In the dynamic world of commodity trading, understanding and predicting commodity prices is crucial. This is where the science of commodity forecasting becomes a game-changer. It’s not just about predictions; it’s about making informed, strategic decisions to stay ahead in commodity market trends.

Let’s delve into the world of AI-driven forecasting and how you can leverage this technology in your commodity trading strategies.

Understanding AI-Driven Commodity Price Forecasting

Artificial Intelligence (AI) is revolutionizing the way we forecast commodity prices. It’s a tool that transforms vast amounts of data into actionable insights for commodity market analysis.

Here’s the deal: AI algorithms analyse data points such as historical trends, global events, market data, even weather patterns and more. This comprehensive analysis helps predict future commodity price movements with a high degree of accuracy.

Why is this important? Because in the world of commodities, where prices can fluctuate wildly, having a predictive edge can be the difference between profit and loss in commodity market trading.

Strategic Purchasing: Leveraging Commodity Price Forecasts

In commodity trading, smart purchasing strategies are crucial. Commodity price forecasts here are not just helpful; they are your strategic edge.

Consider the aspect of timing. It’s a critical factor in forecasting commodity price fluctuations. Knowing when prices are likely to shift gives you the power to purchase at the most beneficial moments. This isn’t about random guessing; it’s about making informed decisions guided by data.

Here’s why timing is key in the commodity market. Prices can surge or plummet based on a myriad of factors. By using forecasts, you can identify potential price dips or spikes. This insight allows you to buy low and, if you’re reselling, sell high.

Imagine this scenario: You predict a price increase in a key commodity. By purchasing before this hike, you secure a lower cost, leading to higher margins. Similarly, predicting a drop means you can hold off on buying, avoiding purchases at peak prices.

And the best part? You don’t need to be a data scientist. Platforms like Vesper translate complex data into understandable insights.

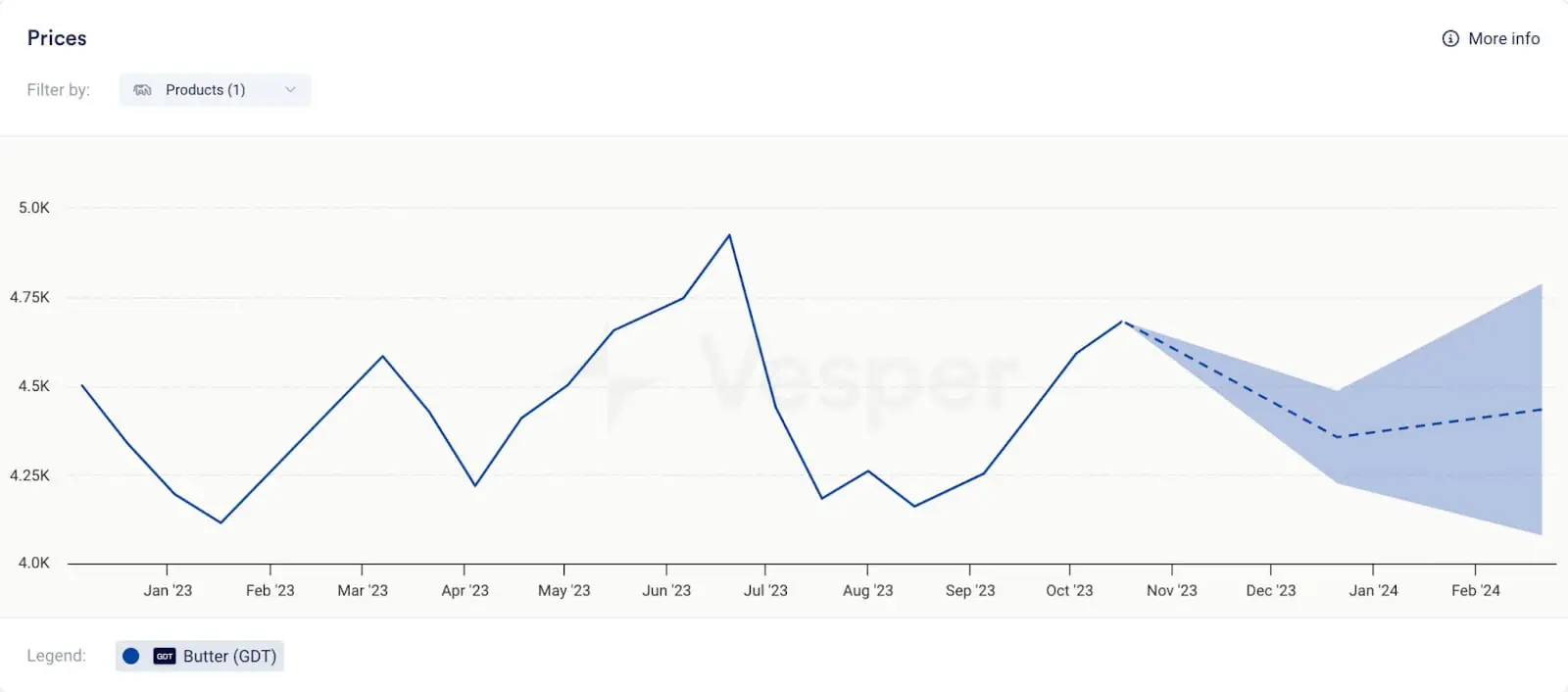

For example, look at this screenshot.

With the price of GDT Butter forecasted to continue dropping until the end of September before rising again, you could plan to purchase within this timeframe to take advantage of lower costs.

Think of it as a finely tuned dance. With accurate forecasts, you’re always in sync with the market’s rhythm. You buy at the most opportune moments, ensuring your investments are timed perfectly to optimise to budgets.

In summary, leveraging price forecasts in commodity trading is all about mastering the timing of your purchases. It’s about being proactive, not reactive, to the market’s fluctuations. With this approach, you’re not just following the market; you’re strategically navigating through it.

Incorporating Production Forecasts into Purchasing Decisions

Production forecasts are more than just numbers; they’re crucial in shaping purchasing strategies. They give you a window into future supply trends, which are inextricably linked to commodity price movements.

Here’s the crux: Understanding future supply levels is vital. This knowledge allows you to predict and prepare for price fluctuations. For instance, if a key commodity is forecasted to have a reduced yield, you can anticipate an upward price trend.

But there’s more to it. This foresight is invaluable. It’s not just about knowing what might happen; it’s about being ready to act on it. When you’re aware of potential supply constraints, you can adjust your buying strategy accordingly, staying ahead of price hikes.

Think about the broader implications. In commodity markets, being proactive rather than reactive can be the difference between profit and loss. Adjusting your purchasing based on production forecasts means you’re not caught off guard by sudden market changes.

Here’s an example: Let’s say you learn that the production of a particular grain is likely to drop significantly due to weather conditions.

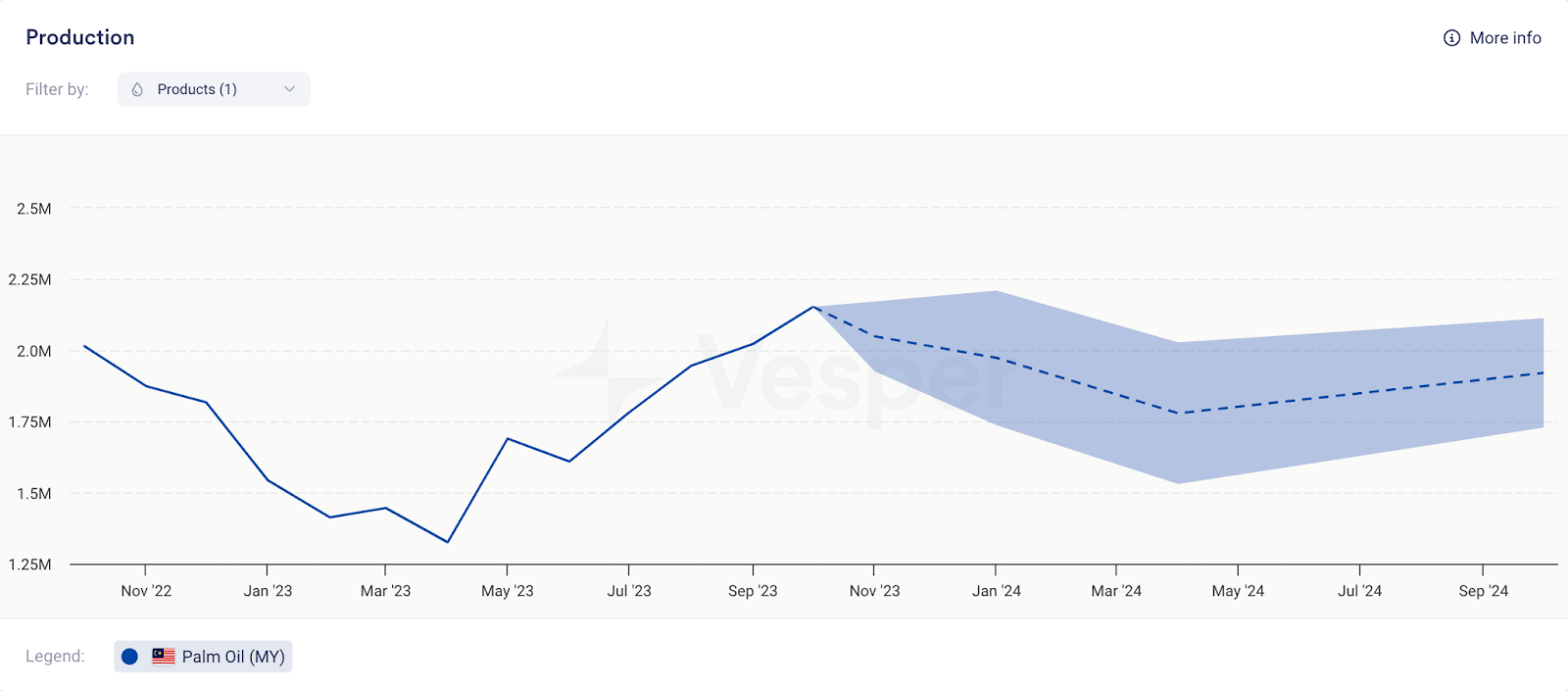

Take a look at this screenshot from Vesper, forecasting a drop in Malaysia’s Palm Oil production until mid April 2024.

Armed with this information, you can buy before prices start climbing, securing a more favourable rate.

In essence, integrating production forecasts into your purchasing decisions transforms your approach from a reactive one to a strategic, forward-thinking one. It’s about having the foresight to make moves that align not just with the current market, but with where the market is headed.

Optimising Purchasing with Ending Stock Forecasts

Ending stock forecasts: they’re the unsung heroes of commodity trading. Often overlooked, they provide crucial estimates of the remaining supply of a commodity.

Here’s why this matters: This data is a goldmine for long-term strategy. It’s not just about what’s happening now; it’s about what will happen. Understanding the projected availability of a commodity helps you plan for the future, balancing risk and opportunity.

Think about the implications. With these forecasts, you’re not just planning for next quarter. You’re looking ahead, making decisions that will impact your business for years. This kind of foresight is invaluable for budgeting and strategic planning.

Consider the domino effect. Knowing the ending stock levels can influence everything from pricing strategies to supply, demand and exports globally. It’s about having a holistic view of the market, enabling decisions that are both tactical and strategic.

Here’s a practical tip: Use ending stock forecasts as a barometer for market health. If stocks are expected to be low, it might be time to secure longer-term contracts to hedge against potential price hikes. On the flip side, high ending stocks could signal a buyer’s market.

Her’s an example: Suppose you’re monitoring ending stock levels in a specific producing region to gauge their impact on local versus global commodity prices. By closely observing these stock trends, you could identify the optimal time to buy. For instance, as stocks reach their peak and the local market is saturated, it presents a prime buying opportunity.

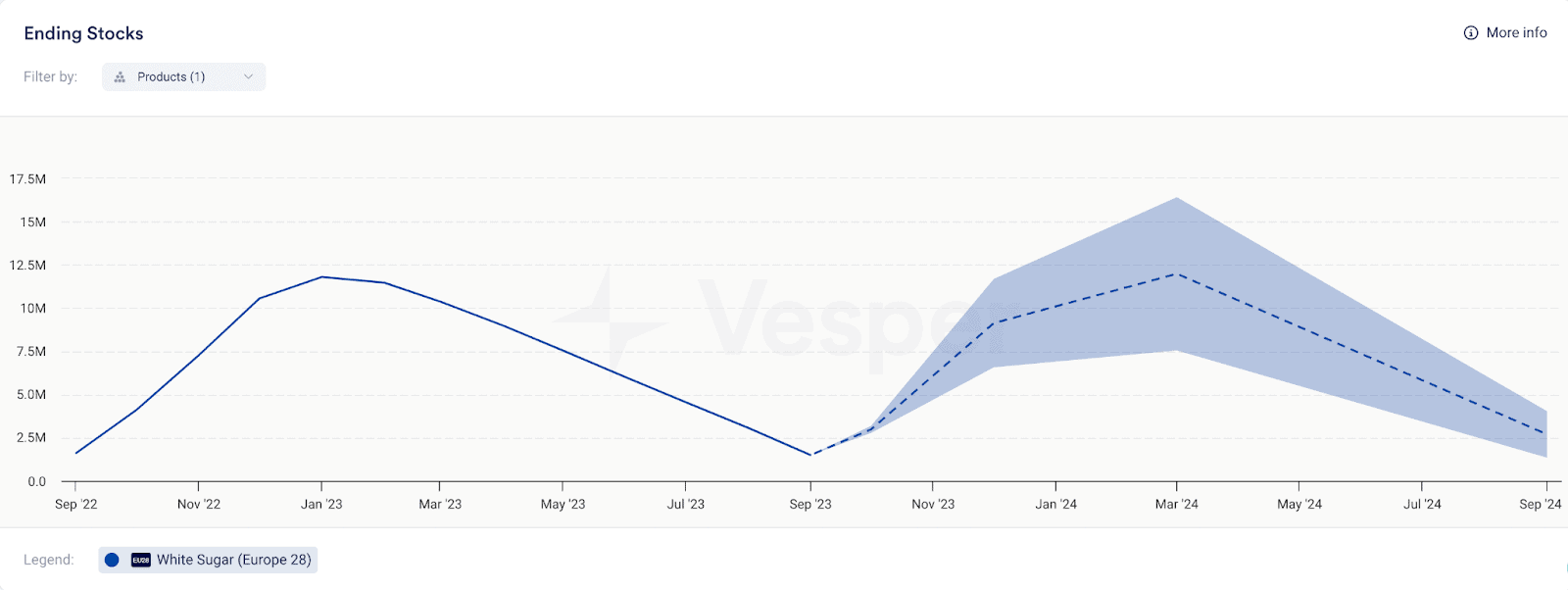

Take a look at this screenshot from Vesper’s AI-driven forecasts, showing the anticipated peak in EU-28’s Sugar Ending Stocks over the next 12 months.

With this insight, you’re positioned to buy when stocks are abundant, ensuring a more favorable rate and avoiding the premium prices of global sourcing.

In short, optimising purchasing with ending stock forecasts means you’re always a step ahead. You’re not just reacting to the market; you’re anticipating it, ensuring your business remains agile and responsive to changing market conditions.

The Power of AI in Commodity Forecasting

Let’s take a moment to appreciate the power of AI in this field. It’s not just about processing data; it’s about uncovering trends that are invisible to the naked eye.

Consider this: AI can predict market movements by analysing a range of factors, from geopolitical events to consumer trends. This level of analysis was unthinkable a few years ago.

For commodity players, this means a significant advantage. You’re no longer just relying on traditional methods but are equipped with advanced tools to navigate the complexities of the commodity market.

Practical Tips for Utilising Commodity Forecasts

Stay Informed: Always keep abreast of the latest forecasts and market trends.

Be Proactive: Use forecasts to anticipate market movements, not just react to them.

Diversify: Don’t rely on a single forecast; use a combination of forecasts and data.

Monitor Continuously: The market is dynamic; continuously adjust your strategies based on the latest data.

Embrace Technology: Utilise AI-driven tools and platforms, such as Vesper, for more accurate forecasting.

In conclusion, the science of commodity forecasting is a critical tool for anyone involved in commodity trading. By understanding and leveraging AI-driven forecasts, you can make more informed decisions, reduce risks, and potentially increase profits.

It’s not just about having data; it’s about using that data effectively. As the commodity market continues to evolve, staying ahead with advanced forecasting methods will be key to success.

Ready to take your commodity trading to the next level? Embrace the science of forecasting and watch your strategy transform. Try Vesper’s AI-generated forecasts here.