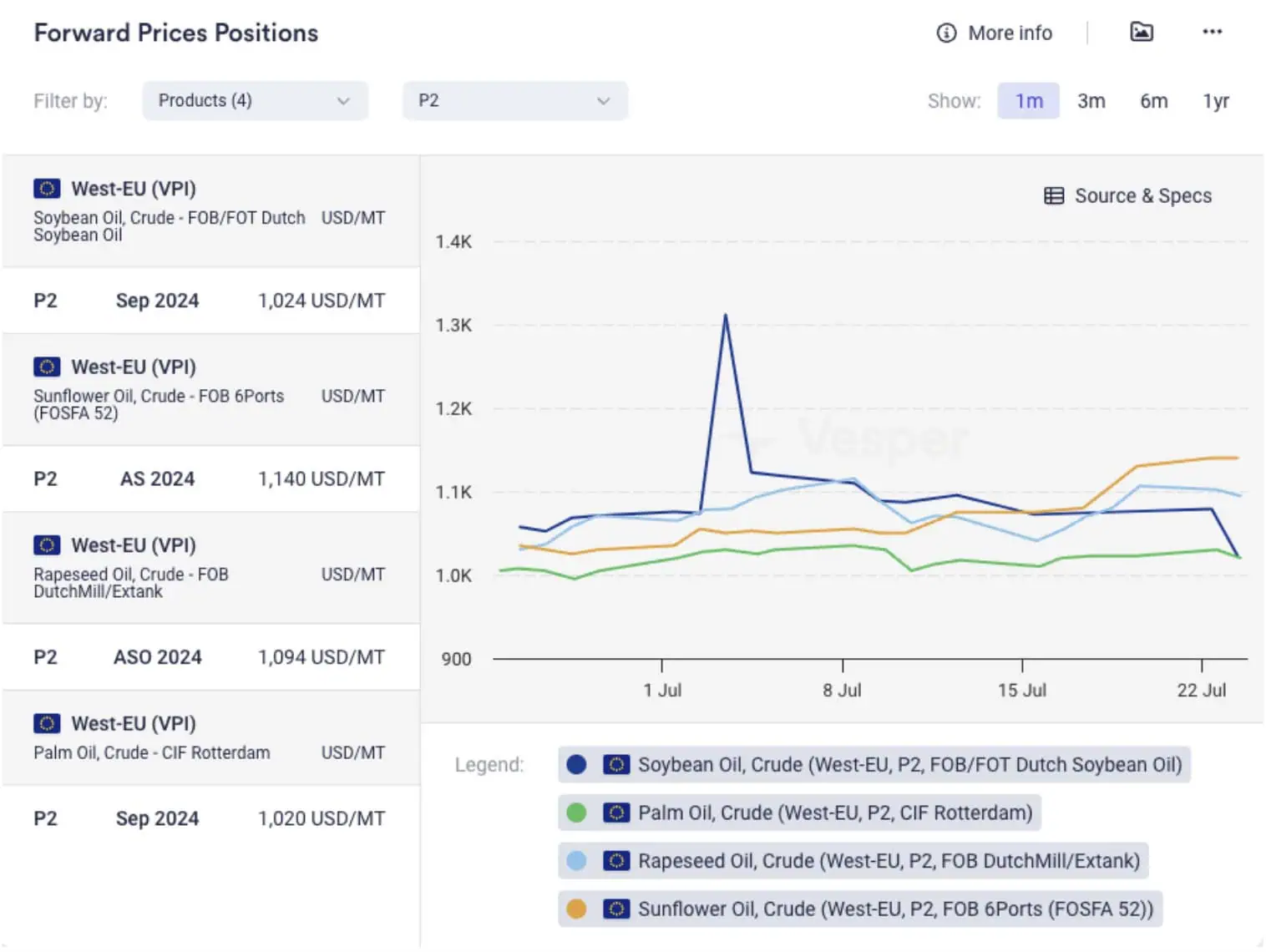

Sunflower oil (SFO) is currently traded at a premium over other oils in the EU, as indicated by the paper market (see Figure 2). The Vesper West EU Forward Price Index for Crude Sunflower Oil (as of 22nd July 2024) rose to $1140/mt (FOB 6Ports, FOSFA 52, Aug-Sep), up from $1075/mt the previous week.

Figure 1: Foward Prices Positions in USD/mt

Factors Driving the Price Increase

Market liquidity is extremely low, as reported by participants and reflected in vessel lineup data. Concerns over crop damage due to hot and dry weather are pushing prices higher. Additionally, prices for competing oils are also on the rise, contributing to the increase in SFO prices.

Export and Crop Data

Minimal changes have been observed in vessel lineup data since the previous report. In July, Ukrainian ports exported 154,000 mt of sunflower oil, indicating a potential decline compared to last year. Russia exported only 27,000 mt via sea. Hot and dry weather is damaging crops in Bulgaria, Romania, Moldova, and southern parts of Ukraine and Russia. The risk of crop losses remains high without imminent rainfall. The forecast remains hot and dry for the next 14 days, leading to further reductions in crop projections. Strategie Grains and OilWorld have lowered their sunflower crop estimates for Russia, Ukraine, Romania, and Bulgaria by a combined 1 million metric tonnes (mmt) compared to the previous month.

Market Reactions

Elevated sunflower seed prices in the Black Sea region are causing crushers to reconsider their pricing and trading strategies. Decent buying demand from importers has been noted in Russia and Ukraine, but the limited number of offers results in slower liquidity.

Market Outlook

Vesper’s machine learning model predicts an upward price trend for BMD crude palm oil until September, after which a decrease is expected, see Figure 2.

Figure 2: 1-month price forecast for Crude Palm Oil (BMD) in MYR/mt

Short-term Challenges

Current market volatility makes it difficult to agree or disagree with model projections. Various factors, including the US elections, weather updates, geopolitical impacts on mineral oil markets, potential changes in India’s budget and vegetable oil import duties, and uncertainties around rapeseed and sunflower crop sizes, contribute to this instability.

Long-term Forecast

The market anticipates that La Niña could elevate prices due to potential disruptions in harvests caused by excessive rainfall during peak production periods, though the impact remains uncertain. From February to April, El Niño might lead to lower yields in late 2024, potentially reducing Indonesian palm oil production below 48 mmt. The European Union Deforestation Regulation (EUDR) will increase costs for palm oil sold to the EU, leading to higher prices. A shortage of sunseed and rapeseed can also support higher prices.

In conclusion, the combination of adverse weather conditions, regulatory changes, and market volatility suggests that the outlook for sunflower oil and other related commodities will remain complex and challenging in the coming months.

For more price AI-driven price forecasts for vegetable oils like palm, olive, soybean, sunflower, coconut, and rapeseed, try Vesper for free.