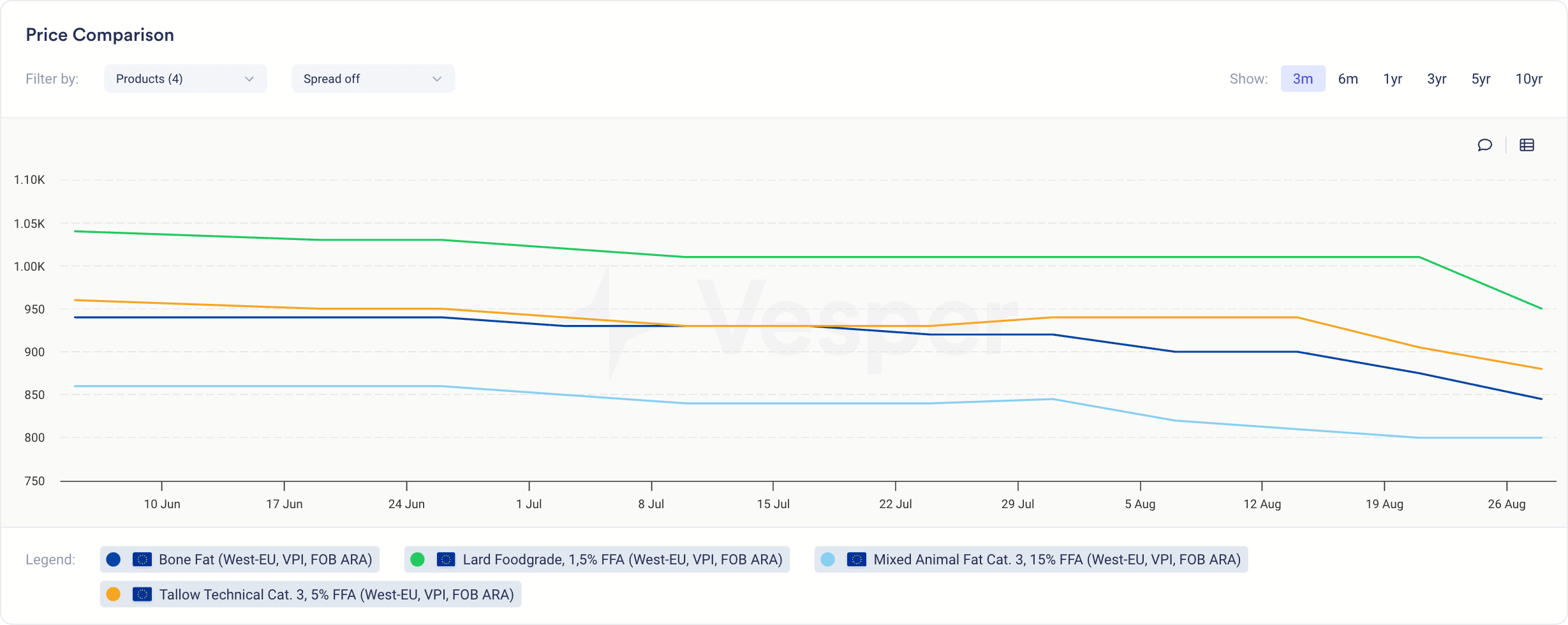

Vegetable oil prices have increased recently due to a combination of higher Brent crude prices, adverse weather risks in the U.S. affecting soybean crops, and Indonesia’s aggressive biofuel mandates and reduced export levies. These factors have tightened supply and driven up demand, contrasting sharply with the stagnant market for animal fats, which are struggling under low demand pressures. According to the latest Vesper Price Index, all animal fats decreased except for FOBARAMixedAnimal Fat (15% FFA):

Figure 1: Vesper’s Price Comparison Widget for Animal Fats in EUR/mt

- FOB ARA MixedAnimal Fat (15% FFA) remained stable at €800/mt

- FOB ARA BoneFat (5%FFA) decreased to €845/mt from €875/mt same period last week

- FOB ARA Technical Talow (5% FFA) decreased to €880/mt from €905/mt same period last week

- FOB ARA Lard(1.5% FFA) dropped to €950/mt from €1010/mt same- Cat 1 Animal Fat (30% FFA) declined to €680/mt from €700/mt same period last week

Taras Reshetiuk from Dutch-based Connex reported to Vesper that prices are expected to continue falling, with demand primarily coming from the pet food sector. Oleochemicals have already secured their Q4 needs, and there is no biodiesel demand due to the availability of cheap and abundant tickets. Taras also noted that in Q4, slaughtering will increase, leading to a higher supply of fats. Combined with a pessimistic outlook on demand, this is expected to put further pressure on prices.

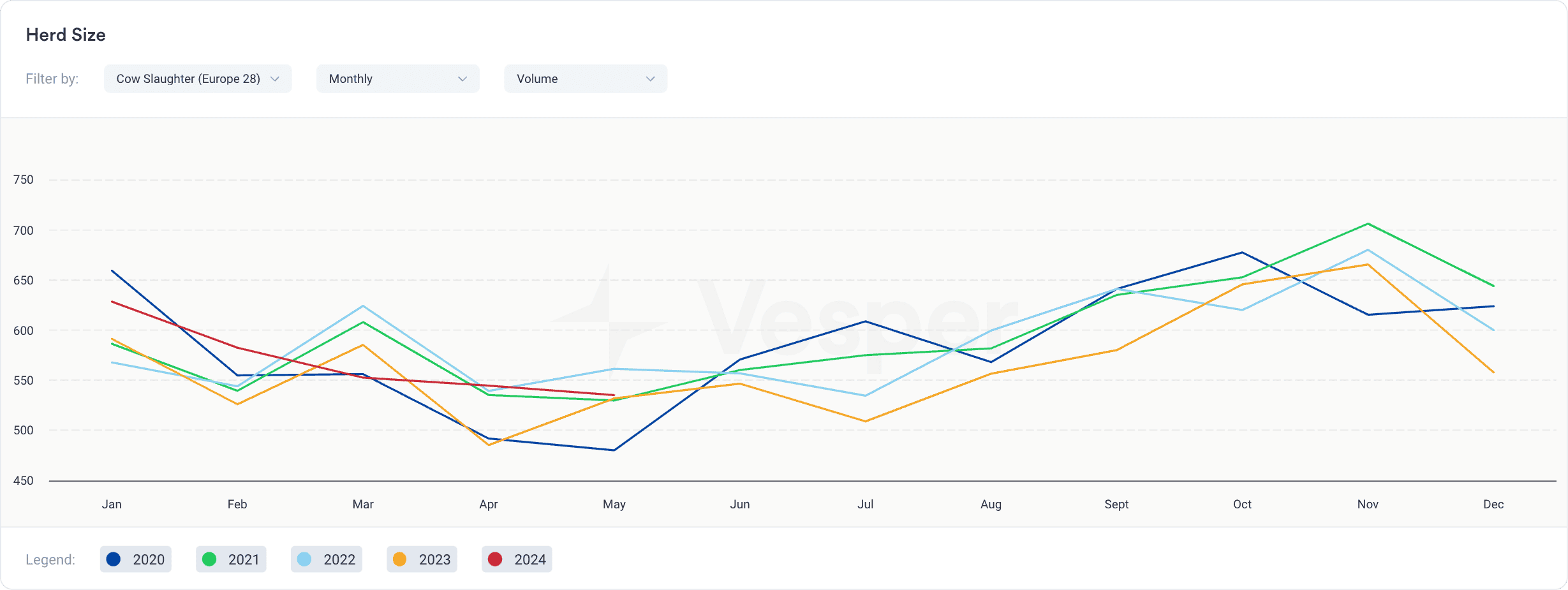

-> Tip: Vesper also tracks data on cow slaughter in Europe, which can provide insights into the future supply of animal fats. As shown in the figure below, herd sizes have fluctuated over the past few years, impacting the volume of cow slaughter and, consequently, the availability of animal fats. Monitoring these trends can help predict potential shifts in the market and the supply-demand dynamics for animal fats in the coming months.

Figure 2: Cow Slaughter figures for Europe-28 (x1000 cows)

Keep up with the latest trends and price changes in the vegetable oil and animal fats markets. Start your free trial with Vesper now and get the insights you need!