Uncertainty has once again gripped the dairy markets following reports of a foot-and-mouth disease outbreak on a farm in East Germany. The potential for further infections has raised serious concerns about the future of dairy production in Europe, triggering both hesitation and strategic moves among buyers, producers, and traders.

As the disease spreads, European dairy markets are facing major disruptions, with significant implications for exports, especially from Germany. With health certificates for products from Foot-and-Mouth-Disease-affected regions being suspended, concerns are mounting over how long the disease will impact trade and whether other regions will step in to fill the gap.

Butter Prices and Market Activity

The European butter market, in particular, is facing significant uncertainty due to the concerns surrounding Foot-and-Mouth-Disease. The outbreak has caused trading to come to a standstill in the region, as buyers have become increasingly cautious. This has been particularly noticeable in Germany, where many European buyers are avoiding German butter products due to the risk of contamination.

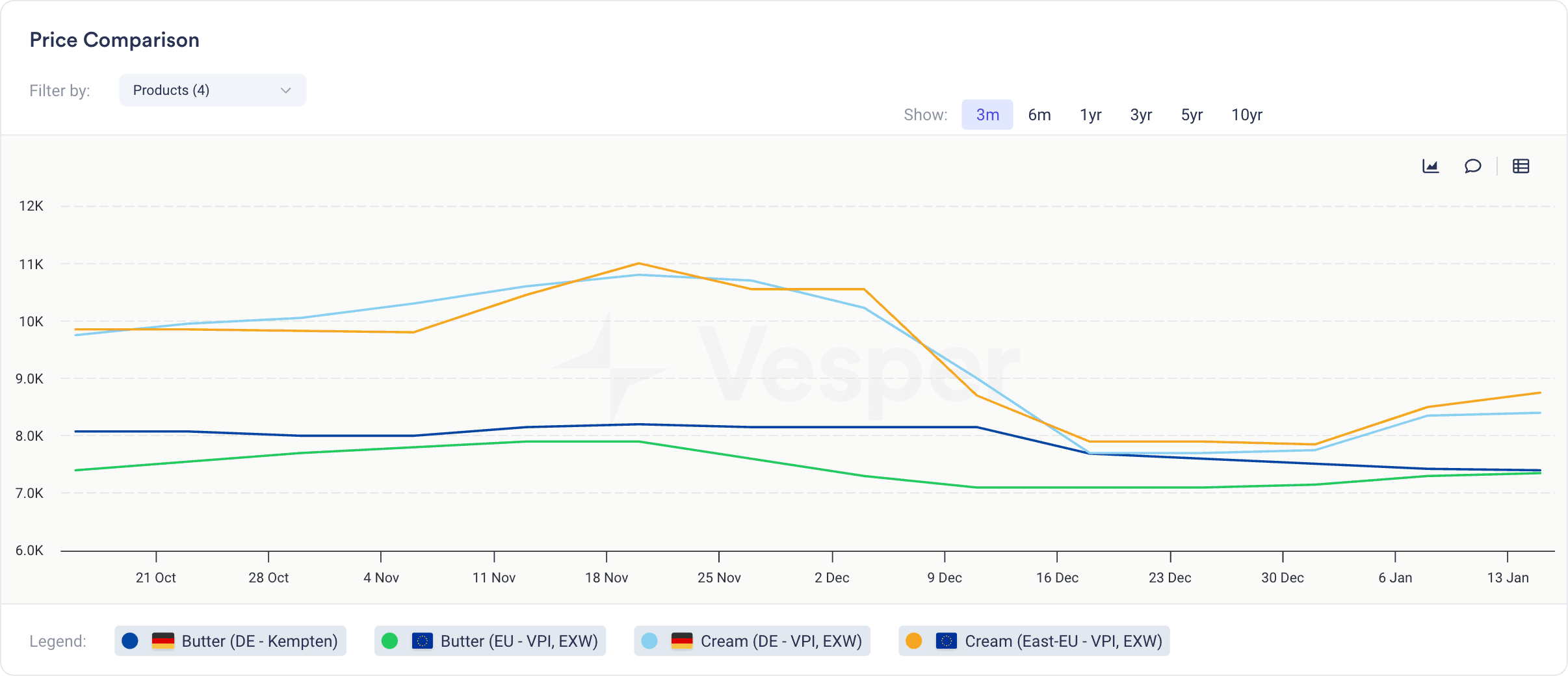

Beyond Europe, some international buyers are even moving away from all European butter, fearing potential spread and contamination. Despite this, German butter prices have not yet weakened compared to other countries, which suggests that the full impact of the disease on prices may not have been realized. On the other hand, cream prices have risen across most of Europe—except in Germany—indicating a potential shift in pricing dynamics across the continent, see Figure below.

The broader outlook for butter remains challenging. While demand for butterfat is high globally, production has struggled to keep up, and this tight market could be further complicated by the Foot-and-Mouth-Disease situation. Europe is heading into its flush season, but with the added uncertainty of potential supply disruptions, it’s unclear whether enough stock will be available to meet global demand.

SMP (Skim Milk Powder) at Risk

Even though many buyers in the European market are a bit reluctant to trade due to uncertainties surrounding the food-and-mouth disease, we do see increased interest from European buyers in non-German SMP volumes.

At the same time, there’s a very dark cloud hovering over German exports of SMP over the coming months, as certain health certificates will not be given as long as Foot-and-Mouth-Disease has been around in the last three months. Many sellers are therefore looking to sell their volumes sooner rather than later, before a lack of exports could start to weigh down on SMP prices.

Slower European exports would mean that Oceania and the United States would be on the front row for securing more exports, which at the moment favours Oceania due to the elevated prices in the United States. Within the United States, production has dropped -10.9% YOY to the lowest November volumes in 10 years, driven by very low milk production volumes in California. At the same time, exports also dropped a massive -19.7% YOY, as higher prices for NFDM have lead to lower demand from importing regions.

WMP (Whole Milk Powder) Prices and Global Demand

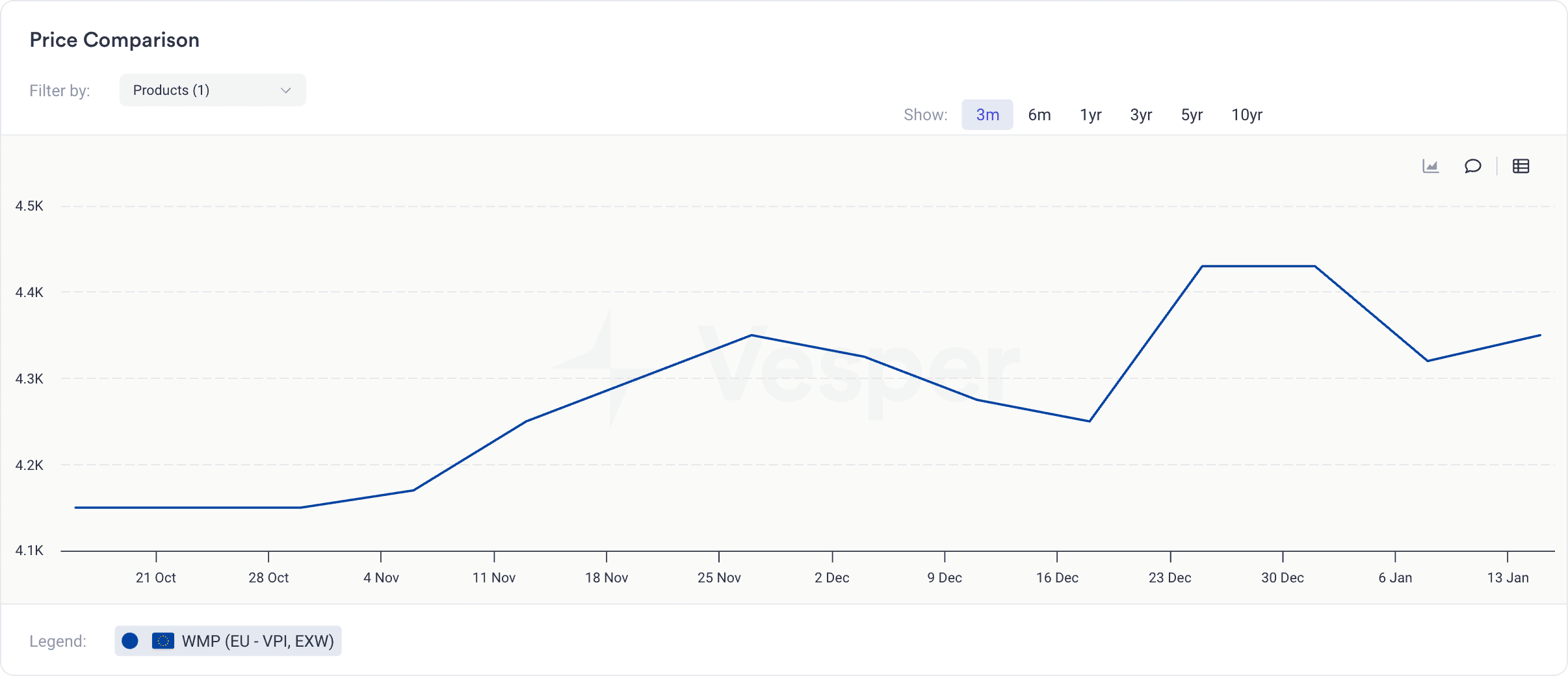

Whole Milk Powder (WMP) markets are also facing a delicate balancing act, particularly in Europe, where Foot-and-Mouth-Disease concerns are exacerbating already volatile price conditions. In the EU, the prices for WMP have been moving sideways for months, primarily driven by fluctuating milkfat prices, see Figure below.

The Foot-and-Mouth-Disease situation is only complicating matters, adding to an already tense market environment. Based on valorization and production costs, prices should be at least be €4200/mt before WMP production is profitable for EU manufacturers.

Meanwhile, Oceania’s WMP market has seen a slight price drop since December, driven by weaker demand from key importing countries, notably China. However, recent price reductions have sparked a slight uptick in demand from regions such as the Middle East, providing some relief. The ongoing uncertainty in Europe, coupled with supply challenges in Oceania, means that the outlook for WMP remains unpredictable as the market grapples with these competing pressures.

Looking Ahead: What’s Next for Dairy Markets?

At this point, it’s difficult to predict the long-term effects of the Foot-and-Mouth-Disease outbreak on the global dairy market. The immediate impact has been felt most keenly in Europe, with buyers becoming hesitant and international demand shifting away from affected regions. While the potential for a drop in exports from Europe looms large, other regions, including Oceania and the U.S., may be able to capitalize on this shift—if they can meet the demand.

For now, the dairy market is in a holding pattern, with many players waiting to see how the situation develops over the next few weeks and months. If more cases of Foot-and-Mouth-Disease emerge, and if the disease continues to spread, dairy prices could rise, supply could tighten, and trade could be further disrupted. However, if the situation is contained quickly, the impact may be more limited, and global dairy trade could regain its balance.

Ultimately, the fate of the dairy market depends on how effectively authorities can contain the disease and restore confidence among buyers and traders. Until then, the industry will continue to monitor developments closely, uncertain of what the future holds.

Stay updated on future dairy market trends amid the Foot-and-Mouth-Disease outbreak. Visit Vesper for free.