January witnessed a significant recovery in the sugar market, driven by a confluence of factors. Industrial consumers, who had previously missed purchasing opportunities due to swiftly rising prices, seized the moment to consolidate their raw material purchases as prices dipped, offering a palpable sense of relief.

Additionally, lower-than-average rainfall in Brazil over December and January amplified concerns over the availability of sugarcane for the upcoming March harvest. Concurrently, a consensus is emerging about a projected decrease in sugarcane production for the 2024/25 season, with estimates suggesting a 5-7% drop.

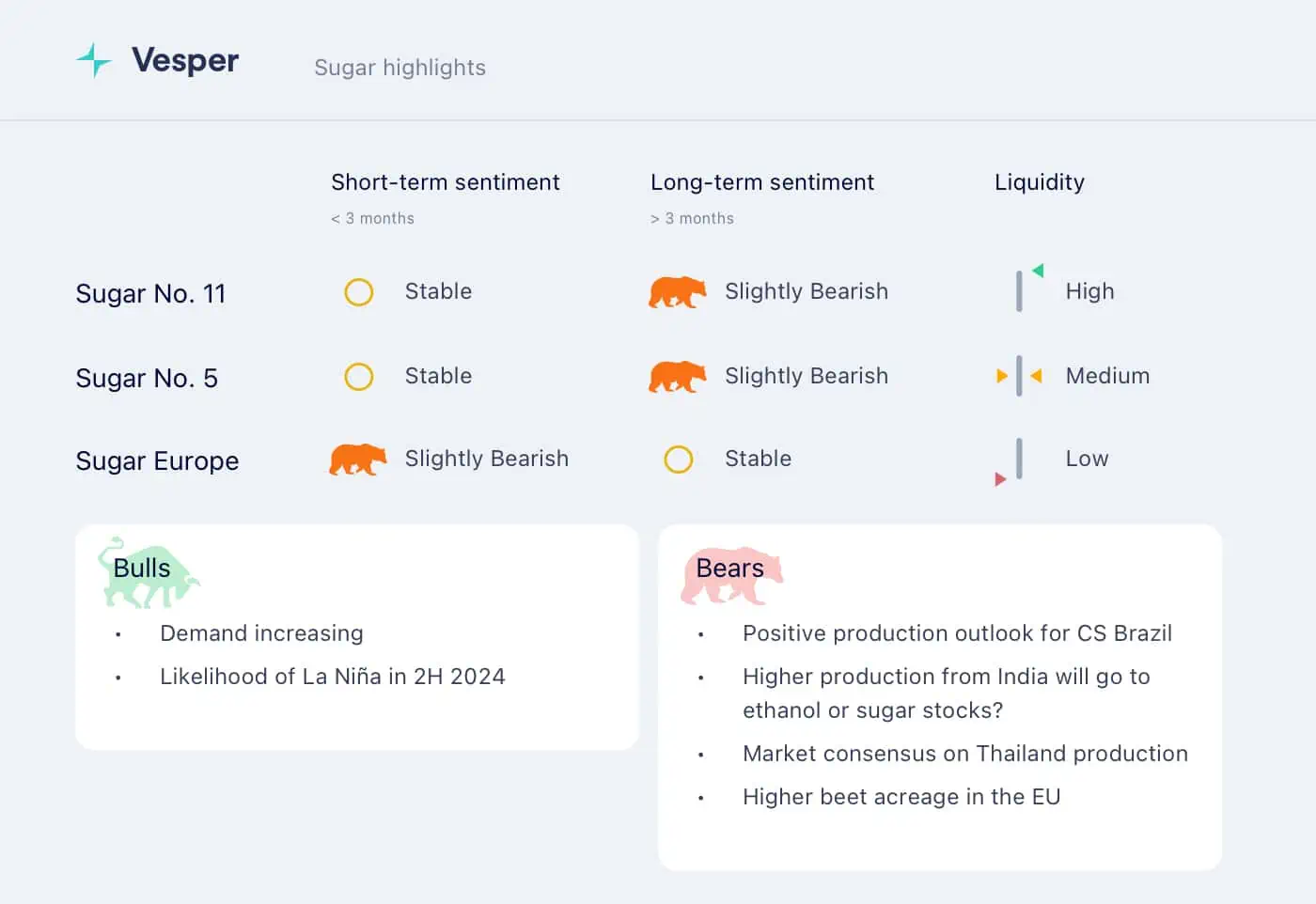

The market has stabilized somewhat, with sugar prices oscillating between 23 and 24 USD cents/lb (see Figure 1), thanks to a clearer understanding of production levels in India, Thailand, and Brazil, alongside stable market fundamentals.

Figure 1: Price comparison of Raw Sugar in USD/lb

Optimism regarding Brazil’s sugar production and exports contrasts with India’s situation, where improved production forecasts (albeit lower than the previous season) introduce a bearish element.

A critical question looms over India’s sugar surplus: will it be channeled into ethanol production or bolster stock? If it boosts the latter, the substantial end-of-September stocks could exert downward pressure on prices. Factors such as electoral outcomes and increased Fair and Remunerative Price (FRP) payments to sugarcane farmers could significantly influence cane supply.

Considering the market’s dependence on this sector and the delicate equilibrium between supply and demand, slight shifts in Brazil’s sugarcane industry are poised to have a substantial impact on market dynamics. The climatic conditions remain a pivotal concern, potentially impacting Brazil in the short term and India in the longer term.

For Brazil, the National Institute of Meteorology (Inmet) forecasts below-average rainfall in areas of the Southern region and the states of Mato Grosso and Goiás. For the majority of the Central-West, Southeast, and Northeast regions, as well as parts of Paraná, the forecast indicates rainfall to be within or slightly above average.

The forecast for February also indicates a rise in temperatures across Brazil, except for certain areas in the North, South, and Central-West regions, which align with the parts expecting below-average rainfall.

However, if the mills commence operations earlier than usual, contingent on favourable weather conditions, it could exert downward pressure on prices.

Download our latest highlights for free and get global sugar market prices and updates for the next 30 days.