Gone are the times when milk supplies were incredibly tight. Contrary to what was projected over the summer, multiple EU countries and the US have much more milk, milk fat, and milk proteins than expected. The outcome, unsurprisingly, is straightforward: there is a slight oversupply of liquids and commodities in a market with low demand.

Also read: Why the milk valorization model is a great tool for dairy producers.

Lower global demand has decreased EU and US exports, meaning both regions are now left mostly to their domestic supply and demand, resulting in a steady supply and a demand that is not able to match it. Leading prices to be under more pressure as well.

The trend of preference for cash over stock levels can be observed in the entire dairy industry: some producers actively seek to sell as they believe it is better to take a slight loss today than a bigger one tomorrow. However, buyers are aware of this strategy and are waiting as long as possible to purchase products.

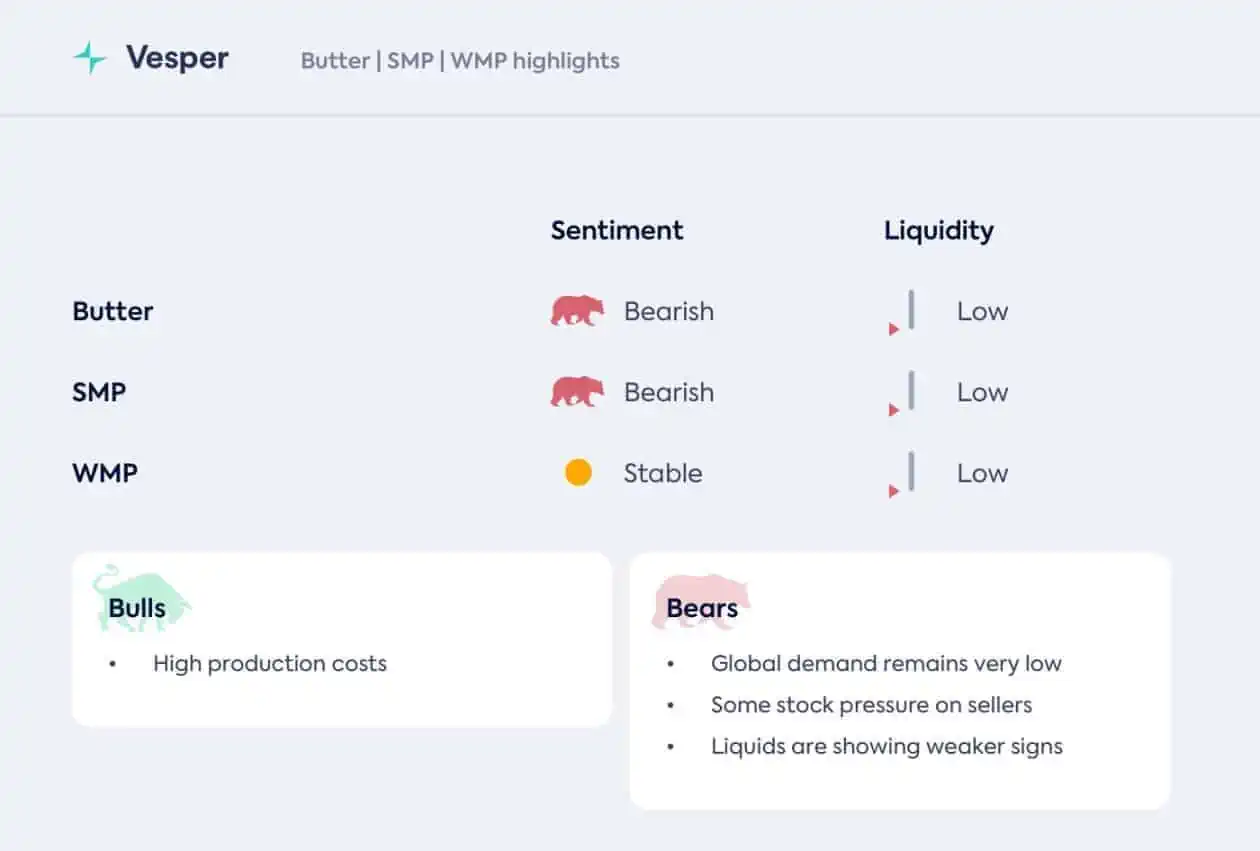

The market “value” is in the eye of the beholder. Some players define the current state of the dairy market as stable. Some others see it as bearish. And some others as significantly bearish. The answer, as always, is somewhere in the middle. A slightly bearish market, it is.

Relevant pages:

Dairy Milk powders