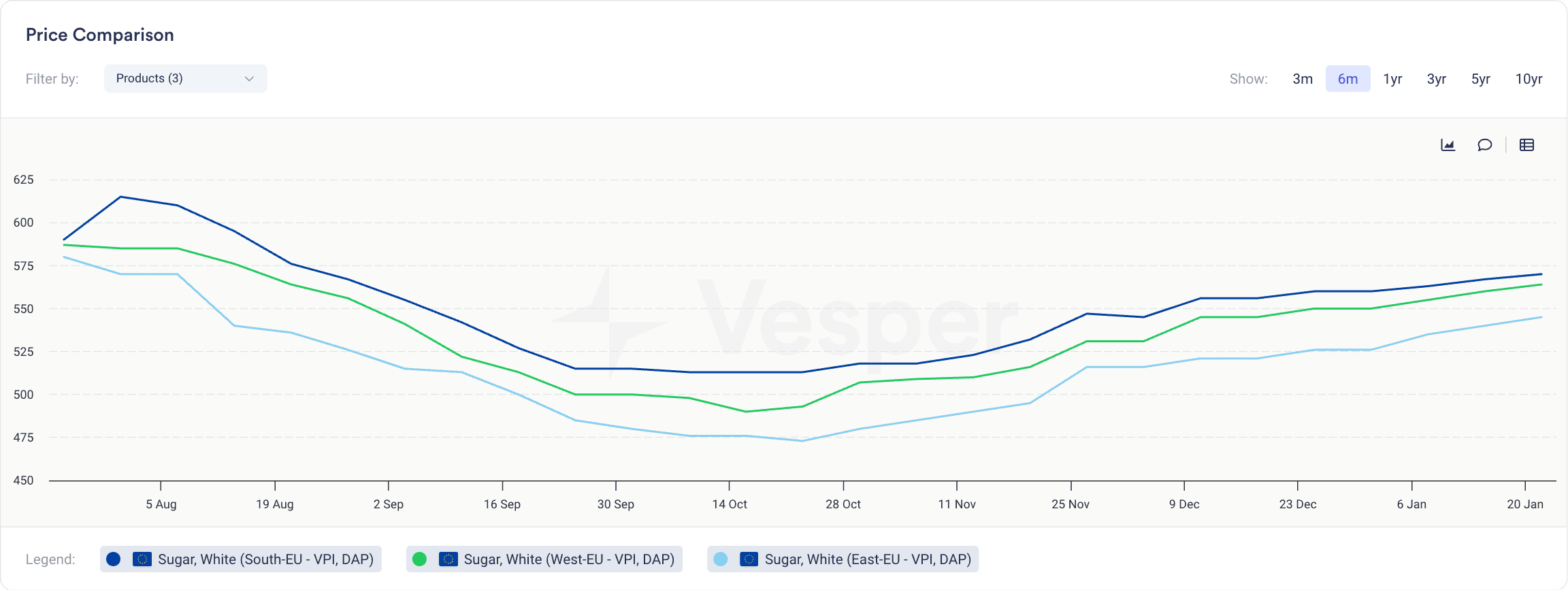

Since October 2024, European white sugar prices have been on an upward trend, driven by a combination of supply constraints, adverse weather conditions, and strong global demand. The price comparison chart below highlights this price increase across different EU regions, showing a clear recovery from earlier declines.

Figure 1: Price Comparison chat for White Sugar prices across Europe in EUR/mt

As 2025 begins, uncertainty surrounds the European sugar market, with supply disruptions, policy shifts, and planting trends set to shape prices. Will sugar prices continue their upward trajectory, or could market conditions lead to a stabilization or even a decline? Let’s explore the key drivers that will influence the market in 2025.

1. Initial Expectations of Higher Production, Later Revised

At the start of 2024, an increase in beet acreage across the EU led to expectations of a significant boost in sugar production for the 24/25 season. This optimism was driven by expanded planting efforts aimed at meeting market demand. However, as the season progressed, unfavourable weather conditions resulted in lower-than-expected sucrose content in the beet crop. This reduction in sugar yield per hectare forced the market to revise earlier production forecasts downward, tempering initial expectations.

2. Lower Sucrose Content Due to Adverse Weather Conditions

Despite the larger acreage of sugar beets planted across the EU, adverse weather conditions during the growing season—specifically periods of drought followed by excessive rainfall—significantly impacted the sucrose content in the crop. These weather fluctuations hindered optimal growth, resulting in lower sugar yields per hectare than initially expected. By October, it became clear that the quality and overall output would fall short of earlier projections, prompting a shift in market expectations toward a tighter sugar supply and a reevaluation of future production forecasts.

3. High Export Volumes

From January to October, EU sugar exports surged to 1.6 MMT, compared to 386 thousand tonnes in the same period of 2023, reflecting strong global demand. This export strength, combined with rising international sugar prices driven by weather disruptions in major sugar-producing countries, placed upward pressure on EU sugar prices by October.

Are White Sugar Prices Expected to Rise or Fall in 2025?

As the sugar market moves into 2025, the key question remains: will prices continue their upward trajectory, or could we see a reversal? Several factors suggest that sugar prices may remain elevated. Below, we explore some influences that could shape sugar prices in the year ahead.

1. UK Policy on Neonicotinoids

The UK government’s decision to ban neonicotinoids in 2025 has posed significant challenges for growers, particularly in combating virus yellows—a disease that neonicotinoids have traditionally helped manage. Without access to these treatments, farmers are reconsidering sugar beet cultivation, which could lead to reduced supply and further price increases.

2. Lower beet planting indication

The upward price trend is expected to continue into 2025, driven by indications of lower beet planting in several key EU countries, as farmers are projected to reduce acreage due to lower profitability. Additionally, average yields are expected to remain under pressure, further tightening supply expectations, while strong global demand for sugar, supported by higher prices in major producing regions, will continue to drive EU export volumes.

3. Factory Closures in France

In France, the closure of the Souppes-sur-Loing factory mid-campaign had ripple effects on the industry. The factory ceased operations after sucrose leaked into a nearby canal, and the financial burden of required infrastructure investments proved insurmountable. This closure disrupted beet processing in the Seine-et-Marne department, with growers forced to transport their crops to more distant factories, incurring additional costs. Competing processors, such as Cristal Union and Tereos, now face logistical challenges in meeting demand efficiently.

Track real-time global sugar prices, access AI-driven price forecasts, and get expert market insights—all on the Vesper platform. Get free access here.