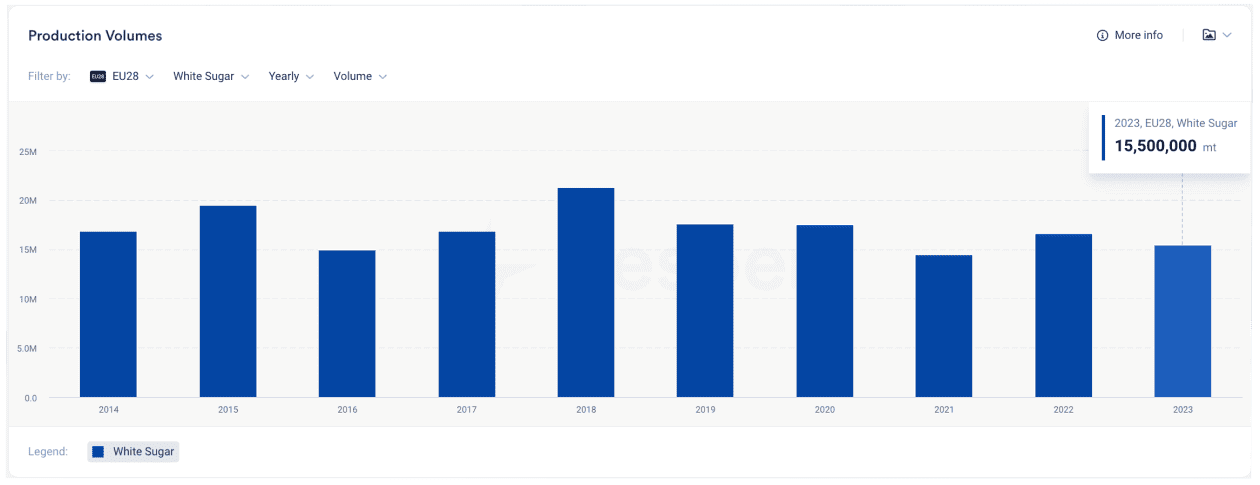

The EU sugar beet production is almost over, and our estimated total crop production is 15,8 MMT (including the UK), implying a drop of 5% of the total sugar availability in the European domestic market compared to the last year, see figure below. To meet the demand for sugar, the EU needs to import larger amounts of sugar from the world market.

So far, during October and November, the EU has imported 443 KMT of raw and white sugar from different countries, which is in line with the same period of last year (+2% YoY), and the December imports are likely to pick up. Brazil’s exports to the EU alone have already reached 125 KMT, but it is expected to increase as imports from other origins come in. The European Commission estimates that sugar imports will reach 2,9 MMT (+24% YoY increase), of which 2,0 MMT (70%) is cane sugar that needs to be refined.

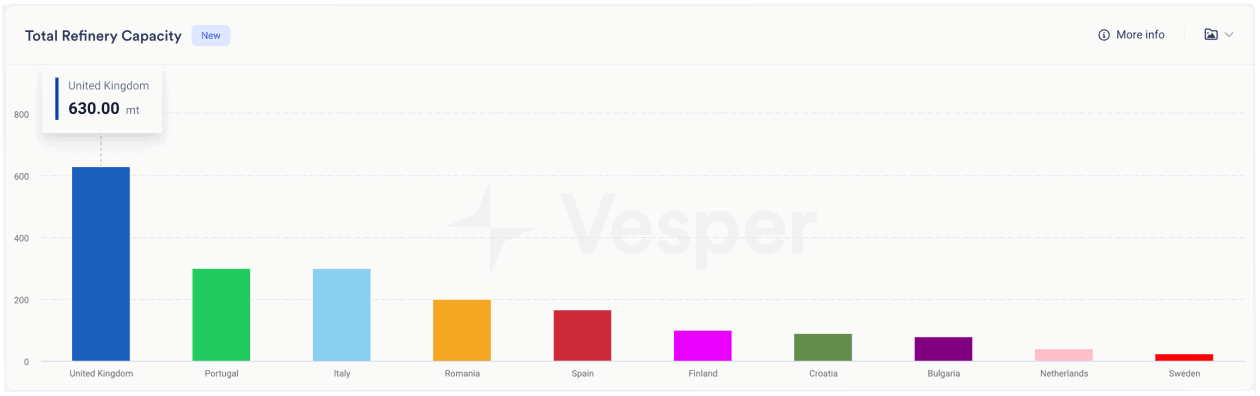

To answer whether Europe can refine the forecasted amount of sugarcane, we have to look at Vesper’s Total Refinery Capacity widget, see figure below. The widget displays the average total capacity per country based on a benchmark of actual performed numbers in the past two years.

PS: Are you a buyer? Use our resourceful Sugar Buyer’s Guide by downloading it for free!

According to the Total Refining Capacity widget, Europe’s total capacity reached 1.9 million metric tons after adding together the capacity of all countries, which is close to the European Commission 2023 estimate of 2,0 MMT. As the European Commission doesn’t reveal much about the maximum refinery capacity to many sugar players, our assumptions on the maximum refining capacity are primarily based on historical data. However, Europe’s refining capacity is likely at its max, as high sugar prices in the EU make it more attractive for buyers to import and refine raw sugar from outside the continent. To better understand the industry’s refining limit, we recommend reviewing the Total Refinery Capacity widget annually.