To help predict the future of Brazilian sugar production, Vesper has introduced a new tool – the Sugar/Ethanol parity widget. In Brazil, sugar cane farmers have the option to produce either sugar or ethanol from their crops. With ethanol competing with gasoline in the fuel market, a drop in gasoline prices leads to a corresponding decrease in ethanol prices, reducing the demand for sugarcane to produce ethanol and potentially leading to an oversupply of raw sugar. The excess supply of raw sugar can push down sugar prices. Conversely, an increase in gasoline prices may lead to an increase in ethanol prices, making it more attractive for producers to produce ethanol from their crops instead of sugar.

Pro tip: Take a look at our free to use sugar calculators, to for example calculate the import parity for raw.

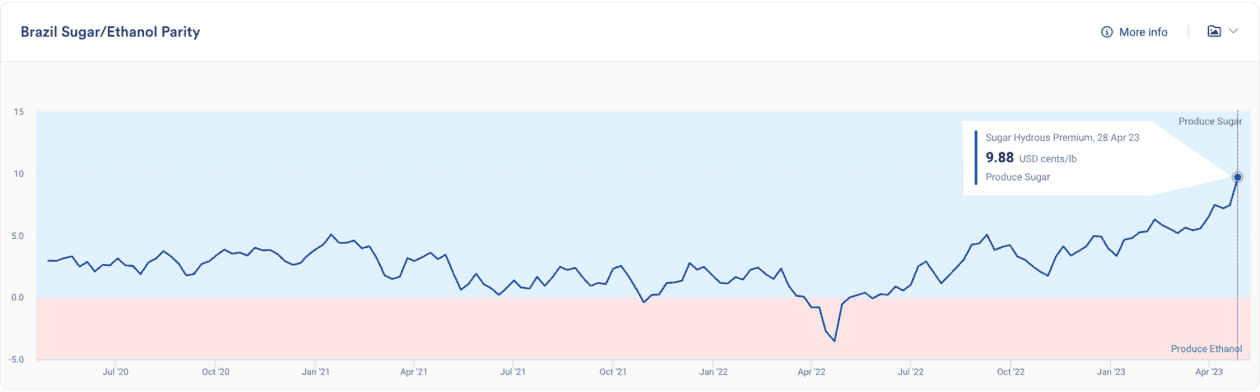

Vesper’s newly launched Brazil Sugar/Ethanol Parity widget helps you understand what product is more attractive to produce for Brazilian sugar mills, as it shows weekly sugar/ethanol price differences. The widget displays the current level of the Sugar – Hydrous premium (the difference between the Sugar No.11 price and the Hydrous Ethanol in Sugar equivalent price). This price indicates which product (sugar or ethanol) is more profitable for the mills. If producing sugar becomes more profitable, Brazilian mills are likely to prioritise sugar production, leading to higher sugar availability in the global market and lower prices, and vice versa.

Based on the line graph below, it can be concluded that the mills will remain to produce sugar over ethanol, as the dark blue line is situated in the upper blue bound of the widget. Considering the prices of April 28, sugar closed at 26,99 c/lb and ethanol in sugar equivalent at 17,1 c/lb, leaving a premium for sugar of 9,88 c/lb. In this scenario, ethanol needs to be at 4,0 BRL/l (EXW, net of taxes) or higher, to incentivise mills to produce ethanol over sugar.