When Remi joined Universal Nutrition, a leader in sports supplements, as a Procurement Manager, he faced an immense challenge. Stepping into a role previously held by someone with 30 years of experience and industry contacts, Remi had big shoes to fill. “The guy who did this role before me had gut feel and industry contacts, and I came in flying blind.” Unlike his predecessor, Remi had to rely more on data-driven tools to gain insight into a volatile market. “For me, especially as a new hire, it was like, ‘Okay, if you want to have faith in me, I need to have faith in the external world and industry data.'”

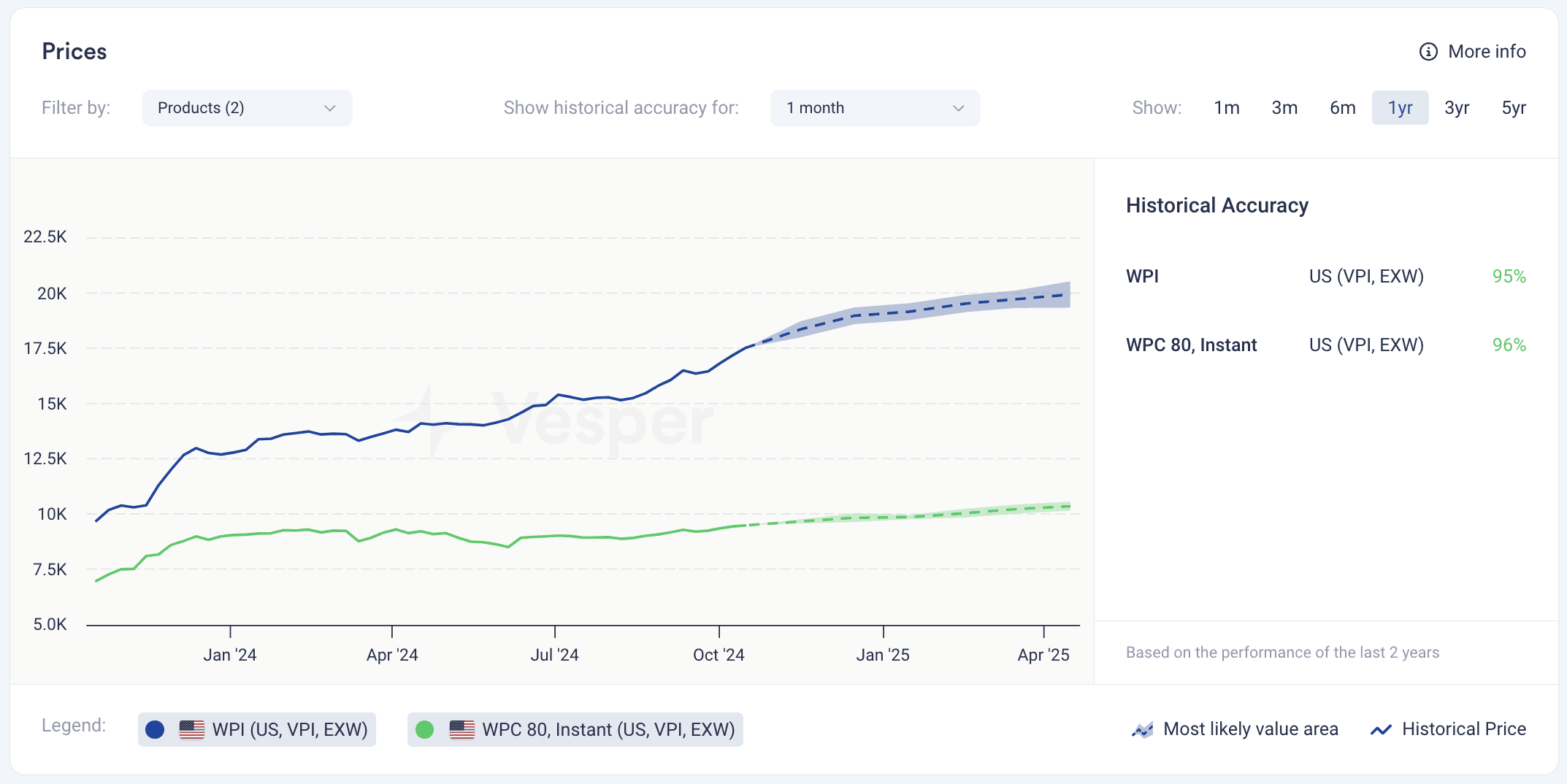

When evaluating his options, Remi quickly realized that Vesper provided unique value compared to other commodity intelligence platforms like Mintec by Expana. “As a single user, the price of a platform like Mintec didn’t justify the size of my spend or the potential savings,” Remi explains. “While Mintec was more costly, Vesper offered unique benchmarks and tailored insights specifically for the sports nutrition sector, making it the perfect fit for Universal Nutrition’s procurement needs without breaking the budget.” Vesper allowed Remi to track market trends and make informed decisions with precision and flexibility, all at a cost that made sense for the business.Getting a return on investment was remarkably easy for Remi. The platform’s real-time price indices allowed Remi to get a clear, up-to-date view of market trends for the ingredients most critical to Universal Nutrition’s products, like WPC and WPI in a highly fluctuating market.

Knowing When to Buy

By leveraging Vesper’s market analyses, Remi found it easy to maximize his return on investment. “The intelligence provided allows us to time our purchases strategically. We can justify the subscription cost very quickly by avoiding bad purchasing decisions.” This strategic approach helped Universal Nutrition avoid overstocking when prices were high and capitalize on lower prices when the market softened.

Vesper’s market reports are created by in-house analysts who combine global industry insights with solid data to deliver clear, unbiased commentary. The market drivers section offers users like Remi a concise snapshot of the whey market, highlighting price drivers, future expectations, and trading activity based on short- and long-term sentiment, liquidity, and key factors summarized under Bulls and Bears. These weekly reports provide straightforward analysis for a quick understanding of market trends and drivers. See an example from the latest market highlights below.

Coupled with Vesper’s AI-driven price forecasts, Remi received recommendations on where the market was heading for the next 3 months, and when to make critical procurement decisions. “Vesper’s market intel and the reports are very useful. I’ve seen it align closely with what we observe.”

“Historically, we’ve been conservative because of supply disruptions and volatile usage,” Remi notes. With the analyses, he could assess inventory and strategically recommend the right moments to lock in contracts. For example, when market data indicated that prices would remain high until the end of the year, Remi advised his team to cover their needs only until Q4 and then wait for potential price drops in Q1.

“The vendor might say one thing, but with data in hand, I can present trends to senior management and suggest we cover a bit longer before prices spike,” Remi shares. This data-driven approach not only protected Universal Nutrition from unexpected price hikes but also strengthened Remi’s credibility with senior leadership. “It’s my recommendation, backed by Vesper’s data, so if the decision doesn’t go as planned, the responsibility is shared with the team.”All in all, in setting up contracts, Remi’s process became more precise and forward-thinking. Based on Vesper’s analyses, he often recommended placing floating purchase orders that the company could call off as needed. This strategy allowed Universal Nutrition to remain flexible, adjusting procurement as market conditions evolved. “We place POs we can call off if necessary, based on market factors. The data empowers us to make these decisions confidently,” he explains.

Building Trust and Confidence with Suppliers

Vesper’s market analyses have become crucial for Remi, not only for understanding market dynamics, but also for strengthening relationships with vendors. This dual advantage helps him maintain leverage in negotiations, ensuring he’s never at a disadvantage. “Instead of just negotiating for a lower price, I show my suppliers the latest data from Vesper, making it clear that I have full market transparency,” Remi emphasizes. “This way, there’s no room for exploitation, and we can have more straightforward, data-backed discussions.”

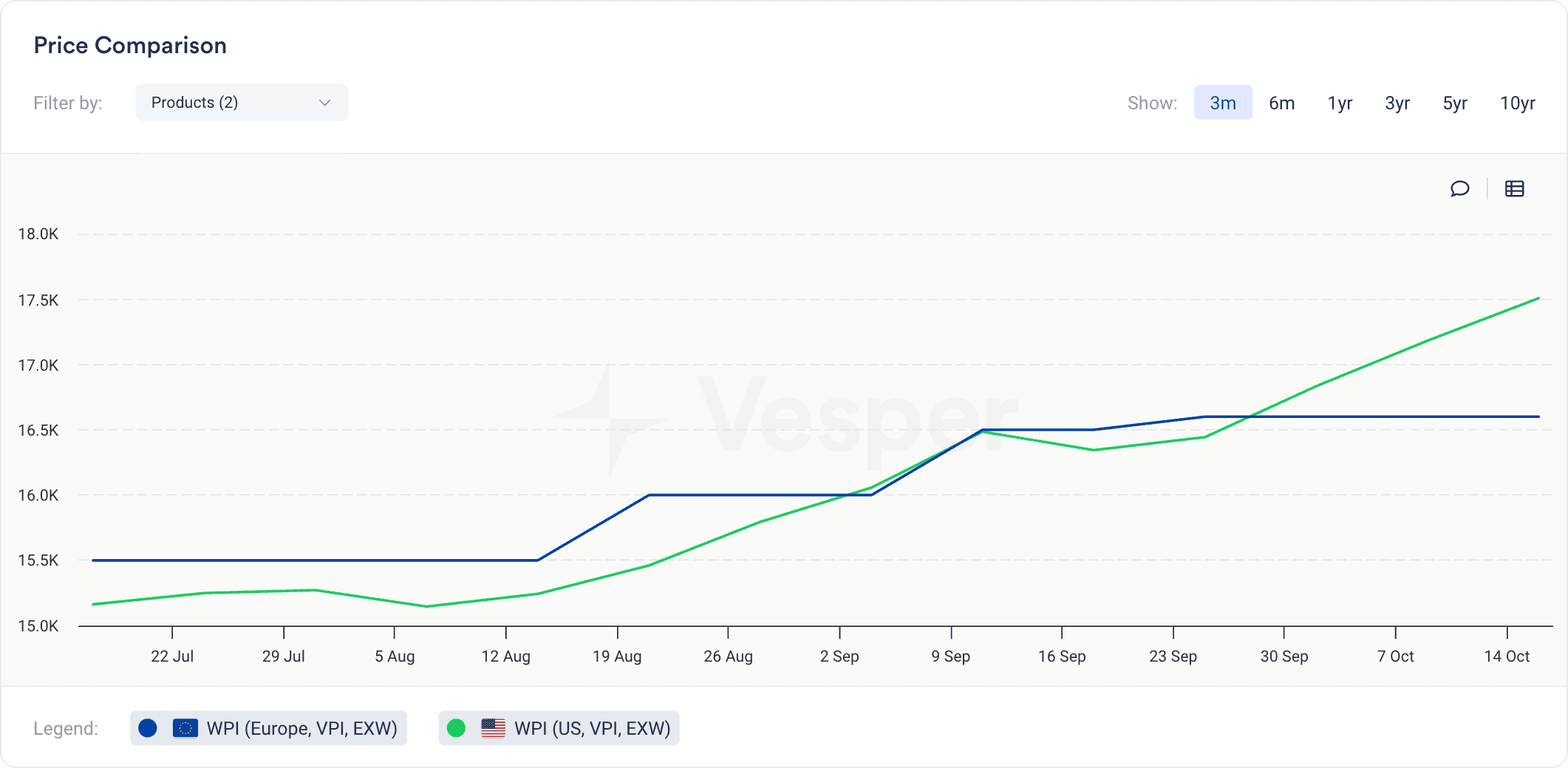

Beyond the market analyses, Remi also relies on the Vesper Price Index (VPI), an independent price benchmark, for critical pricing decisions. “I use the Vesper Price Index for WPC US and WPI US, and I also compare these with the European prices.” It’s very useful because we often get comments like, ‘Oh, look, it’s cheaper in Europe.’ But Vesper shows us the full picture, so we know when and where it makes sense to buy.”

Remi explains that in recent months, the Vesper Price Index hasn’t been as effective in negotiations due to tight conditions in the whey market. Sellers are less inclined to adjust their prices based on the index, knowing that buyers have fewer alternatives and are more likely to pay a premium.

However, it still provides crucial reassurance. “The VPI is not so much a tool to bring prices down in this market—it’s a reassurance tool to show that pricing is fair.” This enables him to confidently justify higher prices to senior management by showing they align with market trends. “When I present the data, senior management sees that the prices we’re paying are reasonable, even if the market is tough.”

All in all, although Vesper’s VPI doesn’t always reduce costs, it gives Remi the confidence to stand before leadership and defend his purchasing decisions. In doing so, he ensures Universal Nutrition isn’t overpaying, while also validating that their procurement strategy is sound under current market conditions.

Check out which Sports Nutrition Price Benchmarks Vesper has added in 2024 here.