In 2017, China’s government set an ambitious goal for its dairy sector: to attain 70% self-sufficiency in milk production by 2020. By 2022, the nation reported a commendable 66% self-sufficiency, marking significant progress. China’s journey toward self-sufficiency began following the 2008 incident with melamine, which made Chinese residents lose trust in locally produced milk products. The extensive overhaul of the industry has centred on modernising dairy farms to restore local milk supply safety and quality.

Tip: Our dairy calculators are available for you to use free of charge, ideal i.e. for calculating SMP Prices.

Through additional milk production, they are hoping to fulfil their local consumption with local production, and not rely on additional imports, and thus meet self-sufficiency. This article focuses on the factors contributing to this slight growth and presents possible scenarios for the upcoming season, backed up by Vesper’s Commodity Intelligence platform.

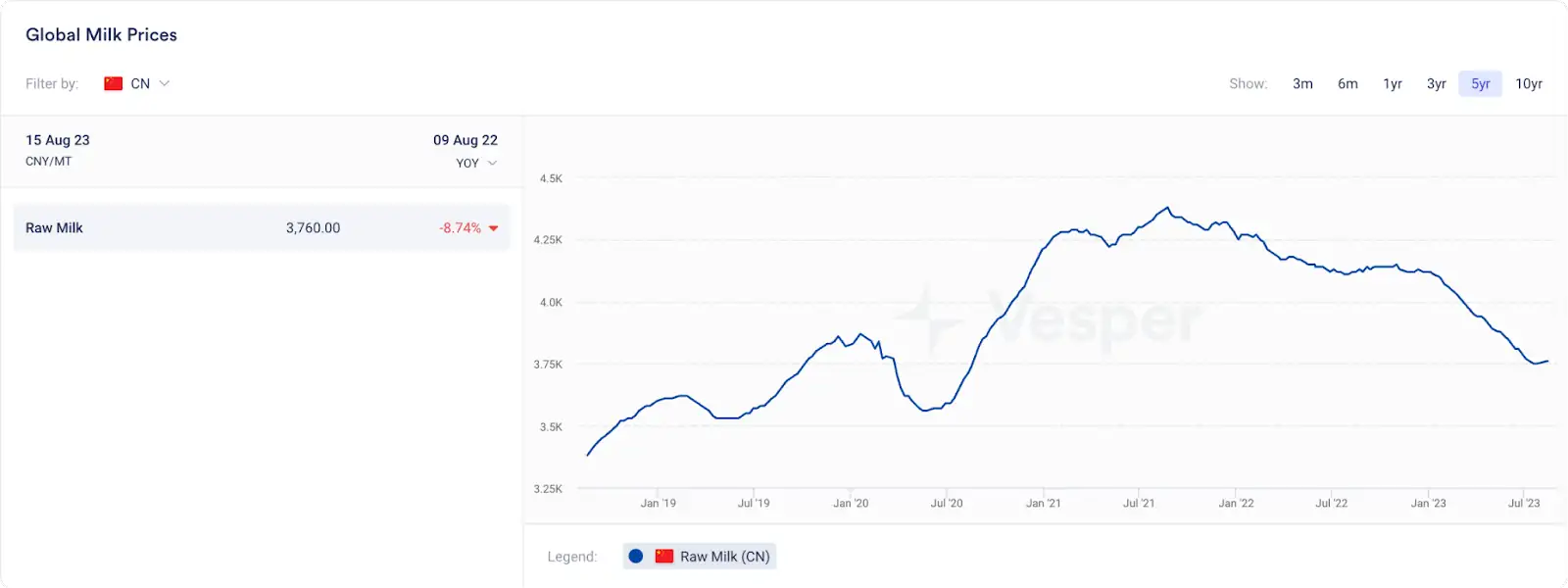

Fluctuations in Chinese milk prices across the past 5 years

In the past 5 years, China has been paying incredibly high prices to their farmers to incentivise them to produce more milk. China increased their milk prices significantly – prices rose from roughly 3.570 CNY/MT to 4.120 CNY/MT from mid 2020 till the end of 2022 (Fig. 1).

Fig 1. Chinese Global Milk Prices

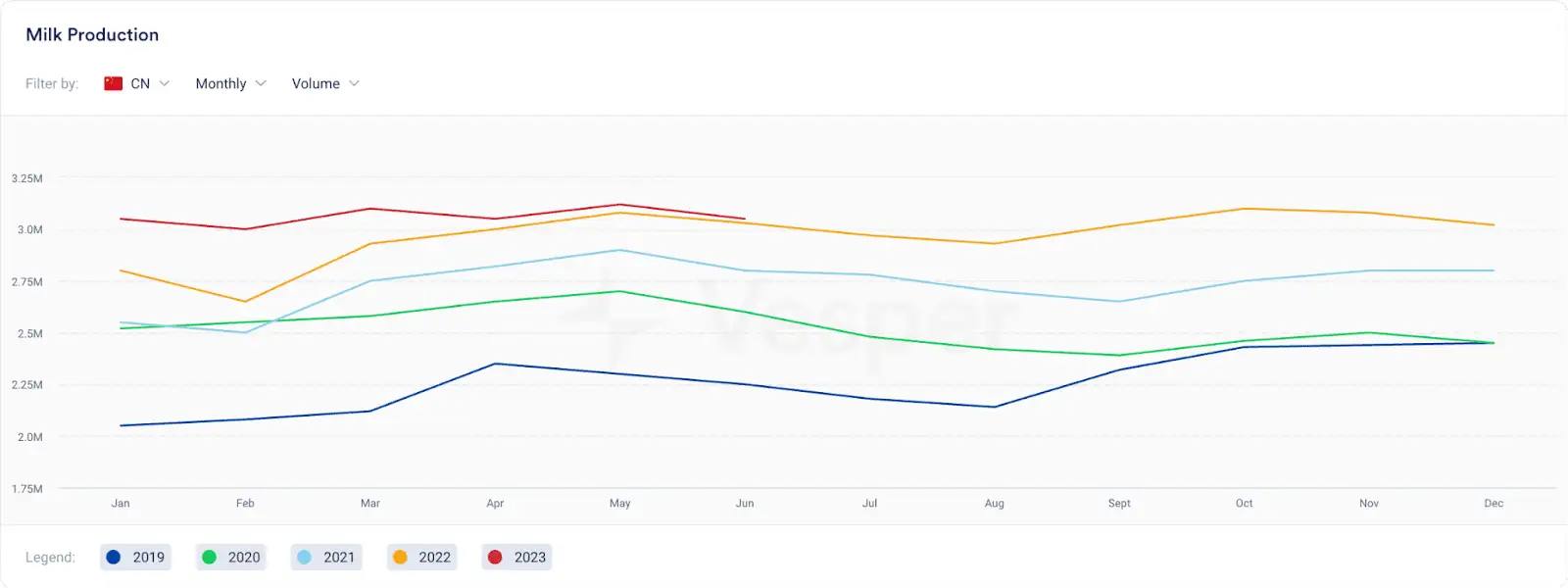

Illustrated in Figure 2, a distinct pattern in milk production aligns with China’s milk prices – each year following 2019 has witnessed a growth in milk production. Upon closer examination of year-to-date figures and year-on-year comparisons, we observe that 2020 saw an increase of nearly 12%. In 2021, this growth was 8,25%, and in the most recent year, it rose by 8.57%. The current year’s increase stands at 5.03% up until June ‘23, indicating notable expansion, albeit falling short of initial expectations.

Fig 2. Chinese Monthly Milk Production

Stagnating milk production

Starting this year, China has undergone a significant decrease in milk prices, with a drop from 4120 CNY/MT to the present rate of 3760 CNY/MT. China decreased its milk prices to remain a competitive player in the global market, as global average dairy prices decreased by roughly 26% compared to the previous year. And in spite of the Chinese government’s dedicated attempts to reignite its economy after strict Covid-19 lockdowns, the demand for dairy products in the country has struggled to gain momentum.

This decrease in Chinese Raw Milk prices is creating a split in China itself. On one side, we observe the presence of significantly large farms that exhibit remarkable efficiency across various aspects such as feed management, machinery utilisation, and workforce allocation. These farms can maintain their production levels effectively and retain a favourable profit margin, allowing them to continuously increase their milk output in the market. On the other side, smaller farmholders are struggling to maintain a healthy profit margin due to their higher input costs and lack of scale advantages. So even though China is still undergoing substantial growth, the rapid increase in output that was observed earlier is now showing signs of slowing down.

What’s next?

China’s pursuit of self-sufficiency remains unchanged, but is contingent upon the performance of the Chinese economy, as this is intricately tied to Chinese milk prices and, consequently, milk production levels. The latest economic data for H1 2023, as released by the National Bureau of Statistics, shows a recovery of the Chinese economy after lifting most COVID-19 restrictions. Nonetheless, the monthly data demonstrates a significant slowdown in growth during May and June, indicating potential obstacles in the near future. China experienced a 6.3% GDP growth in the second quarter, compared to the mere 0.4% growth in the same quarter of 2022 – the second lowest growth rate over the past decade.

While the decrease in milk prices could have a short-term effect on milk production, Vesper’s predictions suggest that by the end of 2023, the total production for the year will surpass that of 2022.

Visit the Vesper platform for more data on the Chinese dairy market.