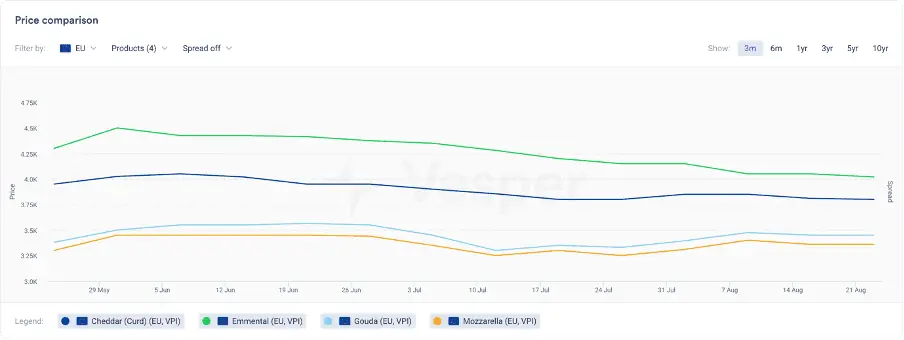

In the dairy markets we see today, cheese stands out in both sentiment and prices, with prices maintaining relatively elevated price levels (Fig 1). While it’s true that trading volumes remain restricted and a certain degree of uncertainty persists, the current price levels don’t lie. Compared to the weaker Butter, SMP, and WMP markets, cheese is the only product that can still command a valorisation exceeding €0.40/kg from milk.

Pro tip: Try our Cheese Yield Estimation Calculator and more, using our free dairy calculators.

Fig. 1: Price Comparison for the Week’s Vesper Price Index (23/08/2023)

- Cheddar: €3800 | $4076/mt ($1.85/lb) EXW (Decreased)

- Emmental: €4020 | $4312/mt ($1.96/lb) EXW (Decreased)

- Gouda: €3450 | $3700/mt ($1.68/lb) EXW (Remained)

- Mozzarella: €3360 | $3604/mt ($1.63/lb) EXW (Remained in Europe, Decreased in the US to €3676 | $3943/mt or $1.79/lb) EXW

The favourable stock situation is enabling manufacturers to extend high-priced offers for cheeses, a trend that is expected to continue until buyers resist further price hikes or manufacturers face more significant stock pressure. Interestingly, the common factor among all producers currently is the absence of substantial stock pressure.

How will the higher valorisation for cheese and declining milk production play out? Will manufacturers be able to lock in a lot of export sales, or will they see stock levels rising further? Are all buyers going to lock in Q4, or will we see a lot of spot market activity in the last quarter of the year? There are a lot of (partially) unanswered questions that will define the outlook of the cheese market in the months ahead.

For most cheese types, the existing to short-term sentiment appears to move between bearish and stable, with limited potential for upward price movement. In terms of the European outlook, the potential for downward price adjustments looms towards year-end. A few exceptions exist; for instance, Mozzarella and Cheddar in the US are likely to experience a tighter market with substantial upward price potential in the forthcoming weeks, given the decreasing milk supply. Conversely, Cheddar in New Zealand is expected to weaken due to the onset of milk production season and the surplus milk initially intended for WMP.

Finally, the Emmental market is likely to remain in a slightly weakened state as long as the current availability is not lowered. Recent price fluctuations have stimulated more buyer interest and likely curtailed additional production, but there are still quantities that need to be moved, possibly at lower prices, before market stability can be achieved.

Keep track of the latest cheese trends through Vesper’s Commodity Intelligence Platform.