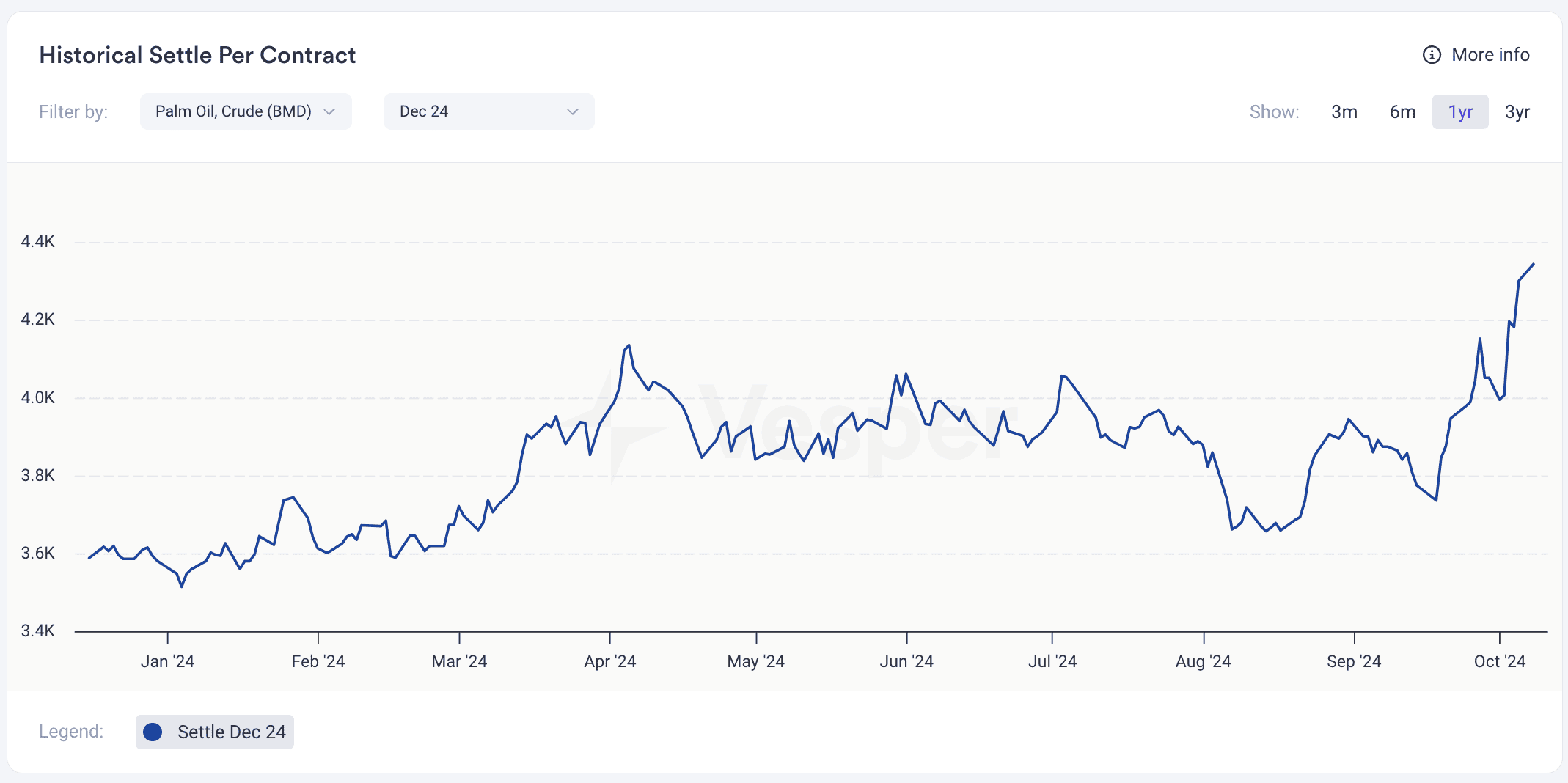

Palm oil prices have surged to their highest level this year, largely due to a sharp rise in Brent crude oil prices. The benchmark December 2024 palm oil contract on the Bursa Malaysia Derivatives (BMD) has climbed above 4,300 MYR per metric ton, a significant increase compared to earlier in the year, see Figure 1.

Figure 1: Crude Palm Oil (BMD) in MYR/mt

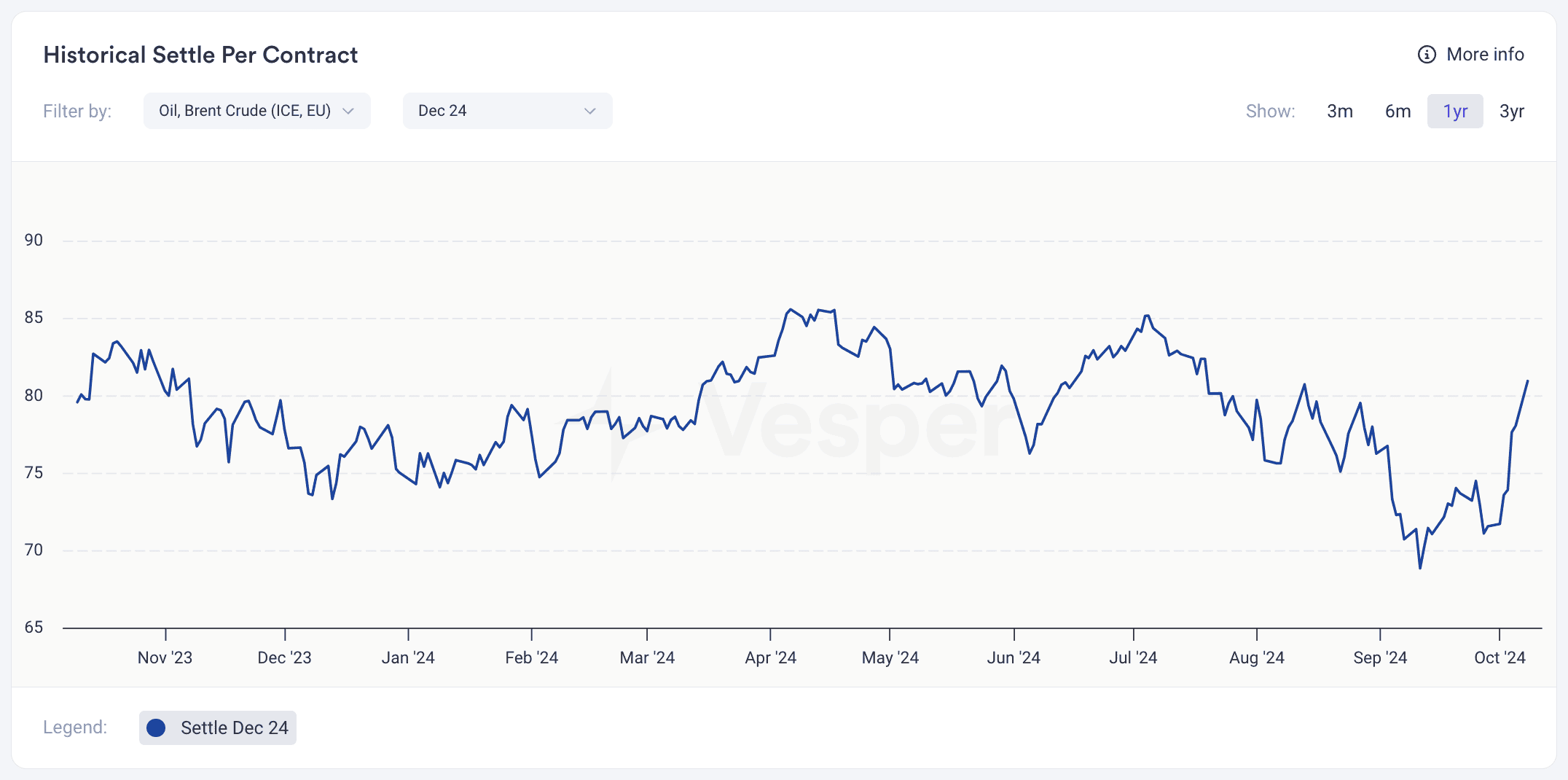

The dramatic rise in palm oil prices is closely linked to a recent 12.1% surge in Brent crude oil prices for the December 2024 contract (ICE, EU) over the past week, see Figure 2. This spike has been driven by growing concerns over potential geopolitical conflict in the Middle East.

Figure 2: Brent Crude Oil (ICE, EU) in USD/Barrel

Specifically, there are fears that Israel may target Iran’s oil production facilities, with Kharg Island—a vital hub responsible for transporting 90% of Iran’s crude exports—being a potential target. Such an attack could severely disrupt the global oil supply, leading to the sharp rise in crude prices.

Palm oil, a crucial ingredient in both the food and biofuel industries, has a strong connection to crude oil due to its role in biodiesel production. As crude oil prices increase, biodiesel becomes a more economically viable alternative fuel, boosting demand for palm oil. This effect is particularly pronounced in countries like Indonesia, where government policies mandate biodiesel production, driving up palm oil prices in response to rising energy costs.

Outlook

The Middle Eastern escalation complicates the price outlook, with analysts warning that any impact on physical infrastructure or oil logistics could pose an upward risk for Brent Crude prices, which would, in turn, affect vegetable oil markets.

Vesper’s machine learning model predicts a slightly bullish trend in BMD palm oil prices in the next 3 months, with a correction afterwards, see Figure 3.

Figure 3: Crude Palm Oil (BMD) Price Forecast in EUR/mt

The market sentiment is not aligned with the model’s prediction. Market participants expect the production peak to occur later this year, with lower numbers in September. A correction is anticipated as palm oil holds a significant premium over other oils.

Longer-term stable-bullish (model shows stable-bearish). Questions around Indonesian supply are associated with lower production and increased domestic consumption by the biodiesel industry. The country’s exports could fall by 2 million metric tons to 30.2 million tons in 2024 from a year ago, said Fadhil Hasan, head of the trade and promotion division at the Indonesian Palm Oil Association. In the first half of 2024, exports fell 7.6% to 15.06 million tons, he said. Meanwhile, a few agencies expect a bull run for the prices for the period between Jan and Mar 2025 due to the Chinese Lunar New Year and the holy month of Ramadan.

To check out the latest spot and forward prices for palm oil, visit Vesper’s platform for free.