Understanding the dynamics of commodity prices today

The world of commodities are akin to a colossal machine with cogs and wheels, each influencing the other. And at the heart of it all? Commodity prices.

Commodities are the lifeblood of economies. They fuel industries, fill our plates, and form the foundation of global trade. And the fluctuations in commodity prices aren’t just numbers changing on a screen. They’re a reflection of the global market heartbeat.

But what influences the prices of these commodities on the global stage?

Several factors are at play, each weaving into the complex tapestry of global commerce. Here’s a primer on some of the factors we’ll delve into below and how they impact commodity prices:

- Supply-demand matrix: The balance between supply and demand significantly influences commodity prices. An oversupply can cause prices to drop, while a high demand can drive prices up. Various factors like global events or economic policies can further affect this balance, leading to price fluctuations.

- Trade dynamics: Import and export activities, tariff regulations, and global trade relations dictate commodity price trends. A smooth supply chain can keep prices stable, while disruptions or changes in trade agreements can cause price volatility.

- Weather patterns: Weather conditions have a profound impact on agricultural output and subsequently, commodity prices. Events like droughts, temperature extremes, or natural disasters can lead to lower yields or total crop failures, affecting the supply chain and market prices.

Ready to delve deeper into the factors shaping commodity prices today?

The supply-demand matrix

The age-old dance of supply and demand – the fundamental forces driving the market’s rhythm. When it comes to commodities, this duo influences the way prices sway.

Let’s break it down:

- Supply surge: When there’s a bumper harvest or an overproduction of a commodity, the market floods and prices dip. It’s simple economics. More supply leads to lower prices as the commodity becomes less scarce.

- Demand drive: Conversely, when demand spikes — perhaps due to a trendy superfood or a sudden industrial need — prices climb. The commodity becomes a hot ticket item and its price soars.

While the theory is straightforward, the real-world scenario is often more nuanced. Various factors can impact both supply and demand, leading to a ripple effect on commodity prices.

Let’s take a deeper look:

- Weather woes: Unpredictable weather conditions can have either a positive or negative agricultural output, affecting the supply of commodities like wheat, corn, or coffee.

- Economic policies: Government policies on trade or subsidies can either spur or stifle demand.

- Global events: Events like political unrest or pandemics can disrupt supply chains, affecting both supply and demand dynamics.

US Butter supply and demand real-life example with Vesper data

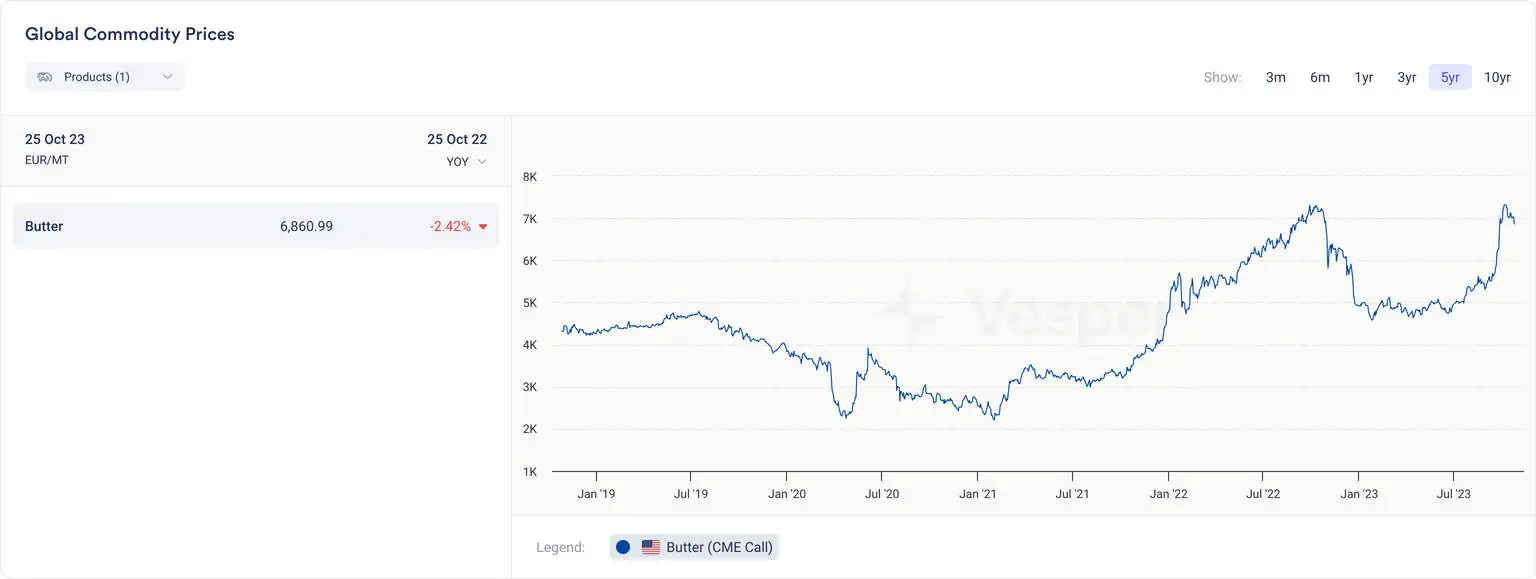

Figure 1 shows a spike in US butter prices in late September 2023. Figure 2 reveals that US Butter supply peaked in May, a month earlier than the usual June. Following this, supply started to decrease while demand increased, as indicated by the blue bar in Figure 2. The delicate balance of supply and demand is reflected in the September price spike, as the butter supply started to decrease while demand began to increase.

Figure 1. Vesper: Global Commodity Prices Graph – US Butter

Figure 2. Vesper: Supply and Demand Graph – US Butter

In essence, the supply-demand matrix is the cornerstone of commodity pricing, reflecting a dynamic interplay influenced by countless external factors.

From weather anomalies to global events and economic policies, the ripple effect on supply and demand is noticeable.

Understanding this matrix, with its subtle nuances and pronounced shifts, is crucial for anyone looking to navigate the complex waters of pricing on commodity markets.

Import/Export dynamics

In the ever-evolving narrative of global commerce, import and export dynamics play a starring role. Their influence on commodity prices is a central theme that unfolds with every shift in the trade winds.

Now imagine a world stage. Countries are the actors, commodities are the scripts, and trade agreements are the plot twists. The storyline? A complex interplay of demand, supply, and the ever-pivotal pricing of commodities.

The plot thickens with every cross-border transaction, each import and export activity, altering the storyline, and influencing the commodity price trends on the global market.

Let’s break it down:

- Supply chain choreography: The harmony or discord in the supply chain dance directly mirrors on commodity prices. A smooth choreography of goods from production to international markets keeps prices stable. But, throw in a disruption, and you have a plot twist that could send prices spiralling.

- Tariff tangles: Tariffs, the critical characters in our trade tale, can either be villains or heroes depending on their impact. High tariffs may restrict imports, potentially driving up domestic commodity prices.

- Trade agreements: Ever the plot twisters, trade agreements can open up new markets or tighten existing ones, causing ripples through commodity price landscapes.

- Global relations: The rapport between countries, be it cordial or contentious, dictates the trade narrative, impacting import/export dynamics and, by extension, commodity prices.

In a nutshell, import/export dynamics are a pivotal force, steering the narrative of commodity prices on the global stage.

From the choreography of supply chains to the intricate dance of tariffs and trade agreements, every movement resonates through the market, painting a vivid picture of commodity price trends.

Navigating this realm requires a keen understanding of the global trade narrative, equipping one to anticipate the plot twists and turn them to an advantage in the complex saga of commodity prices.

Weather patterns and agricultural output

Mother Nature: the silent yet potent player in the commodity market arena. Her whims and fancies, in the form of weather patterns, wield a mighty influence over agricultural output and, by extension, commodity prices.

Let’s unravel this:

- Rainfall & droughts: The right amount of rainfall can bless an agricultural season, while droughts can spell doom. These weather extremes can significantly impact the supply of agricultural commodities, sending prices on a roller-coaster ride.

- Temperature fluctuations: Too hot or too cold, and crops could fail. Temperature extremes can lead to lower yields or even total crop failures, affecting supply and consequently, commodity prices.

- Storms & natural disasters: These unpredictable events can wreak havoc on agricultural output and disrupt supply chains, causing both short and long-term effects on commodity prices.

In essence, the impulse of Mother Nature plays a pivotal role in orchestrating the tune to which commodity prices dance.

From gentle rainfall to angry storms, every weather pattern leaves a distinct imprint on agricultural output, weaving a complex narrative that directly translates to commodity prices.

Unlocking the intricacies of this narrative empowers one to not just respond to, but anticipate market shifts, rendering weather patterns a key player in the grand scheme of commodity prices.

Conclusion: preparing for tomorrow’s market with today’s commodity price knowledge

In the unfolding narrative of commodity markets, being well-versed with today’s prices is akin to having a crystal ball that glimpses into tomorrow’s market scenarios. But as we’ve navigated through the factors influencing commodity prices, it’s evident that this isn’t a solo journey. It’s a collective endeavour, intertwined with global market trends, weather patterns, and technological innovations.

Ready to embrace the future of commodity trading with a robust understanding of today’s prices? Start your 14-day free trial today.