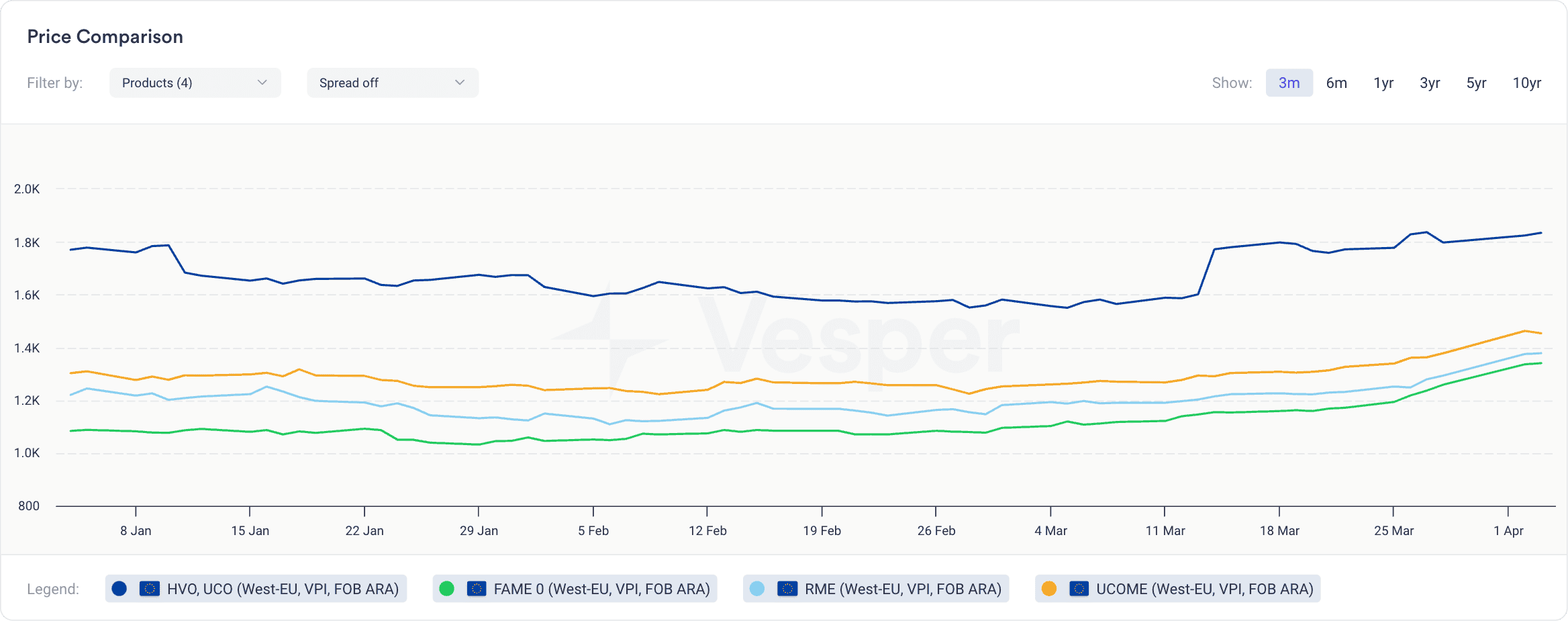

The Vesper West-EU Price Index has reported a noteworthy escalation in the prices of various biodiesel products. As of the latest update, RME prices have experienced a 6.57% week-over-week increase, climbing to €1279 | $1378 per metric tonne (FOB ARA), up from €1195 | $1293.

UCOME prices have also seen a significant rise, with a 5.97% increase to €1349 | $1454 per metric tonne (FOB ARA) from the previous €1273 | $1378.

Furthermore, FAME 0 prices jumped by 6.51%, reaching €1244 | $1340 per metric tonne (FOB ARA), up from €1163 | $1259.

Notably, the price index for HVO (UCO) observed a 2.47% increase, reaching €1702 | $1834 per metric tonne (FOB ARA), from an earlier €1661 | $1797.

Figure 1: Vesper’s price comparison for the West-EU in USD/mt

A recent announcement by Germany that B10 and HVO100 are now allowed to be sold at pumps sparked price increases in HVO and, subsequently, in other biodiesel prices. Outright biodiesel prices rose quicker than feedstocks, widening the margins for producers. As producers rush to secure these good margins, higher interest for feedstock makes it follow biodiesel prices.

This situation has also led to fluctuations in the cost of UCO (CIF) basis, with some market participants noting differences of up to $100 per metric ton in CIF prices in Rotterdam. Additionally, there’s a reported increase in prices in China and Indonesia, with the FOB price for UCO (5% FFA) in Indonesia at $880 per metric ton, and FOB prices in China ranging between $850 and $900.

According to one market player “Some players in China with whom we previously worked now refuse to sell CIF or give way too high CIF prices. Some prefer to sell locally instead.”

Some buyers have found themselves in a difficult situation after purchasing Used Cooking Oil (UCO) on a Free On Board (FOB) basis from China, now facing challenges due to high freight costs Those who have UCO in European storages possess “gold”, said one market source.

Furthermore, there’s a growing sentiment that the market will strengthen further, as the U.K. is considering abolishing inward processing relief, which is used as a “tax loophole” for those who import biodiesel into the U.K. Despite biodiesel carrying a 6.5% import duty, inward processing relief permits certain importing entities to potentially evade import duty or VAT on goods designated for repair or transformation into another product.

Sources suggest this shift could commence by late April or early May, following a 30-day right-to-reply phase post-meeting. Market participants said that expectations of the introduction of China biodiesel antidumping duties by the EU in the summer also support the prices.

Download our latest highlights for free for more insights on the biodiesel market.