Following significant developments in the sugar industry last week, highlighted by the Dubai Sugar Conference and the Datagro Conference, there’s a general agreement that sugar production in CS Brazil will likely fall short of last year’s output due to below-average rainfall during the summer.

Datagro estimates a lower cane availability by 9.8% in 24/25 to 592 MMT (vs 598 MMT in Dubai), and the sugar mix is forecasted at 51.6% (vs 51.4% in Dubai). This combination is expected to reduce sugar production by 4.8% to 40.5 MMT (vs 40.8 MMT in Dubai), and ethanol production by 9.3% to 30.5 Mcbm.

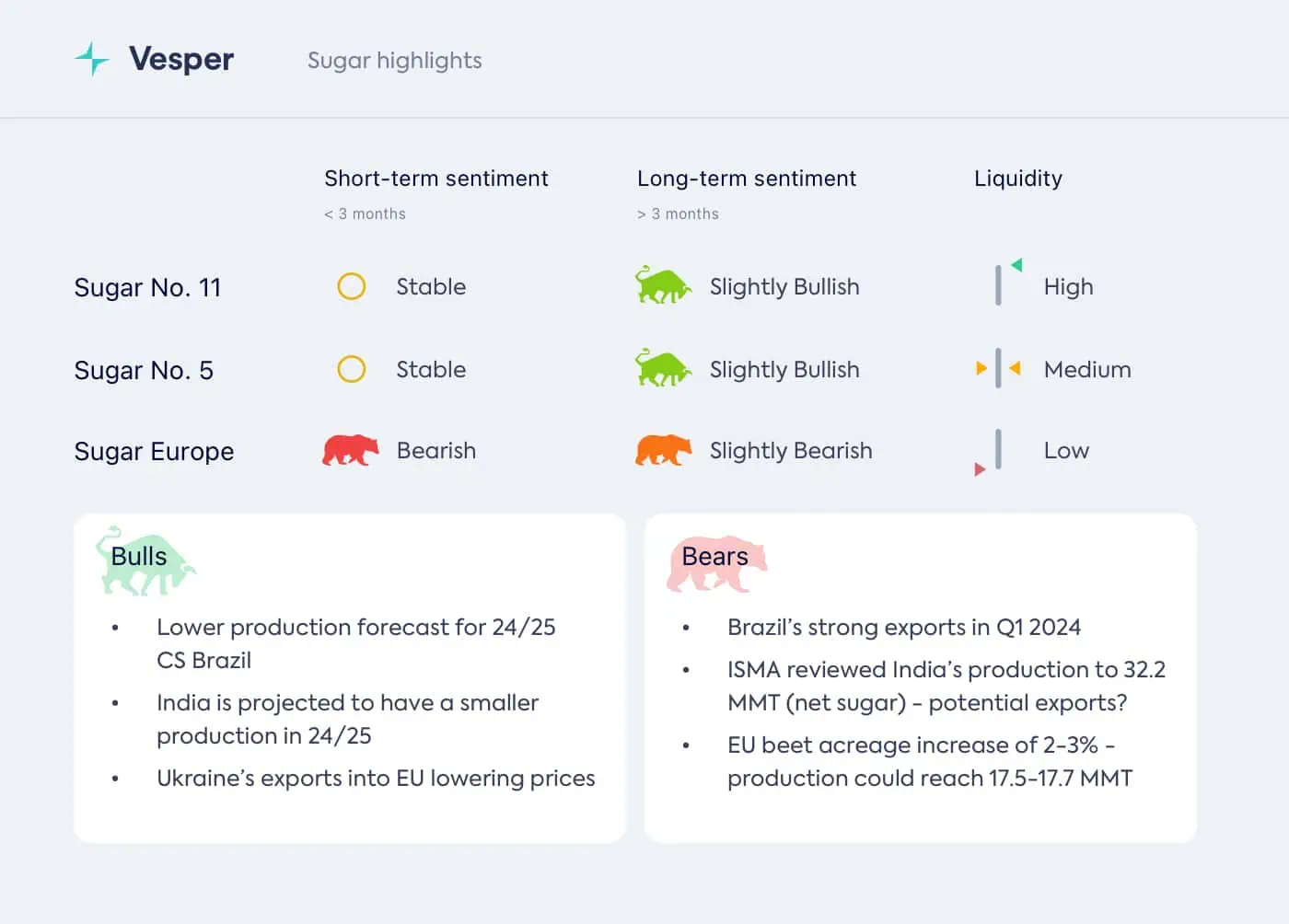

Meanwhile, in the EU and UK, an increase in beet acreage and improved yields are anticipated to boost production in those regions significantly. However, the situation in India remains a point of interest.

Up until last week, the consensus was that India would not engage in sugar exports during the global crop year 23/24, with production forecasts hovering around 31 million metric tons (net sugar). Yet, current figures show production slightly trailing last year’s by 1.2%, despite a revision made in January. On Tuesday, ISMA updated its forecast, adopting a more optimistic stance on the total sugar output for 23/24, now expected to reach 34 million metric tons (before ethanol diversion). With 1.7 million metric tons anticipated to be diverted to ethanol, this leaves a net sugar production of 32.2 million metric tons, marking a 1 million metric ton increase from the previous estimate. This development means the market must now closely watch India’s next moves, as any unexpected exports could exert downward pressure on sugar prices.

Download our latest highlights for free for more insights into the global sugar market.