Sandor, an international business consultant and trader who works for himself, operates at the intersection of sugar, dairy, and oils and fats. His business is a unique blend of trading and advisory services. “I also do advisory work in primarily Eastern European countries, so my business is a mixture of everything,” Sandor explains, capturing the diverse nature of his professional activities.

The decision to become self-employed was not taken lightly. Sandor had grown weary of the corporate grind. “I had enough of having bosses,” he says with a sense of relief. “I was tired of people telling me what to think and how to think.” The traditional work environment, with its rigid structure and expectations, no longer appealed to him. For Sandor, the freedom to think independently and make his own decisions was paramount.

However, even as a self-employed trader, Sandor finds support in the advanced tools at his disposal. “With platforms like Vesper, I don’t feel alone; it’s like working with a team of data analysts,” he says. “The platform encompasses heaps of information that give me confidence in making trading decisions on my own.”

Building a Network

With over 6,000 connections on LinkedIn and years of experience in the industry, Sandor’s approach to acquiring clients is straightforward. “I know people,” he says confidently. Networking is key to his business “I always meet new people with new projects,” he notes, underscoring the importance of connections in his line of work. His client base is primarily composed of local Horeca (Hotel/Restaurant/Café) businesses, although he occasionally ventures into retail.

When asked why clients choose to work with him, Sandor notes that his reputation is a key factor. Over the years, he has built trust through a series of successful projects. “Usually, they’ve seen me work with someone else or heard about a project I was involved in.” In an industry where trust and reliability are essential, this word-of-mouth recognition is a strong testament to his work.

Sandor’s trading activities are as diverse as his client base. He primarily deals in sugar, dairy products, and vegetable oils, with a monthly trading volume of around 600 to 700 tons.

“Specifically, products such as sugar from Eastern Europe, sunflower oil, olive oil, and dairy items like UHT milk and butter”, he lists, adding that he also used to trade grains like feed in Hungary, although that was a long time ago.

Sandor’s sales markets cover a diverse range of countries, each presenting its own challenges and opportunities. He uses Vesper’s country-specific pricing data, accessible through its filtering options, to monitor market trends in each country. This approach helps him navigate the distinct dynamics of markets in Hungary, Poland, Greece, Slovakia, Bulgaria, Ukraine, and Serbia more effectively.

The Impact of Price Forecasting on Building Long-Term Relationships

Sandor is not one to mince words. “I think intellectual honesty is the most important thing,” he emphasizes. If a project seems dubious, Sandor doesn’t hesitate to voice his concerns. “I don’t engage with projects where I don’t see a positive outcome,” he says, highlighting his commitment to integrity over profit.

Sandor’s approach to client relationships is built on a long-term perspective. “I don’t want to press out the last cent just now because we can do it now. It’s better to give good advice, even if it means making less money now, but ensuring the client stays with you in the future.” This philosophy is evident in his advisory role, where he provides strategic guidance to clients.

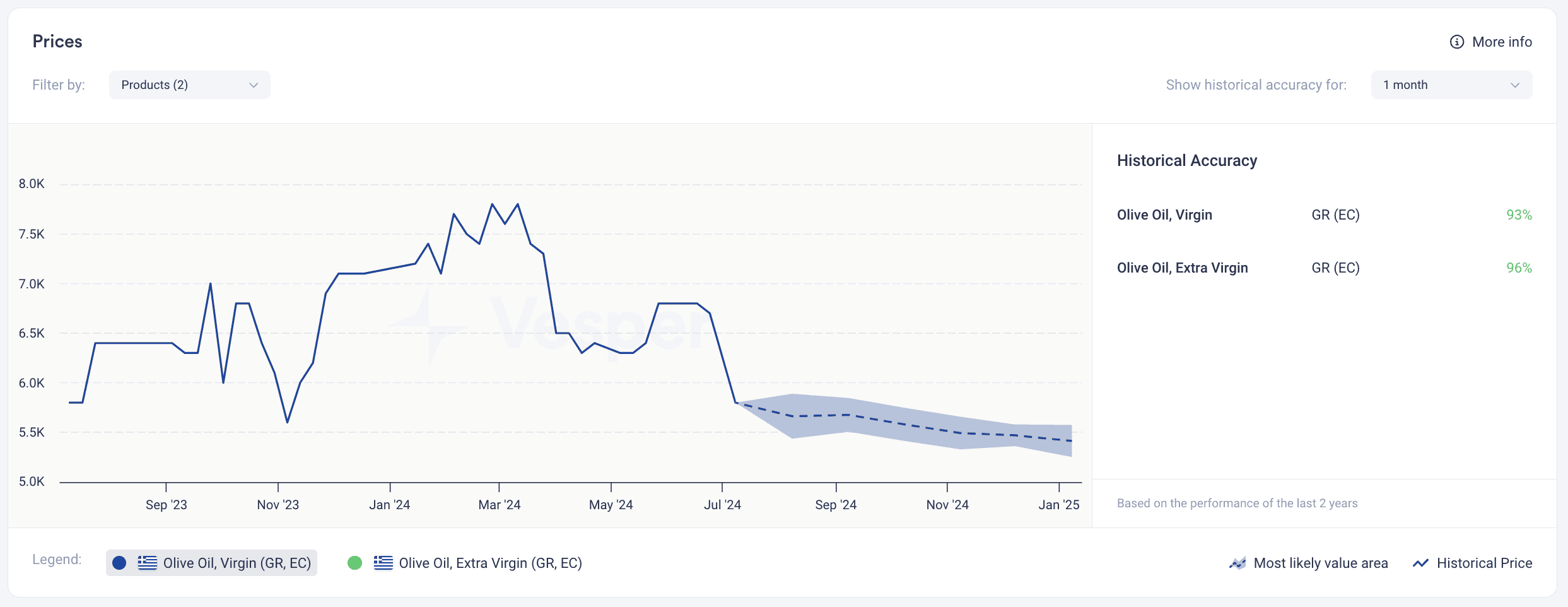

For example, when advising on olive oil purchases, Sandor recently suggested waiting for expected price drops. “If you’re not in a hurry, it’s better to wait,” he advises. Tools like Vesper play a key role in these decisions. The platform’s pricing forecasts, as illustrated in the figure below, offer a clear view of anticipated trends, such as the projected decline in olive oil prices in the coming months.“It helps me avoid making a decision now when it might be wiser to wait two weeks or a month,” Sandor notes, emphasizing the importance of timely and accurate data in his decision-making process.

Sandor’s engagement with Vesper goes beyond using their data for his trades. His participation in Vesper’s Oils and Fats Community WhatsApp Group further enhances his decision-making. “From some perspectives, these are even more useful than raw data,” he notes. The group allows for the exchange of ideas and strategies with like-minded traders, which often leads to better outcomes. “Maybe your approach is bad, and others can offer a different point of view,” he says, valuing the mutual knowledge transfer that the community provides.

In addition to benefiting from the community, Sandor also contributes his expertise, particularly in the areas of sugar and sunflower pricing. By sharing his insights and analysis, he helps shape Vesper’s Price Index and pricing forecasts and discussions within the Vesper platform, enriching the data available to all users. This collaborative approach not only strengthens the community but also ensures that Sandor stays at the forefront of market developments.If you’re interested in becoming a partner like Sandor and contributing to Vesper’s growing community, you can learn more here: Become a Partner.

Blending Expertise with Pricing Insights

To navigate the dairy market, Sandor relies on both price comparisons and expert insights from Vesper’s Data Researchers. In countries like Greece, where local dairy production is constrained by the climate, he strategically leverages his connections in Hungary, Slovakia, and Poland. “Greece imports a lot because it’s cheaper,” he explains, highlighting that he sources butter and UHT milk from these countries to maintain cost efficiency.

Sourcing affordable European butter has become increasingly challenging due to rising prices, driven by higher cream costs and supply chain constraints. Vesper’s platform plays a crucial role in this process, enabling Sandor to compare average butter prices across Eastern European countries and identify the most cost-effective sourcing options, see figure below.

Additionally, to stay updated on the latest market trends, Sandor takes advantage of Vesper’s bi-weekly Dairy Cafe, a free online webinar series that offers valuable insights into the dairy industry. “If I need more detailed information on current dairy market trends, I simply attend Vesper’s Dairy Cafe,” he says. This resource helps him understand the factors driving the market and provides expert advice on the optimal times to trade, ensuring he can offer the most competitive prices to his clients.

Multiple Data Points for Smarter Sugar Trading Decisions

When it comes to trading sugar in Eastern Europe, Sandor stresses the importance of staying informed about the Ukrainian market. “Being up to date is crucial due to the significant price differences that can occur,” he explains. For instance, there are times when Ukrainian sugar prices are lower than those in Eastern Europe, but this trend can reverse. During such periods, Sandor monitors the fluctuations closely. “This kind of insight is invaluable,” he says. “By staying on top of these changes, I can strategically decide when to buy or sell, maximizing my profit margins.”

The same strategic approach applies to the vegetable oils market. “You don’t bring sunflower oil to Bulgaria,” Sandor remarks, highlighting the need for careful consideration of regional markets when sourcing products.

While Sandor has experience working with large producers, he prefers smaller ones. “I don’t really enjoy working with the big ones,” he says bluntly. His experience with large sugar producers has left a strong impression. “Bigger **ses than the European big sugar producers are very hard to find on the market,” he remarks. The preference for smaller producers is rooted in their more humane business practices. “They don’t use their position to disadvantage others, unlike many big producers,” he explains.

When negotiating with sugar producers, Sandor relies on a mix of data sources, including Vesper and Platts. “I show them my mix, which includes Vesper and Platts. Platts isn’t better than Vesper, but just another source of data that helps me validate my decisions” he adds, demonstrating the importance of having multiple data points in negotiations.

Tip: To explore the option of accessing multi-commodity data on Vesper’s Commodity Intelligence platform, book a demo to see how we can customise the data to meet your business needs.