A Missed Opportunity

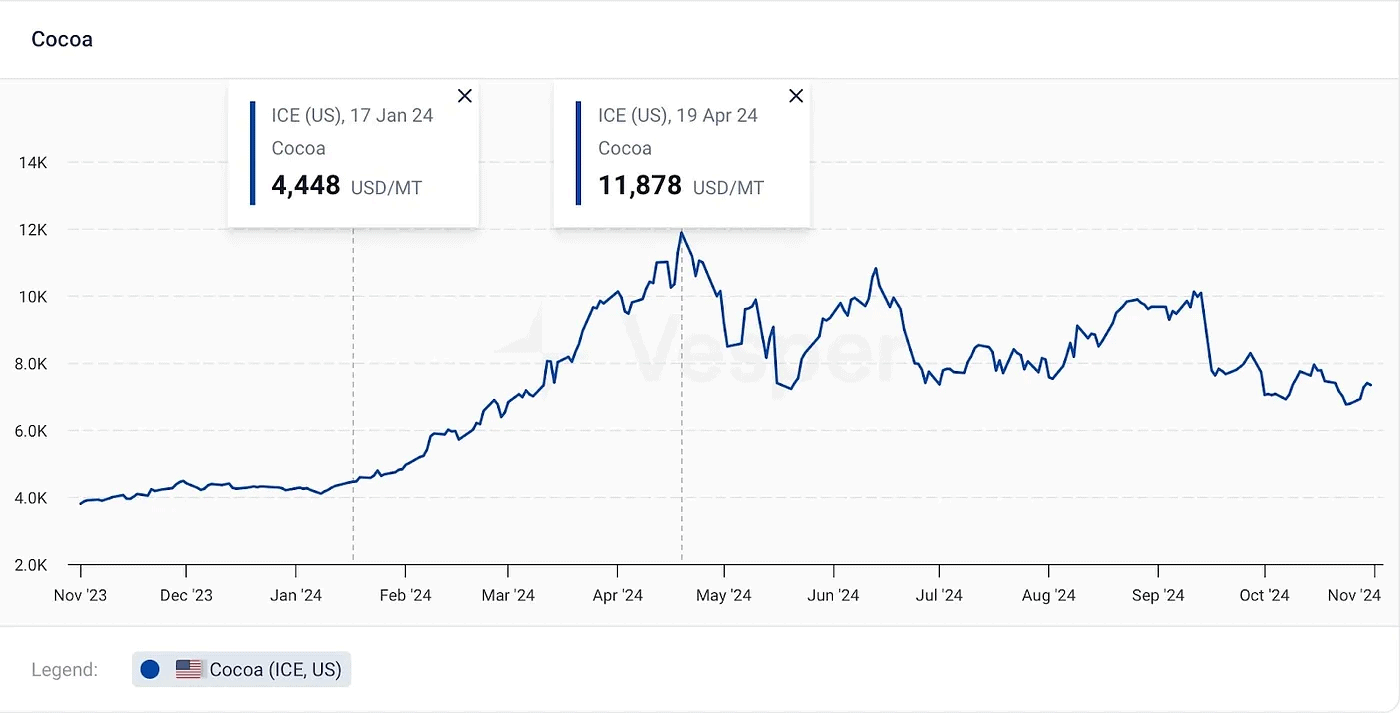

In today’s volatile agricultural commodity markets, anticipating price movements is crucial. It helps avoid being blindsided by sudden price swings and clarifies where potential risks lie. This awareness allows for timely actions, such as hedging open positions. In 2024, the price of cocoa skyrocketed to an all-time high of 11,878 USD/MT*. Most market players were blindsided by the surge, relying heavily on traditional supply and demand (S&D) fundamentals. Yet, a deeper dive into technical indicators would have signaled the coming wave. For those who focused on analyzing the price charts, the warning signs were there; MACD signals suggested buying cocoa on January 17th of that year, when prices were still at 4,448 USD/MT.

Commodity players often default to analyzing fundamental data when it comes to making buy, sell and hedge decisions. However, there’s a lot of untapped potential in leveraging technical analysis as well. At Vesper, we’ve seen that models that include price dynamics in addition to your typical S&D variables perform significantly better for both short-term forecasts (1 month) and long-term forecasts (12 months) across all agricultural commodities.

In this article, we’ll explore the difference between technical and fundamental analysis. We’ll look at how both approaches contribute to understanding commodity markets. We’ll also explain how we at Vesper built AI models that combine insights from both methods, giving us an edge in accurate price forecasting.

*Cocoa spot price on the ICE US, April 19, 2024

Fundamental vs Technical Analysis

Fundamental Analysis

Fundamental analysis is the bedrock of most commodity players. It focuses on analyzing S&D balance sheets and how those could be influenced by macroeconomic changes, weather patterns, and geopolitical events. When it comes to agricultural commodities, this includes projections for stock levels, production estimates, and consumption trends. By understanding these dynamics, analysts gain valuable insights into the market.

Analysts who focus on fundamentals aim to identify potential imbalances in supply and demand. They closely examine S&D balance sheets to look for discrepancies that could signal price shifts. For instance, if production estimates fall short of consumption forecasts, it may indicate a forthcoming price increase as the market adjusts to restore balance. Conversely, a surplus of crops could lead to declining prices as supply exceeds demand.

Fundamentals are most relevant when discussing long-term market movements, as fundamental shifts often take time to be absorbed by the market. Data is frequently delayed, incomplete, or subject to revisions, while geopolitical events may take time to impact supply chains, and the effects of changes in weather patterns might not be clear until later in the season. As a result, market participants can’t always react instantly, leading to more gradual adjustments that unfold over longer periods.

Technical Analysis

On the other hand, technical analysis (TA) involves examining price charts, volume data, and historical patterns to predict future price movements. The underlying belief in TA is that all relevant information is already reflected in the current price and its movements. Therefore, by studying price action and trends, technical analysts aim to identify recurring patterns and signals that provide insights into future price behavior. They believe that price movements tend to follow specific, predictable patterns due to repeated behaviors of market participants like fear and speculation. As a result, past price action can offer valuable clues about the direction the market is heading and can provide a competitive edge in timing market movements.

Key technical indicators used in commodity markets include:

- Moving Averages (MA): These help smooth out price data and highlight trends by averaging prices over specific periods, giving a clearer view of market direction.

- Relative Strength Index (RSI): A momentum oscillator that signals whether a commodity is overbought or oversold, helping assess the strength of recent price movements.

- Bollinger Bands: These measure market volatility and price trends, giving clues about resistance levels, and potential breakouts or reversals when prices move outside of the bands.

- Volume-Based Indicators: These track the amount of trading activity to better understand the strength of price movements. High volume during a price move indicates a strong market conviction, while low volume may signal a weakening trend or potential reversal.

Technical analysis is particularly valuable in short-term trading, as these indicators help commodity players identify emerging trends and momentum shifts. This enables them to anticipate future price movements early on and helps them make better-informed decisions.

Not All Commodities are Created Equal: When Technicals Work

The predictive value of technical and fundamental indicators can differ significantly across agricultural commodities. Whether a commodity is traded on the futures market, its market liquidity, seasonality, and trade volumes can all influence how effective these indicators are.

For instance, commodities traded on futures markets, such as grains (wheat, corn) or oilseeds (soybeans), are highly liquid, benefiting from wide participation from traders, hedgers, and speculators. In these markets, technical analysis tends to be more indicative due to the more predictable price movements driven by consistent trading patterns.

In contrast, less liquid markets, such as niche crops that aren’t always traded on the futures market, often experience more erratic price behavior. This volatility can make traditional technical indicators less effective as their price movements are more susceptible to external shocks or supply and demand changes.

Another factor that plays a critical role in the effectiveness of technical versus fundamental indicators is seasonality. Seasonal commodities typically exhibit recurring price patterns aligned with planting and harvest cycles, weather conditions, and regional growing seasons. These predictable cycles enable technical indicators to capture price movements, such as the usual pre-harvest rallies or post-harvest dips. However, for commodities that lack clear seasonal patterns or those grown in multiple regions with staggered harvest times, price behavior may not exhibit the same regularity. In such cases, fundamental analysis, which focuses on the most recent production and inventory data, often provides a clearer picture. For example, global production changes in crops like coffee or cocoa can significantly affect prices, making fundamental insights more valuable in these contexts.

While both forms of analysis remain relevant across all agricultural commodities, their effectiveness can vary depending on factors like the ones we described above. This adds to the difficulty of consistently applying a single approach across a wide range of commodities. Market participants must be mindful of these nuances and adapt their strategies to capture the best insights for each commodity accordingly.

The Power of AI: Combining Technical and Fundamental Insights

As you probably understand by now, we believe the real power lies in combining both Fundamental and Technical analysis. However, integrating these two approaches can lead to an even more overwhelming amount of data, making it challenging to draw clear conclusions, especially when different indicators seem to conflict. This is where AI starts playing a critical role.

At Vesper, we’ve developed advanced machine-learning models that leverage this hybrid approach. By processing vast amounts of data from both sides and balancing out conflicting signals, we’re able to provide clearer, more accurate price forecasts, achieving accuracies of, on average, 95 percent for 1-month forecasts and 87 percent for 6-month forecasts across all agricultural commodities. When in September this year the Dutch butter price reached an all-time high of 8.100 euros per metric ton, our latest AI model successfully predicted this strong increase months before. When diving deeper into why our model predicted this unexpected increase by analyzing the model’s Shapley values, essentially a method that helps us understand which factors were most important in the prediction, we see that while butter production numbers were driving our forecasts down, the effects of various technical variables were so strong that they pushed the forecast to a net increase.

Thanks to our access to massive amounts of global fundamental data, proprietary price series, and deep understanding of both AI and the various commodity markets, Vesper is uniquely positioned to provide clear, actionable price forecasts in markets where both fundamentals and short-term price movements are essential. By leveraging our extensive database and advanced machine-learning techniques, we create models that capture the nuances of market dynamics, equipping commodity players with the insights they need.

In Summary

Relying solely on fundamental analysis to forecast commodity prices can leave significant blind spots, especially in today’s fast-moving and increasingly sentiment-driven markets. Technical analysis provides valuable insights into short-term price movements and market psychology, helping traders stay ahead of sudden price shifts that fundamentals might miss.

By harnessing the power of AI to combine both technical and fundamental analysis, we can generate more accurate price predictions across different timeframes, enabling all commodity players to time the market better and make more informed decisions.

Want to experience Vesper’s forecasting? Start your free trial here.