UNICA’s report for the second half of September shows that the cane crush in Brazil’s Center-South (CS) region was 38.8 million metric tonnes (MMT), a 13.62% decrease compared to the same period last year. The Total Recoverable Sugar (TRS) rate increased to 160 kg/tonne, up 3.72% year-over-year (YoY). However, the sugar mix dropped to 47.8%, a decrease of 3.31 percentage points YoY, leading to lower sugar production at 2.8 MMT, a 16.21% reduction YoY. In contrast, ethanol production slightly increased to 2.2 million cubic meters, marking a 0.26% rise YoY.

Figure 1: CS Brazil’s bi-weekly sugar production in MT

The reduced cane crush and sugar output in CS Brazil continue to put upward pressure on the market, keeping prices elevated. As of October 15, 2024, the price for raw sugar (BR, Partner Price, FOB Santos) rose to 506 USD/MT, while refined sugar (BR, Partner Price, FOB Brazil) increased to 599 USD/MT. However, the price for crystal sugar (BR, Partner Price, FOB Brazil) decreased slightly to 505 USD/MT. The white sugar premium has also dropped by 3.8% over the past two weeks, reaching USD 75/MT—a level not seen since December 2021—mainly due to strong supply from MENA and Europe.

Overall, from April to the end of September, cane crushing in the CS region reached 505.4 MMT, an increase of 2.35% YoY. The TRS rate rose slightly to 141.02 kg/tonne, up 0.61% YoY. Despite the higher cane crush, the sugar mix decreased to 48.85%, down by 0.69 percentage points YoY, resulting in total sugar production of 33.1 MMT, a modest 1.53% increase YoY. Ethanol production saw a more significant rise, reaching 25.2 million cubic meters (Mcbm), up 7.44% YoY. During this period, two mills completed their crushing activities, bringing the total to four so far, compared to three mills that had finished by the same time last year. As of the end of September, 258 production units were operational in the Center-South region, down slightly from 261 units in the 23/24 season.

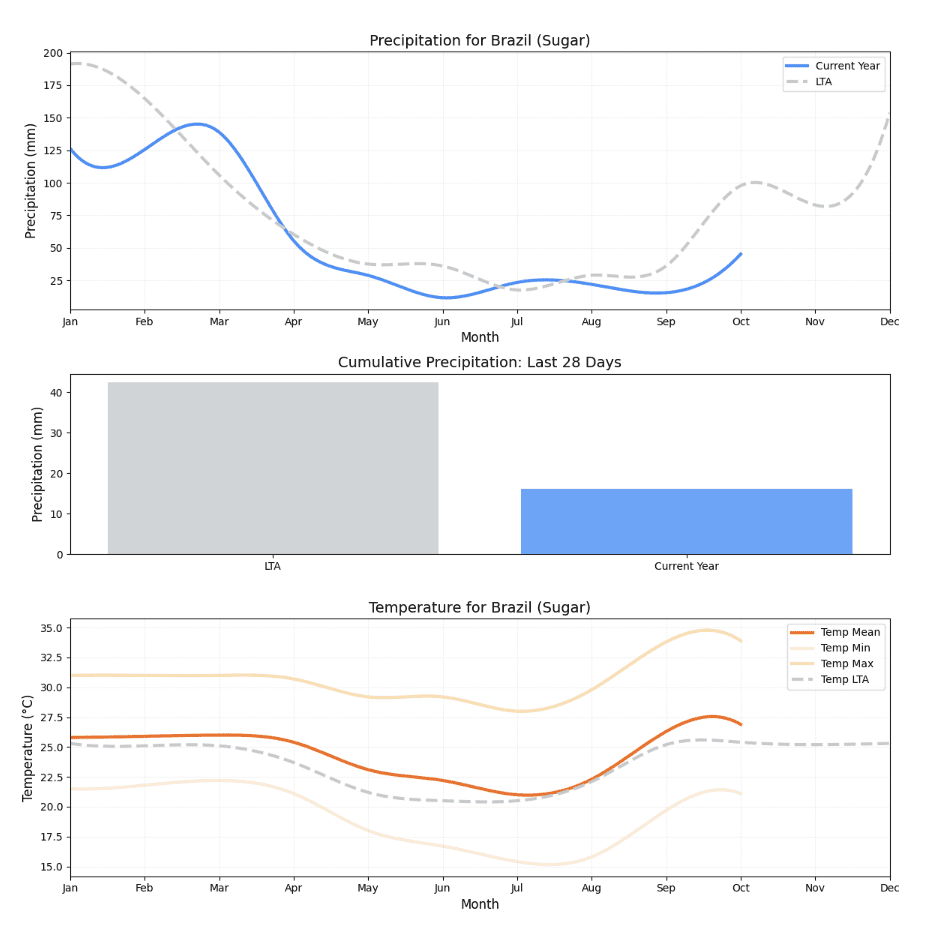

In terms of weather, the first 13 days of October saw key producing regions like São Paulo, Minas Gerais, and Goiás experiencing 66%, 31%, and 25% less rainfall than the historical average, respectively, underscoring the persistent dry conditions this year, see Figure below.

Figure 2: Precipitation and temperature for Brazil (sugar)

In September, Brazil exported a total of 3.95 MMT, marking a 24% increase YoY and a 1% rise from August 2024. In the first nine working days of October, exports reached 1.64 MMT, a significant 34% jump compared to 1.23 MMT in the same period last year.

Outlook

According to Vespers’ AI-driven price forecasts, the outlook for the CS Brazil sugar market remains bullish, driven by substantial declines in both cane crush and sugar production, coupled with unfavorable weather conditions (see Figure below).

Figure 3: AI-driven price forecasts for Raw and Refiner Sugar Brazil in USD/mt

The 13.62% decrease in cane crush and the 16.21% drop in sugar production in the second half of September, along with ongoing dry weather and increasing exports, are expected to keep prices elevated in the coming months. This will likely continue to exert pressure on the market. Furthermore, these conditions may impact the 25/26 season, as they are expected to affect future yields.

For more insights into the global sugar market, explore Vesper for free.