Introduction to Commodity Alerts: Staying Ahead in the Market

In the high-stakes arena of commodities, information – particularly timely and accurate commodity data – isn’t just power; it’s the key to profit.

Imagine this: while your competitors are busy sifting through heaps of data, you’re making sharp, informed decisions. The secret? Commodity alerts.

But what exactly are commodity alerts?

Simply put, they’re timely notifications that keep you one step ahead of market shifts. Whether it’s a sudden price change in crude oil or a forecasted surplus of soybeans, these alerts can be the difference between a smart move and a missed opportunity.

Why are they crucial?

The commodity market is a living, breathing entity, constantly influenced by global events. A political upheaval here, a weather anomaly there – and the market tides turn rapidly.

With alerts, you’re not just passively observing. You’re proactively engaging with the market pulse, armed with insights to cut through the noise and hone in on what truly matters.

The outcome is clear:

Quicker reactions. Smarter strategies. And decisions that are not just timely, but timeless.

In the coming sections, we’ll dive into the types of commodity alerts that can strengthen your decision-making process, how to set them up, and most importantly, how to use them to stay ahead of the curve.

Types of Commodity Alerts: Price, News, and Trend Notifications

When it comes to staying informed in the ever-evolving commodities market, diversity is your ally.

Why settle for a single type of alert when you can have multiple at your disposal?

Here’s the rundown on the types of alerts that can transform the way you interact with the market:

Price Alerts

Picture this: You’re casually sipping your morning coffee when a price alert chimes in. Corn has hit your target price. Before others have even logged in, you’re already strategising your next move.

That’s the power of real-time Price Alerts.

They’re not just notifications. They’re the drumbeats of the market, signalling you to act fast on price fluctuations, from meats to milks, berries to biofuels.

News Alerts

The commodity world spins on the axis of information. News Alerts are your own personal informant, giving you the heads-up on market-moving events as they happen.

New trade regulations? Crop reports?

These alerts sift through the daily noise to bring you what’s truly impacting your commodities—from geopolitical tensions to economic data releases.

Trend Notifications

Trend Notifications track the ebbs and flows, the gradual ascents and descents that shape the market landscape over time.

Want to know if sustainable energy is impacting oil demand? Or if health trends are swinging sugar consumption? These alerts map out the macro trends that define long-term strategies.

Each type of alert has its unique rhythm, its own beat within the complex commodity symphony.

It’s not just about having these alerts.

It’s about integrating them into a cohesive system that keeps you informed, reactive, and two steps ahead of the market’s next big wave.

As we delve deeper into setting up and utilising these alert systems, remember: in the world of commodities, being informed is being empowered.

Let’s explore how to make these alerts work for you.

Setting Up Price Movement Alerts for Immediate Action

How do you catch the waves of price volatility before they break?

The answer is simpler than you might think:

Price Movement Alerts.

The commodity markets don’t sleep. Prices can soar or plummet in the blink of an eye, driven by factors as diverse as weather events to shifts in trade policy.

But here’s a little-known secret:

You don’t need to be glued to your screen 24/7 to master this volatility. Instead, you set up Price Movement Alerts.

- Identify your key commodities: Whether you’re into Seafood or Dairy, pinpoint the commodities you want to track.

- Set your parameters: Determine the price points that matter to you—specific highs and lows that signal when to take action.

- Test and tweak: Like any good strategy, refinement is key. Start with broader parameters and then hone in as you decipher the market’s rhythms.

Now, let’s get a bit technical (but not too much):

These alerts are powered by algorithms that constantly monitor market prices. When a price hits your pre-set threshold, boom—you receive a notification.

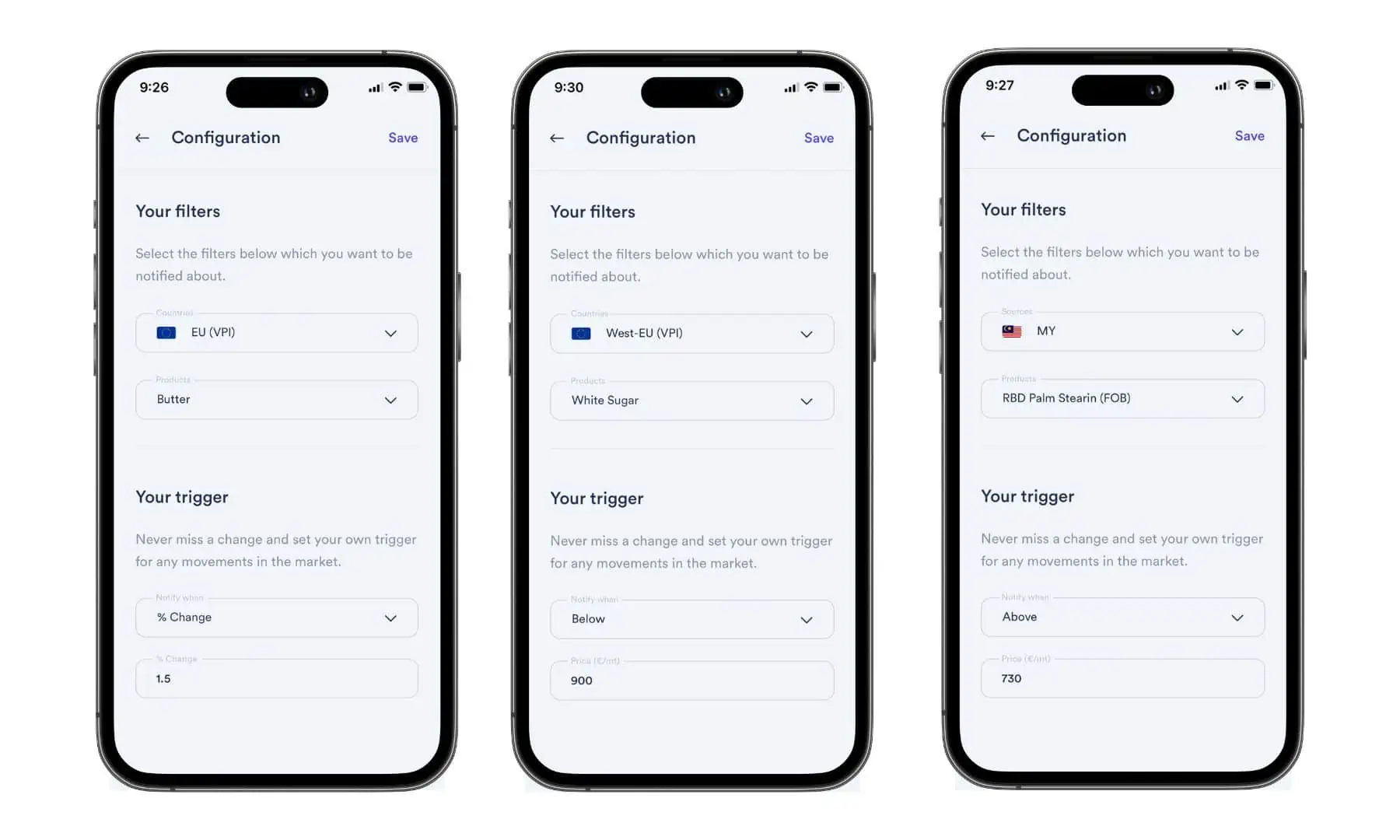

It could be via email, SMS, or even a pop-up on your commodity platform. For example, on the Vesper commodity intelligence platform, you can set price alerts when there is a new value, a percentage change, or the value is above or below a specified price, via email, SMS or in-platform.

The beauty of this system lies in its immediacy and precision. It’s like having your own personal market watcher, dedicated to your interests.

But, remember to avoid ‘alert fatigue’. Too many alerts and you might miss the critical ones. It’s about finding that sweet spot where every alert has value, and every notification could be a call to action.

By effectively leveraging commodity price alerts, you transform volatility from a threat into an opportunity. It’s about being proactive, not reactive.

Utilising News Alerts to Understand Commodity Market Drivers

You know the saying: “Knowledge is power.”

But in the fast-paced commodity markets, timely knowledge is even more powerful.

News Alerts.

These are your eyes and ears on the ground, delivering breaking news that can swing commodity prices from boom to bust in no time.

So, how do you harness these alerts to carve out actionable insights?

- Pinpoint the news that matters: Not all news impacts the market. Focus on policy changes, geopolitical events, and economic indicators related to commodities.

- Select your sources wisely: Credibility is key. Opt for reliable financial news outlets and official commodity reports to feed your alerts.

- Timing is everything: Set up instant notifications. The earlier you act on credible information, the better your position in the market.

And here’s a tip:

Diversify your news alert portfolio. You want a 360-degree view of the market, so include alerts for indirect factors that could affect your commodities, like currency fluctuations or energy prices.

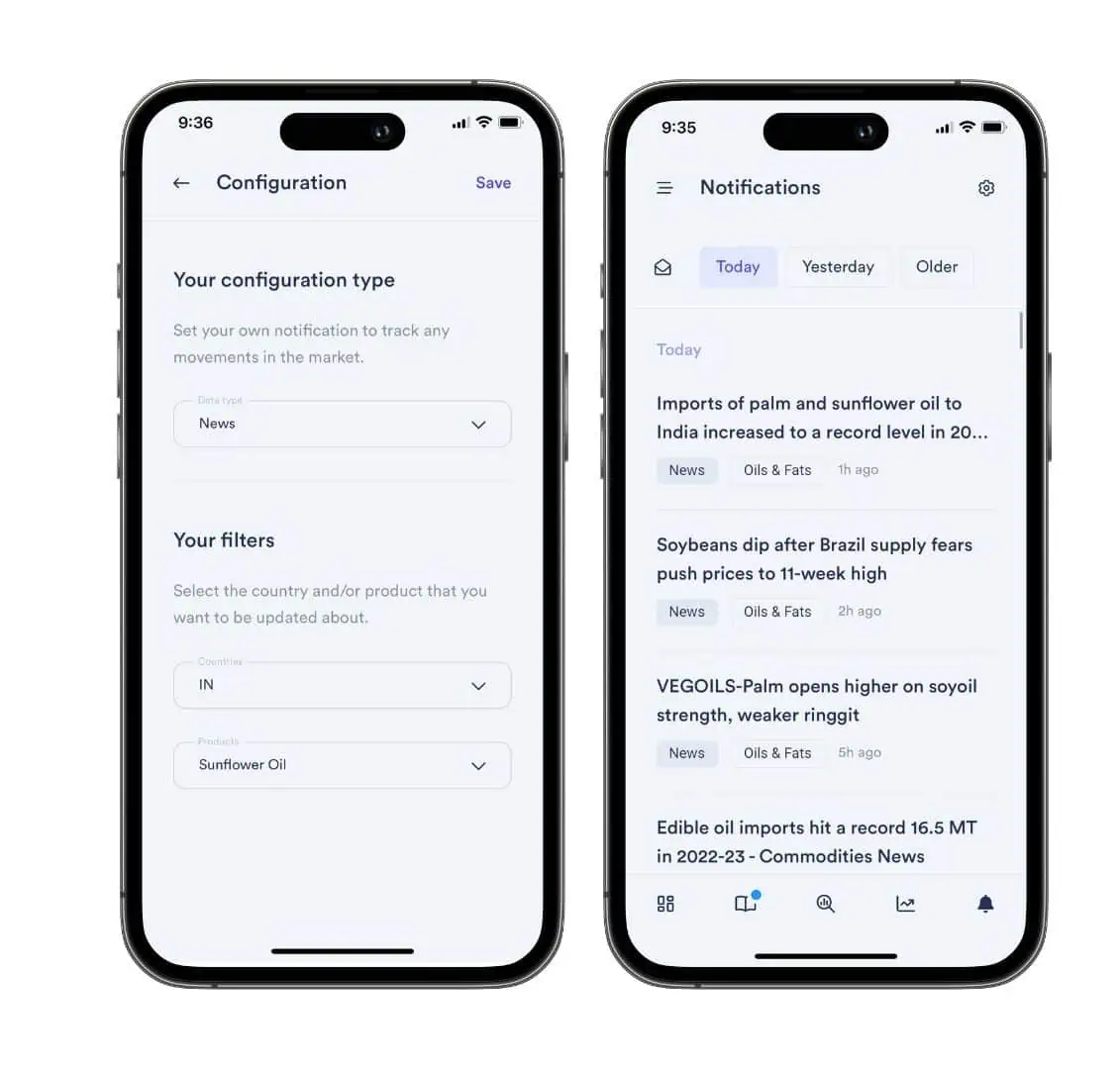

Setting up News Alerts sounds straightforward, but the key is in the implementation. It’s not just about being bombarded with information; it’s about receiving the right information at the right time. On commodity intelligence platforms such as Vesper, you have the capability to tailor alerts for particular countries and topics, ensuring that critical updates are delivered to you as they happen.

Remember, it’s not just the news itself, but the ripple effect it creates.

A political standoff in a resource-rich country, a sudden change in trade agreements, a natural disaster affecting crop yields—all of these can cause significant waves in commodity prices.

By staying on top of these updates, you’re always ready to make informed decisions. And that’s not just smart trading—it’s trading with insight.

Harnessing Trend Notifications for Long-Term Market Insight

Let’s be honest:

In the high-stakes game of commodities, today’s windfall can be tomorrow’s loss.

That’s where Trend Notifications come in, serving as your compass for long-term market navigation.

But why focus on trends?

Because trends are the story of where the market’s been, where it is, and, most importantly, where it’s going.

To harness the full power of Trend Notifications, you need to:

- Automate intelligently. Use tools that learn and adapt to the market, sending you trend alerts that are always one step ahead.

- Filter the noise. Not all trends have the same weight. Focus on those with direct implications for your trading decisions.

- Stay flexible. As trends develop, so should your strategy. Be ready to pivot as your trend notifications shine a light on new market opportunities.

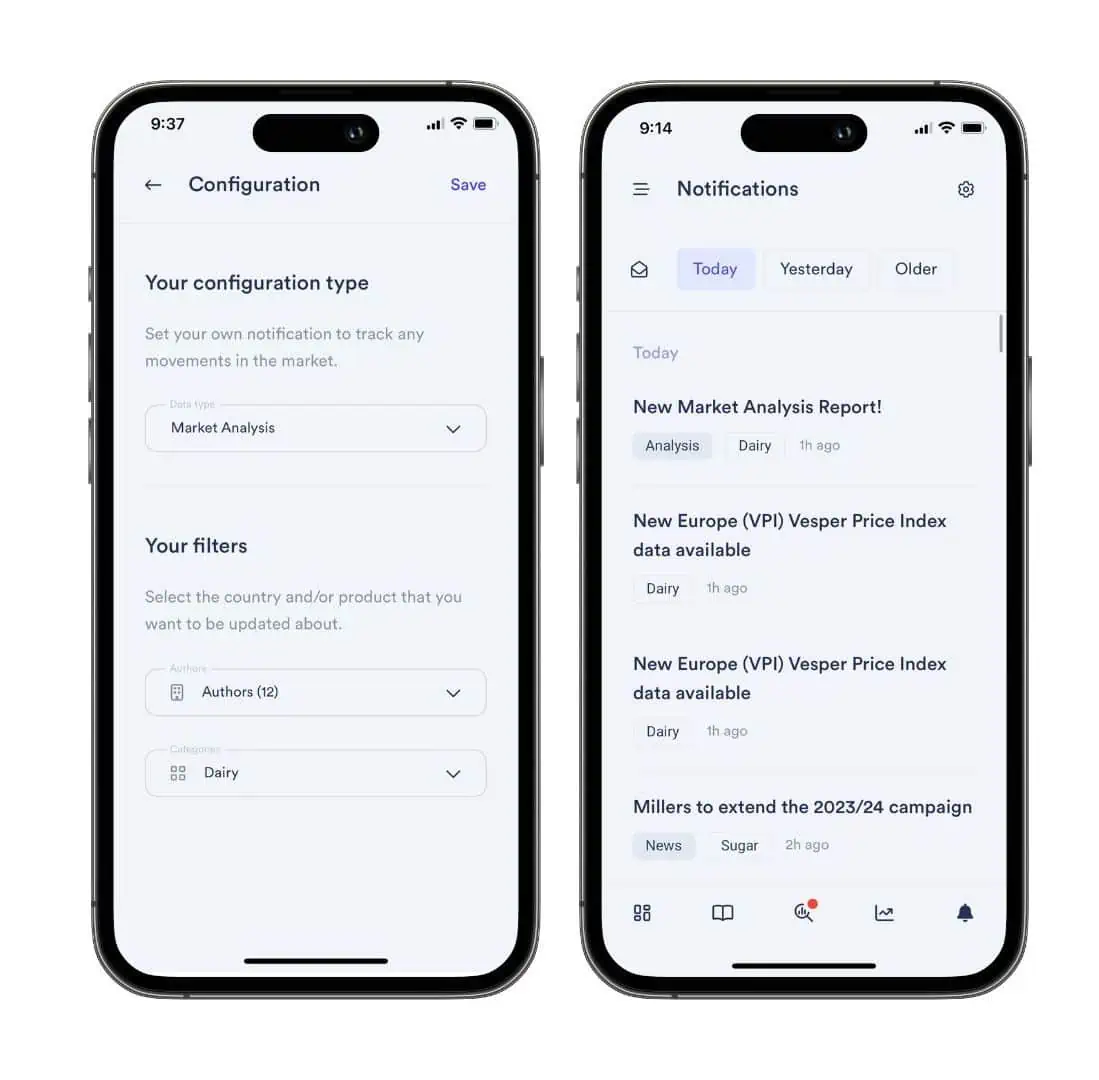

Trend notifications are not about predicting the future with absolute certainty—it’s about increasing the odds in your favour. By leveraging a commodity intelligence platform like Vesper, which regularly publishes analyst-authored market insights, you can configure your alerts to ensure you’re always abreast of the latest trend analyses.

By using trend alerts effectively, you’re giving yourself the confidence to make decisions not just for today, but for a profitable tomorrow.

They are not just alerts; they are your forward-looking lenses, bringing the future into focus and enabling strategic decisions that stand the test of time.

Leveraging Commodity Alerts for Strategic Purchasing Decisions

Imagine having a crystal ball that gives you insights into pricing, news and market trends.

Well, you don’t need a crystal ball when you have commodity alerts.

It’s a game of connecting the dots.

And the dots are the pieces of information you collect from various alerts.

But remember:

In the end, it’s not just about data, but what you do with it.

Use these alerts to time your purchases, negotiate better prices, and ultimately, build a more resilient commodity strategy.

We’ve journeyed through the intricacies of commodity alerts, from understanding their types to setting them up for effective use.

Remember, the goal is not just to react to the market, but to anticipate it. With the right alerts at your disposal, you’re not just following trends—you’re setting them.

Stay alert. Stay ahead. Stay successful.