As of June 5th, 2024, the EU Vesper Price Index (VPI) for butter stands at €6750 ($7345/mt or $3.33/lb) EXW, while the Oceania butter price is at €6708 ($7299/mt or $3.31/lb) EXW. In the US, the VPI for butter is now €6361 ($6922/mt or $3.14/lb) EXW.

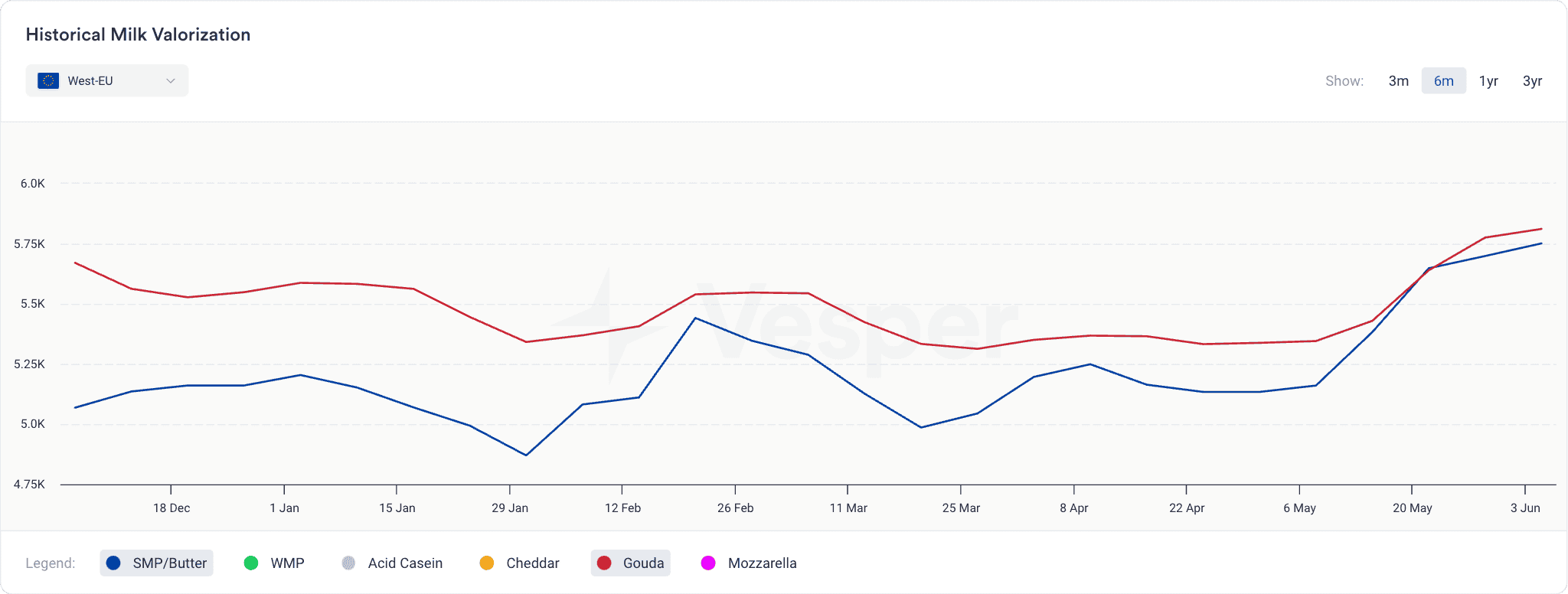

European butter supplies remain tight, especially on the spot market, driving prices higher. Production numbers across the European Union have been significantly lower than anticipated, creating a risky situation given the steady demand for butter. Notably, from a valorization perspective, butter and skimmed milk powder (SMP) have caught up with cheese, potentially leading to increased butter and SMP production at the expense of cheese in the latter half of the year, see Figure 1.

Figure 1: Historical Milk Valorization of European SMP/Butter and Gouda based on the latest European VPI prices (in EUR/mt)

In New Zealand, the short supply of butterfat has pushed the forward curve into backwardation, as observed in the Global Dairy Trade (GDT) events and the Singapore Exchange (SGX) futures market for both anhydrous milk fat (AMF) and butter. Lower production numbers for milk solids in April indicate a current scarcity of milk fat and protein, especially as New Zealand is out of season in June and July.

Despite a recent drop in US butter prices by $0.12/lb in a single day, prices have quickly rebounded to $3.12/lb on the CME, reflecting the strong and persistent demand for butter in the US. April stock levels were significantly higher than in the past two years, initially causing some doubt about price levels and leading to a brief decline. However, buyers have since realised the importance of securing butter supplies for the second half of the year, even at today’s prices.

Outlook

In the short term, butter prices are expected to remain volatile but will likely stay within the upper range observed this year. Lower production and stock levels in most regions (excluding the US) and strong demand for butter and cream, particularly in the US, are likely to support current price levels or even drive them higher in the coming months.

For more butter insights, take a look at our full weekly market analysis. Non creditcard needed.