With the 45Z tax credit set to roll out in January 2025, the biofuel and agricultural sectors are navigating an atmosphere of anticipation and uncertainty. Industry players are grappling with how to strategize amidst unclear regulatory details, especially as proposed modifications could significantly alter the tax credit’s impact. Among these potential changes is a restriction limiting 45Z tax benefits solely to biofuels derived from U.S.-sourced feedstocks, a shift that could reshape trade flows, pricing structures, and global demand dynamics for several key commodities.

What is the 45Z clean fuels tax credit?

The 45Z tax credit, introduced under the 2022 Inflation Reduction Act, offers financial incentives for producing and selling low-emission transformation fuels. This credit begins at 20 cents per gallon for non-aviation fuels and 35 cents per gallon for sustainable aviation fuel (SAF). It applies from January 2025 through 2027.

What changes were proposed, and why is the market waiting for the guidance?

“Farmer First Fuel Incentive” Act proposed in September requires the following important changes:

- Restrict eligibility for the 45Z Clean Fuel Production tax benefits to only renewable fuels that use domestic (U.S.) feedstock

- Extend the 45Z tax credit to a full 10-year credit (until 2034)

Expanding Clean Fuel Production Act proposed in October requires the following important changes:

- Extend the 45Z tax credit to 2037

What are the implications for veg oil and biofuels from the proposed changes?

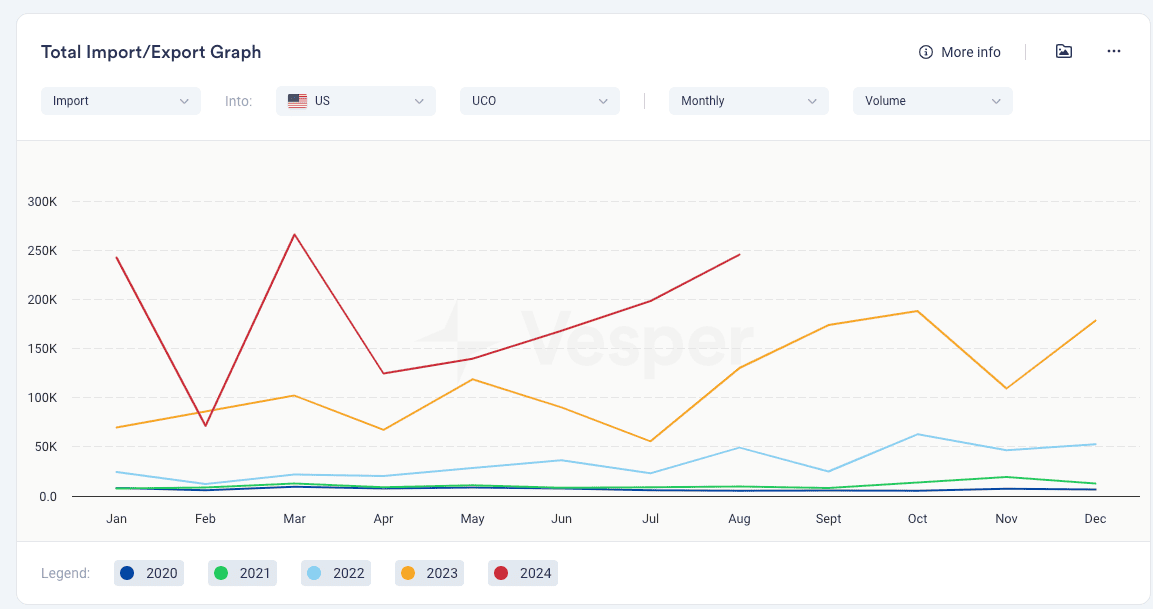

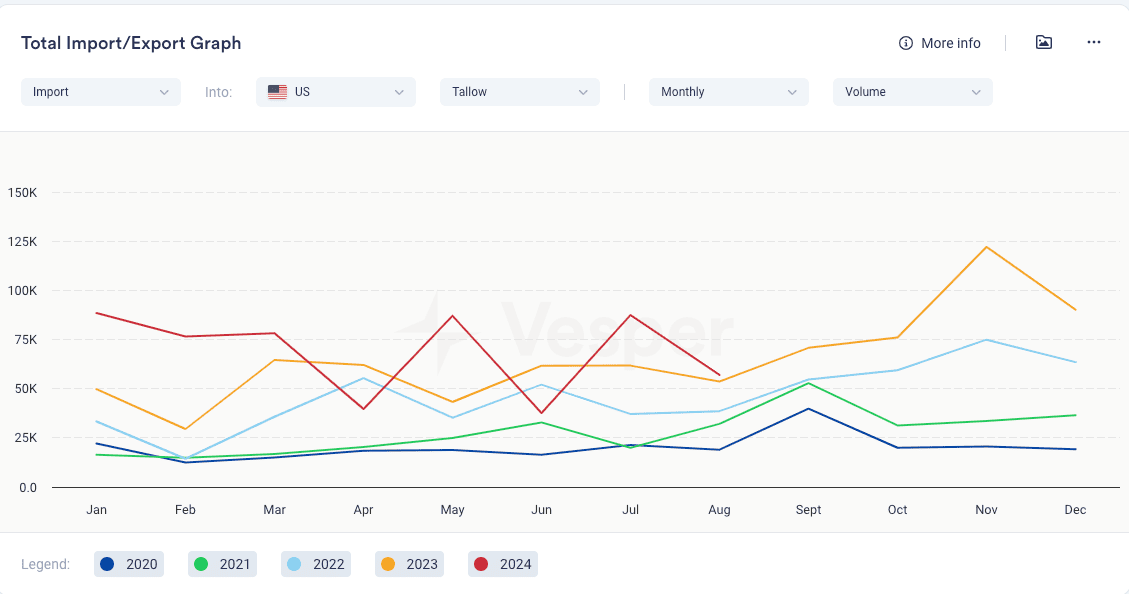

In the past two years, the U.S. has massively increased imports of used cooking oil (UCO) from China and tallow from Brazil, using these as feedstocks for biofuel production. Biofuel output has surged in the U.S. recently, with producers favouring the cost-effectiveness of Chinese UCO and Brazilian tallow over domestic feedstocks. Additionally, UCO has the advantage of a lower carbon intensity.

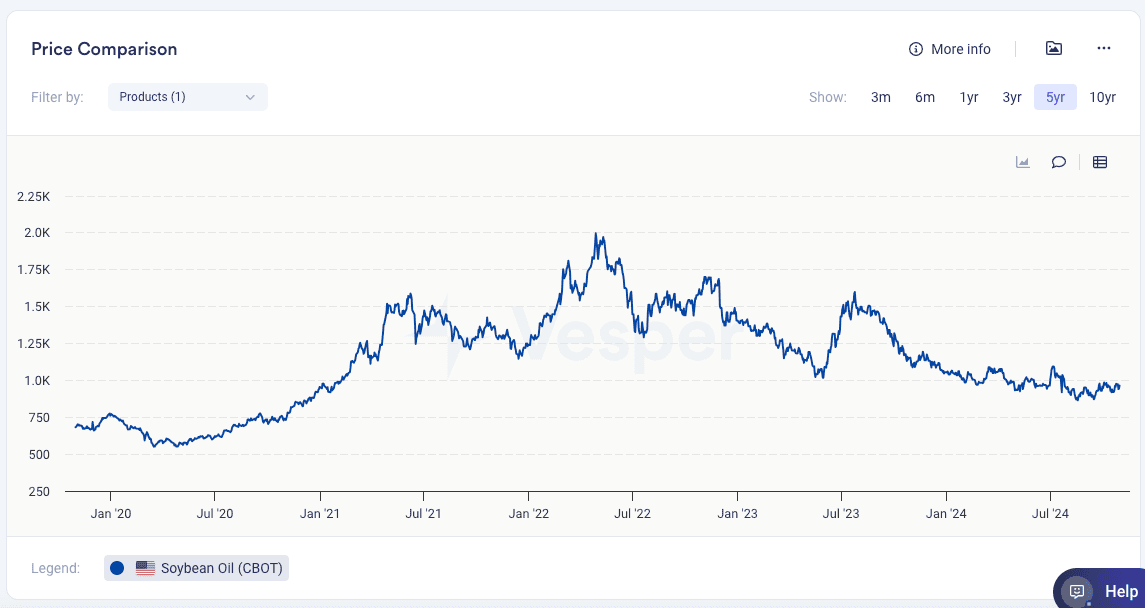

Soybean oil, which was previously a key feedstock for biofuel production, got a hit, and prices declined to a few-year lows. The same happened to soybeans.

If the proposed changes are implemented, U.S. biofuel producers may have less incentive to import UCO and tallow, likely leading to a shift back toward using more soy and canola oils as feedstocks.

Additionally, foreign-produced biofuels that currently qualify for U.S. tax incentives will lose this benefit, making them less competitive in the U.S. market and potentially reducing imports. This change is especially significant for Europe, which exported over 1 million metric tons of biodiesel to the U.S. last year.

However, if the changes are not implemented, current conditions will continue, and imports of Chinese UCO and Brazilian tallow could potentially increase even further.

The industry is still uncertain and lacks guidelines

NATSO (National Association of Truck Stop Owners) reported that by mid-October, biofuel producers bought only about 10% of their biodiesel feedstocks for Q1 2025. That compares with more than 80% by that time over the past decade.

The industry is waiting for the Treasury Department to issue guidance for the 45Z clean fuel production credit that will begin in January. Industry is waiting to see if the proposed changes will be implemented.

Another big uncertainty around the tax credit is the outcome of U.S. presidential and congressional elections taking place next week. It’s not clear if the Biden administration will issue proposed guidance before a new U.S. leader is sworn in. A major question is whether the 45Z credit will be extended beyond its current expiration at the end of 2027.

The delay in guidance is creating significant uncertainty for renewable fuel producers, impacting their ability to assess the financial viability of their output and potentially slowing down the industry’s rapid growth. With no clear timeline or details on the new subsidy, crushers are redirecting a larger portion of soybean supplies to food export markets, according to Kent Woods, CEO of CrushTraders.

Biofuel producers, including those in the SAF industry, are also feeling the effects. CoBank reports that the SAF sector requires sustained government incentives and more long-term offtake agreements to drive growth. The report highlights that airlines have hesitated to commit to long-term SAF agreements due to high SAF costs, which could reduce their competitiveness compared to airlines with lower SAF usage.

There is uncertainty about whether the guidance for the 45Z credit will be available before the credit takes effect. This could potentially create challenges for producers planning to claim the credit in early 2025.

What can we expect?

- The industry is still awaiting guidance on the 45Z tax credit, scheduled to take effect in January 2025 and available through 2027.

- The industry is under pressure, with biofuel and agricultural players struggling to plan their activities effectively.

- The proposed changes would restrict 45Z tax benefits exclusively to biofuels produced from U.S.-sourced feedstocks. Additionally, the 45Z tax credit could potentially be extended to 2034 or even 2037.

- If the changes are implemented, this could reduce U.S. imports of UCO, potentially redirecting these feedstocks to Europe and putting downward pressure on global UCO prices.

- Secondly, this would likely drive higher demand for U.S. soybeans and soybean oil, pushing up their prices and potentially offering some support to other vegetable oils globally.

- Thirdly, this would likely reduce U.S. imports of E.U. biodiesel, increasing its supply in Europe and putting downward pressure on prices.