Introduction: The Significance of Soybean Oil in the US Market.

Soybean oil holds a pivotal position in the US market, commanding significant influence across various sectors. As a versatile cooking oil, it serves as a staple ingredient in households nationwide, finding its way into everything from salad dressings to frying applications. Moreover, its widespread use extends beyond the culinary realm, with soybean oil being a key component in the production of biodiesel, industrial lubricants, and even as a feedstock in the manufacturing of certain plastics.

With such diverse applications, the demand for soybean oil remains robust, impacting its pricing dynamics and driving fluctuations in the market. As we delve into the critical metrics shaping soybean oil prices in the US for 2024, understanding its fundamental importance in the market sets the stage for a comprehensive analysis.

Production Volume Trends: Analysis of Recent Years and Predicted Changes

Analysis of recent production volume trends in the soybean oil industry reveals significant developments that could impact prices in the US market. One such development is the conversion of Phillips 66’s Rodeo, California refinery into a major renewable fuels facility, set to produce 800 million gallons of lower carbon intensity transportation fuels annually. Dubbed ‘Rodeo Renewed’, this project will primarily focus on renewable diesel and sustainable aviation fuel.

While the exact feedstocks for this venture remain undisclosed, its potential impact is substantial, considering the global soybean oil production of 61 million metric tons (Mmt) and US annual consumption of 12 Mmt. Operations are expected to commence by the end of March, indicating a potential shift in the production landscape that could influence soybean oil prices in the US. This move towards renewable fuels underscores the industry’s response to sustainability concerns and regulatory pressures, which could have ripple effects on production volumes and pricing dynamics in the coming years.

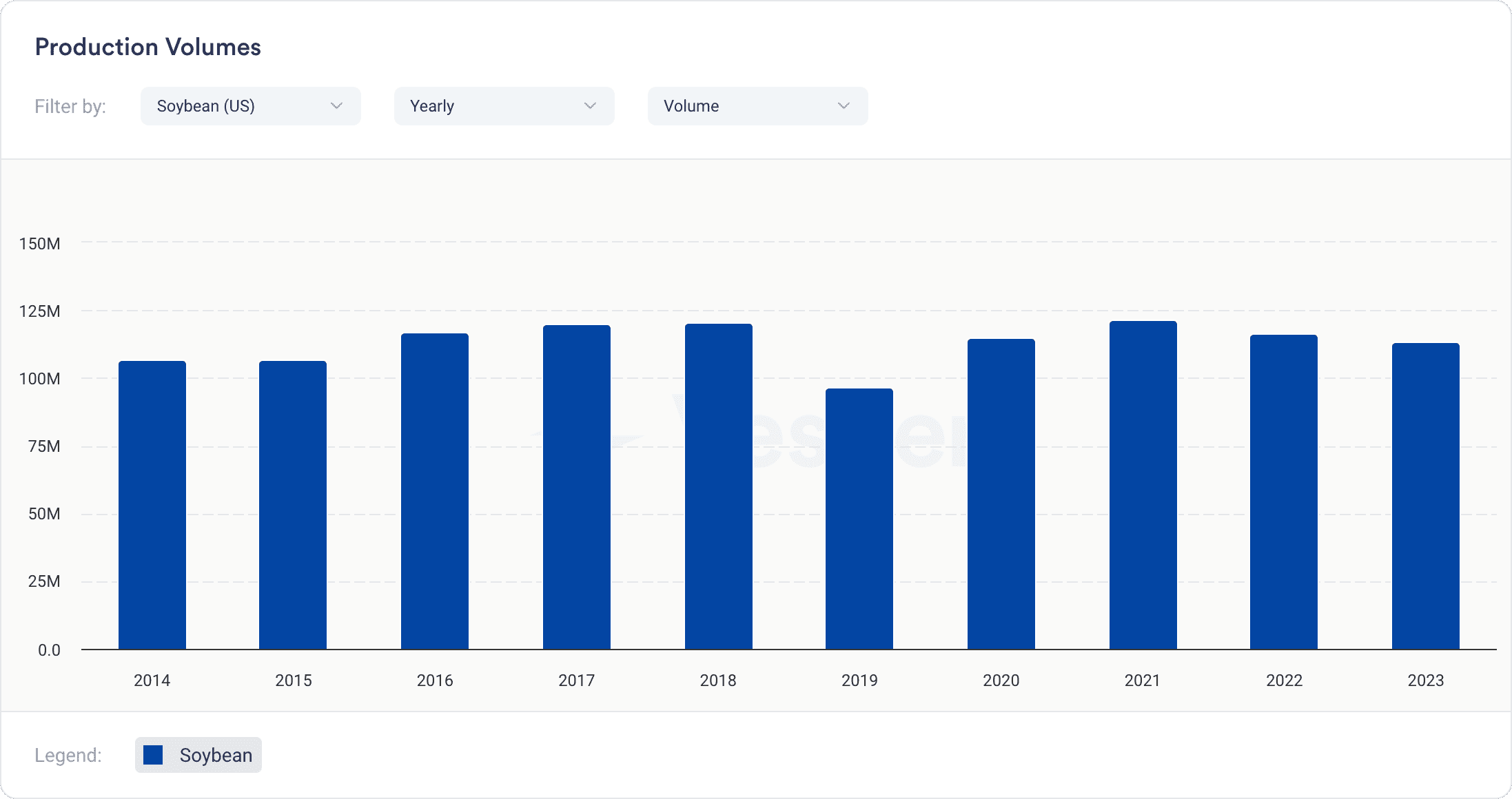

Analyzing the soybean production levels in the US over the last five years reveals a mixed trend with notable fluctuations, see figure 1 below. This pattern suggests a degree of volatility in US soybean production, likely influenced by a combination of factors such as weather conditions, market demand, agricultural practices, and government policies.

Figure 1: US Soybean production volumes

For the soybean market, these fluctuations imply varying levels of supply availability, which can directly influence prices. Higher production levels generally lead to increased supply, potentially exerting downward pressure on prices due to oversupply. Conversely, lower production levels can tighten supplies, leading to upward price pressure.

Overall, the fluctuating trend in US soybean production over the last five years underscores the importance of closely monitoring production dynamics and their implications for market conditions and prices. This variability highlights the need for stakeholders in the soybean and soybean oil industries to adapt to changing conditions and make informed decisions to navigate the market effectively.

Supply and Demand Dynamics: Key Factors affecting Market Balance

- Crop Yields: The annual soybean crop yield significantly impacts supply levels. Factors such as weather conditions, pest infestations, and agricultural practices can affect crop yields, thereby influencing overall supply. In 2022, adverse weather conditions, including droughts in some key soybean-producing states like Iowa and Illinois, led to lower-than-expected crop yields. This resulted in a reduction in overall soybean supply and contributed to higher prices in the market.

- Acreage Planted: The amount of land allocated to soybean cultivation directly affects production levels. Farmers’ planting decisions are influenced by factors like market prices, input costs, government subsidies, and crop rotation practices. In 2021, despite strong market prices for soybeans, many farmers opted to plant more corn due to its profitability relative to soybeans. This decision led to a decrease in soybean acreage planted, contributing to tighter supply conditions in the following year.

- Global Demand: International demand for US soybeans plays a crucial role in market balance. Countries like China, the world’s largest importer of soybeans, heavily influence demand dynamics. Factors affecting global demand include economic growth, population trends, dietary preferences, and trade policies. The trade tensions between the USA and China in recent years have significantly impacted US soybean exports. For example, in 2018, retaliatory tariffs imposed by China on US soybeans led to a sharp decline in exports to this key market, affecting overall demand and prices.

- Domestic Consumption: The demand for soybeans within the USA itself, both for human consumption and as animal feed, impacts market balance. Trends in food consumption patterns, livestock production, and biofuel mandates influence domestic demand. The growth of the biodiesel industry in the USA has increased the domestic demand for soybeans. For instance, in 2023, the Renewable Fuel Standard (RFS) mandated blending a certain volume of biodiesel into the nation’s diesel fuel supply, driving up demand for soybean oil as a feedstock for biodiesel production.

- Trade Policies and Tariffs: Trade agreements, tariffs, and trade disputes can disrupt the flow of soybean exports and imports, affecting market balance. Changes in trade policies between the USA and major trading partners, especially China, can have significant ramifications on soybean prices and market dynamics. The signing of the Phase One trade deal between the USA and China in 2020 provided relief to soybean farmers by restoring access to the Chinese market. As a result, US soybean exports to China surged, positively impacting market balance and prices.

- Government Programs and Subsidies: Government programs, such as crop insurance, subsidy programs, and agricultural policies, can influence farmers’ planting decisions and overall production levels, thereby affecting supply dynamics. The implementation of the Market Facilitation Program (MFP) by the US government in response to trade disruptions provided direct payments to soybean farmers affected by tariffs and trade disputes. These subsidies influenced planting decisions and helped mitigate the impact of reduced exports on market balance.

- Competition from Alternative Oils: Competition from alternative oils, such as palm oil and sunflower oil, impacts the demand for soybean oil, which in turn affects soybean prices. Consumer preferences, health considerations, and price differentials among oils influence demand dynamics. In recent years, the increased use of palm oil in food and biofuel applications has posed competition to soybean oil. For example, the expansion of oil palm plantations in Southeast Asia has led to higher production and lower prices for palm oil, affecting the competitiveness of US soybean oil in the global market.

- Biofuel Production: The use of soybeans for biofuel production, particularly biodiesel, adds another dimension to supply and demand dynamics. Government mandates, environmental regulations, and technological advancements in biofuel production affect the demand for soybeans for this purpose. The Renewable Fuel Standard (RFS) mandates blending renewable fuels, including biodiesel made from soybean oil, into transportation fuel. For instance, in 2022, increased demand for biodiesel due to higher RFS volume requirements boosted the utilization of soybean oil, impacting its availability for other uses and affecting market balance.

These factors interact in complex ways to determine the overall balance between soybean supply and demand in the USA, influencing market prices and profitability for farmers, processors, and other stakeholders in the soybean industry.

Impact of Biofuel Industry on Soybean Oil Demand: Data-Driven Insights

The biofuel industry has a significant impact on soybean oil demand, driven by mandates for renewable fuel blending, technological advancements, and market dynamics. Here are some data-driven insights showcasing the influence of the biofuel industry on soybean oil demand:

- Renewable Fuel Standard (RFS) Mandates: The Renewable Fuel Standard, established by the Environmental Protection Agency (EPA) in the USA, mandates the blending of renewable fuels, including biodiesel made from soybean oil, into transportation fuel. According to EPA data, the RFS volume requirements for biomass-based diesel, which includes biodiesel, have steadily increased over the years, driving up demand for soybean oil as a feedstock.

- Biodiesel Production Trends: Data from the US Energy Information Administration (EIA) indicates a significant expansion in biodiesel production capacity in recent years. For instance, between 2015 and 2020, the annual production capacity of biodiesel plants in the USA increased from approximately 2.5 billion gallons to over 3.5 billion gallons. This growth in production capacity correlates with increased demand for soybean oil as a primary feedstock for biodiesel production.

- Soybean Oil Consumption for Biodiesel: According to USDA data, soybean oil consumption for biodiesel production has shown a steady upward trend. In the 2020/2021 marketing year, approximately 7.9 billion pounds of soybean oil were used for biodiesel production in the USA, representing a significant portion of total soybean oil demand.

- Impact on Soybean Crush Margins: The demand for soybean oil by the biodiesel industry affects soybean crush margins, which represent the profitability of processing soybeans into oil and meal. Data from agricultural research institutions and market analysis firms show that fluctuations in biodiesel demand directly impact crush margins, influencing farmers’ planting decisions and overall soybean supply.

- Government Incentives and Policies: Various government incentives and policies, such as tax credits for biodiesel production and blending, also influence the demand for soybean oil in the biofuel industry. Data from government agencies and industry reports highlight the role of these incentives in stimulating biodiesel demand and supporting the growth of the biofuel sector.

Overall, the data-driven insights highlight the significant impact of the biofuel industry on soybean oil demand in the USA. As the biofuel industry continues to expand and evolve, driven by regulatory mandates and market forces, soybean oil will remain a key feedstock, shaping market dynamics and prices in the soybean oil sector.

Price Fluctuations: Historical Data and Future Projections

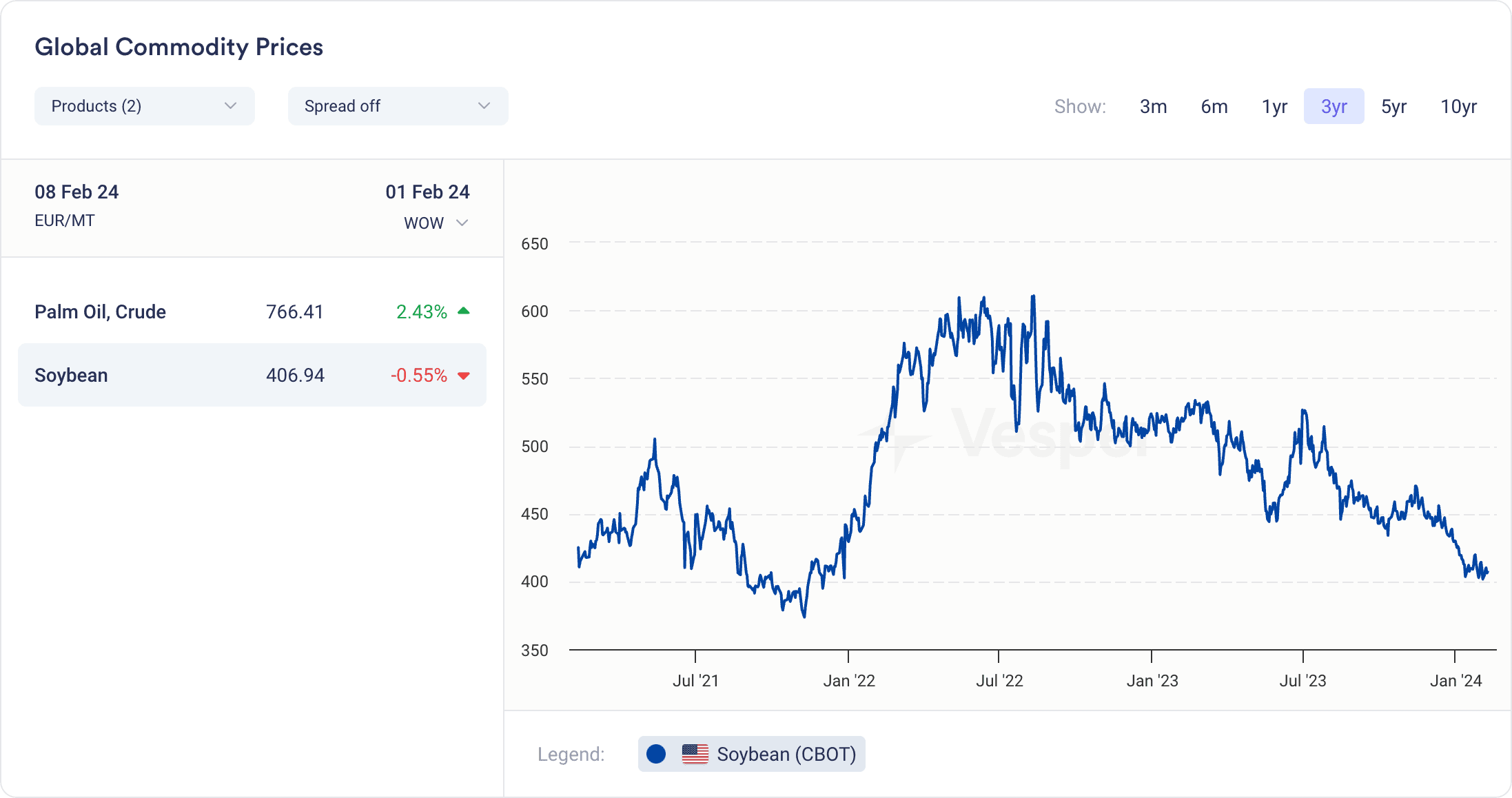

Soybean price fluctuations, as depicted by Vesper’s Global Commodity Price widget based on the Chicago Board of Trade (CBOT), showcase a volatile trajectory marked by significant highs and lows over recent years.

In November 2021, soybean prices bottomed out at 373.50 euros per metric tonne, reflecting prevalent market conditions such as harvest pressure and ample global supplies. Subsequently, by August 2022, prices surged to a peak of 610.35 euros per metric tonne, driven by robust demand from China, reduced crop forecasts, and weather-related concerns impacting yield expectations. However, from August 2022 to February 2024, soybean prices exhibited a continuous downward trend, reaching 406.94 euros per metric tonne. This decline is attributed to factors including improved weather conditions leading to better-than-expected yields, easing supply concerns, trade dynamics, currency fluctuations, and broader macroeconomic factors.

Looking ahead, while past trends provide insights into market behavior, future projections remain subject to various factors such as weather patterns, geopolitical developments, and evolving supply and demand dynamics, highlighting the inherent uncertainty in forecasting soybean prices.

Figure 2: Vesper’s global commodity prices for Soybean

Global Trade’s Influence: How International Markets Affect US Prices

Global trade plays a crucial role in shaping soybean prices in the USA, with international markets exerting significant influence on pricing dynamics. One way in which global trade impacts US prices is through export demand. As one of the world’s largest soybean producers, the USA heavily relies on exports to balance its domestic supply-demand equation. Trends in global demand, particularly from key importing countries such as China, Brazil, and the European Union, directly impact US soybean prices. For instance, increased demand from China, driven by factors like population growth, changing dietary preferences, and the need to replenish depleted stocks, can lead to higher prices in the USA as exporters compete for limited supplies. Conversely, trade disputes, tariffs, and geopolitical tensions can disrupt the flow of soybean exports, negatively impacting prices.

Furthermore, global supply dynamics, influenced by factors such as weather conditions, crop yields in other major producing regions like Brazil and Argentina, and shifts in acreage planted, also play a significant role in determining international soybean prices, which in turn affect US prices. Therefore, staying attuned to developments in global trade, including trade policies, import/export trends, and geopolitical events, is essential for understanding and forecasting soybean price movements in the USA.

In Conclusion – Forecasting The 2024 US Soybean Market

Looking ahead to 2024, the US soybean market is poised for continued complexity and volatility. Factors such as weather patterns, trade policies, and global demand will likely shape market dynamics. With the conversion of Phillips 66’s Rodeo refinery into a renewable fuels facility set to commence operations, the industry may witness shifts in production volumes and pricing dynamics.

Additionally, ongoing developments in the biofuel sector, including regulatory mandates and technological advancements, are expected to influence soybean oil demand. Amidst these uncertainties, stakeholders must maintain vigilance and adaptability to navigate potential challenges and capitalize on emerging opportunities.

Proactive monitoring of market trends and a comprehensive understanding of critical metrics will be essential for positioning within the evolving landscape of the US soybean market in 2024 and beyond.