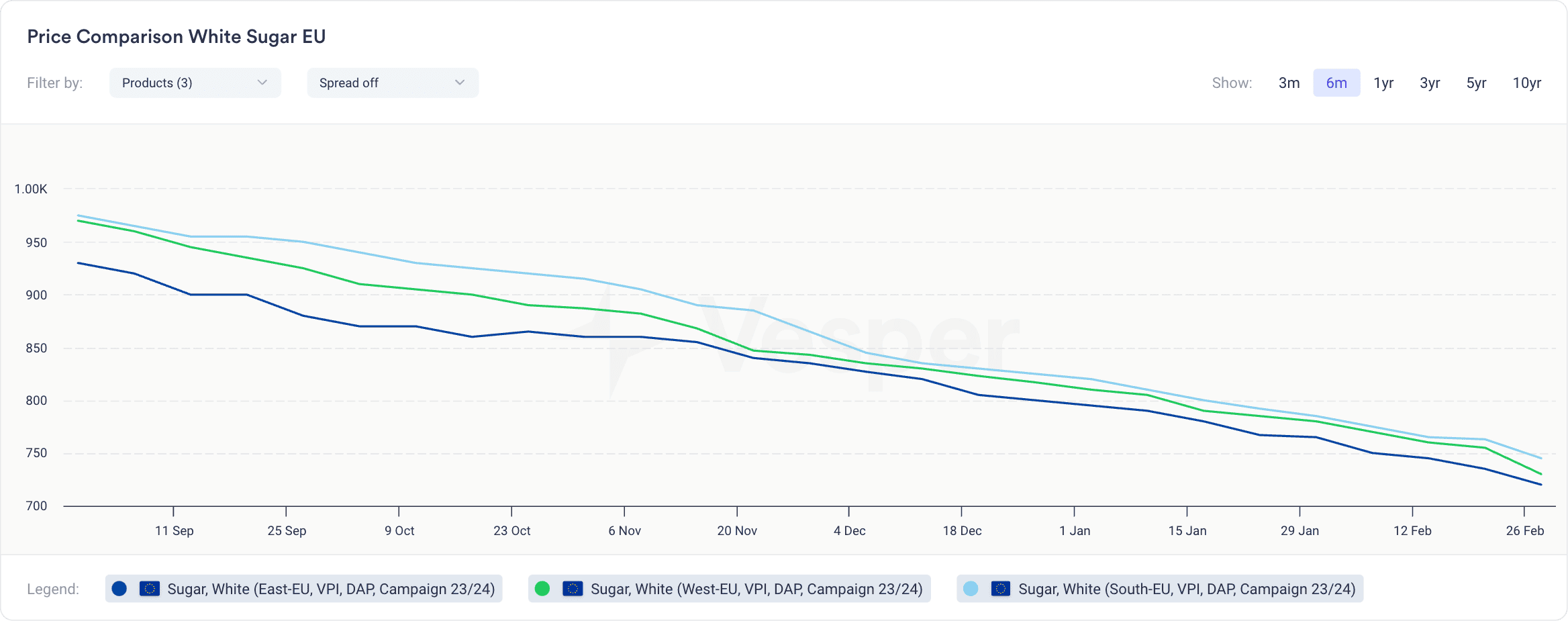

The expected EU sugar production forecast and the influx of Ukrainian sugar exports into the EU are exerting downward pressure on sugar prices, see Figure below.

- The East-EU Vesper Price Index as of 29 February 2024 has decreased to €720 | $781/mt DAP for the 2023/2024 campaign.

- The West-EU Vesper Price Index as of 29 February 2024 has shown decreases to €730 | $791/mt DAP for the 2023/2024 campaign.

- The South-EU Vesper Price Index as of 29 February 2024 has shown decreases to €745 | $808/mt DAP for the 2023/2024 campaign.

June will see stricter controls on Ukrainian sugar exports to the EU, including an export cap. Despite current exports averaging 70 thousand tonnes per month, there’s potential for this figure to rise to 100 thousand tonnes as Ukraine seeks to deplete its stocks before the new regulations, potentially leading to lower EU prices in the following months.

The market outlook, both short and long-term, is increasingly bearish. With Ukraine maximizing exports before the new EU caps, favorable weather conditions in the EU, and a significant 4% increase in beet acreage (nearly 6% in France), the region is poised for higher production levels and a potential surplus. Combined with various duty-free quotas and CXL concessions, the EU28 could face a supply of 20 MMT against a consumption of 18 MMT, indicating an oversupplied market. Key factors to monitor in the coming months include weather conditions and processors’ strategies for stock regulation.

Download our sugar highlights for free to keep track of the EU Sugar Production Forecast, and other global sugar trends.