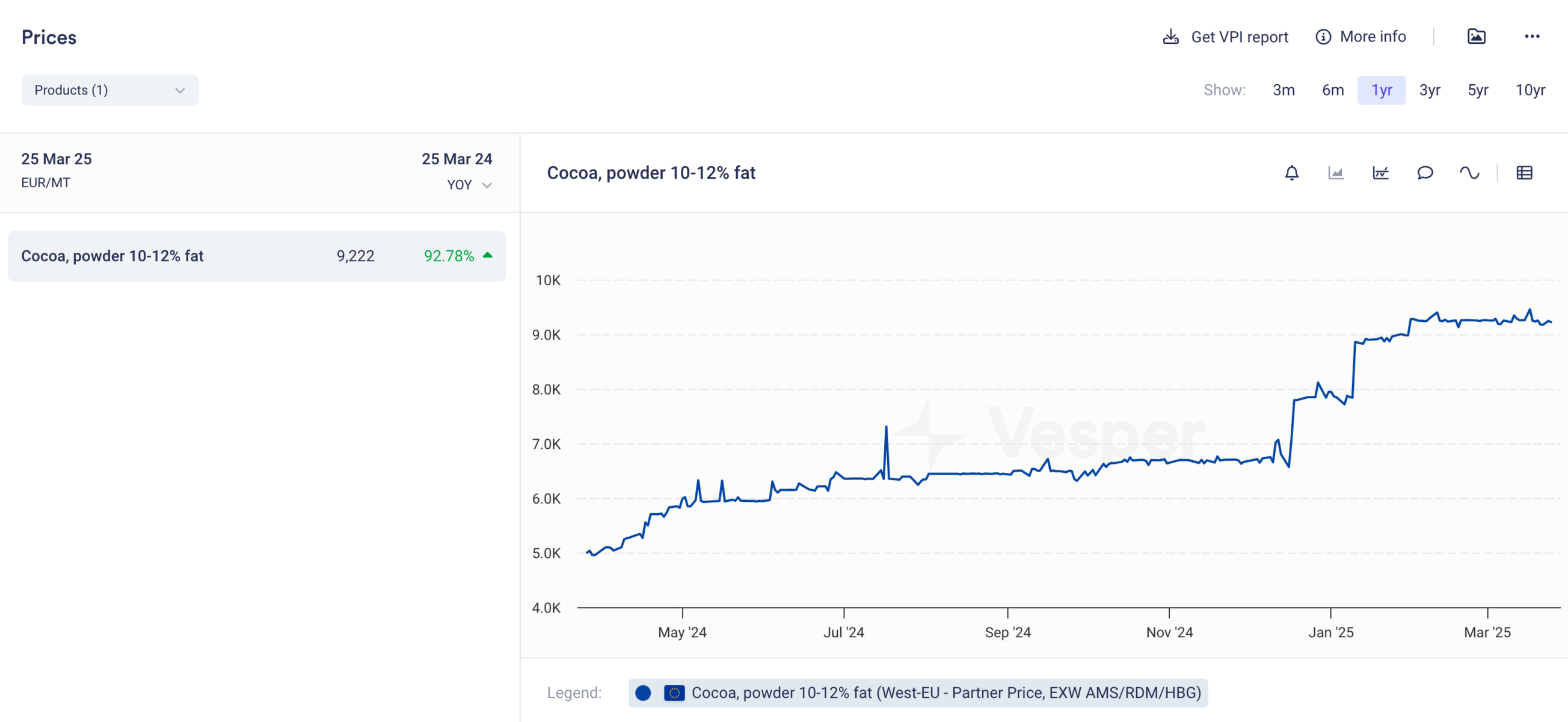

The European bakery industry is facing a significant challenge as cocoa powder prices continue to rise at unprecedented rates. This essential ingredient, critical for everything from premium pastries to everyday cookies and cakes, has seen price increases of over 40% in the past year alone, creating ripple effects throughout the sector.

Why cocoa prices are climbing

Several interconnected factors are driving this price surge. West Africa, which supplies over 70% of the world’s cocoa beans, has experienced increasingly unpredictable weather patterns, with alternating droughts and excessive rainfall damaging crops. Aging cocoa trees across growing regions have led to lower yields, while pest and disease issues—particularly cocoa swollen shoot virus—have further diminished harvests.

For European manufacturers specifically, these global supply challenges are compounded by a weakened Euro against the dollar, making cocoa imports even more expensive since the commodity is primarily traded in US dollars. The EU’s strong sustainability regulations, including the recently implemented deforestation regulation, have added compliance costs throughout the supply chain that ultimately impact prices.

Direct consequences for European bakeries

The immediate effect has been a substantial increase in production costs. For premium European bakeries where chocolate pastries and cakes represent 25-30% of their portfolio, this means significant margin pressure. Mid-sized manufacturers report cocoa-related ingredient costs rising by 15-20% overall in their chocolate product lines, with limited ability to pass these increases to price-sensitive consumers or contract-bound retail customers.

The timing is particularly challenging as European consumers face broader inflation concerns and are increasingly price-conscious in their food purchases. Large retail chains continue to resist substantial price increases, placing bakery suppliers in the difficult position of absorbing costs or potentially losing shelf space.

Quality implications have also emerged as some manufacturers attempt to adapt. Cocoa powder cannot simply be reduced without affecting flavor, color, and texture characteristics that European consumers expect. Premium bakeries, particularly in markets like Belgium, France, and Switzerland, where chocolate quality is intrinsically tied to brand reputation, face especially difficult decisions.

Operational adjustments

European bakery manufacturers are responding to these challenges through various adaptations. Some are adjusting formulations to optimize cocoa usage while maintaining acceptable flavor profiles. This includes enhancing chocolate notes through complementary ingredients like vanilla, coffee, or spices that can amplify perception of chocolate intensity while using less cocoa powder.

Production scheduling has also shifted, with some manufacturers consolidating chocolate product runs to reduce changeover waste. Others are reevaluating their product portfolio, focusing cocoa usage on higher-margin products where premium pricing can better absorb the increased costs.

The procurement approach has evolved as well. European bakeries are increasingly seeking direct relationships with cocoa processors rather than working through distributors, allowing for more transparent pricing and potentially better terms. Some larger manufacturers have accelerated their exploration of alternative sourcing regions beyond West Africa, including Latin American origins that may offer more stable supply chains.

Market segmentation impact

The impact is not uniform across the European bakery sector. Premium artisanal bakeries, especially in Western Europe, have generally been able to pass moderate price increases to consumers who prioritize quality and are less price-sensitive. These establishments often emphasize the provenance and quality of their chocolate ingredients as justification for higher prices.

In contrast, industrial manufacturers producing for mass retail face severe margin pressure, particularly in Eastern and Southern European markets where consumer spending power is more constrained. These producers are more actively pursuing reformulation approaches and in some cases reducing pack sizes to maintain price points.

Private label manufacturers are perhaps the most squeezed, caught between rising ingredient costs and retail clients resistant to price increases that might diminish their competitive positioning against branded products.

Long-term industry implications

The sustained nature of these cocoa price increases is prompting broader strategic reconsideration within the European bakery industry. Product innovation pipelines are being redirected, with some manufacturers developing more offerings featuring alternative flavor profiles that reduce dependence on chocolate. Others are creating tiered product lines that include both premium high-cocoa options and value alternatives with optimized formulations.

Supply chain relationships are also evolving. Some larger European bakery groups are exploring more direct involvement in cocoa supply chains, including investment in processing facilities or partnerships with origin cooperatives to secure supply and potentially stabilize costs. Increased interest in sustainability initiatives reflects not just regulatory compliance but recognition that climate resilience in cocoa-growing regions directly impacts supply security.

The market may also see consolidation as smaller manufacturers with less negotiating power and limited ability to absorb cost increases struggle to remain competitive. This could accelerate the ongoing trend of artisanal bakery acquisitions by larger groups seeking to diversify their product portfolios.

Navigating forward

For the European bakery industry, adapting to higher cocoa prices will require balancing several competing priorities. Technical teams must optimize formulations without compromising the quality standards European consumers expect. Commercial departments need to implement strategic pricing approaches that protect margins while remaining sensitive to market realities. Procurement specialists must enhance market intelligence capabilities to make more informed buying decisions in volatile conditions.

The European bakery manufacturers who will best weather this challenge are those taking a holistic approach—not simply viewing rising cocoa prices as a procurement issue but as a strategic challenge requiring coordination across product development, marketing, operations, and finance.

While cocoa prices may eventually moderate from current peaks, structural issues in global supply suggest that European bakeries should prepare for a “new normal” of higher chocolate ingredient costs. The most resilient will be those who adapt their business models accordingly while maintaining the quality and innovation that has long characterized the European bakery tradition.

Vesper provides real-time price intelligence and market insights to help bakery procurement teams stay ahead of volatility, optimize purchasing decisions, and secure better pricing on their most significant ingredient spends.