With reported decreases in Malaysian stock levels, Palm Oil prices have risen. This trend, coupled with increasing demand from India, has made sunflower oil a more attractive option.

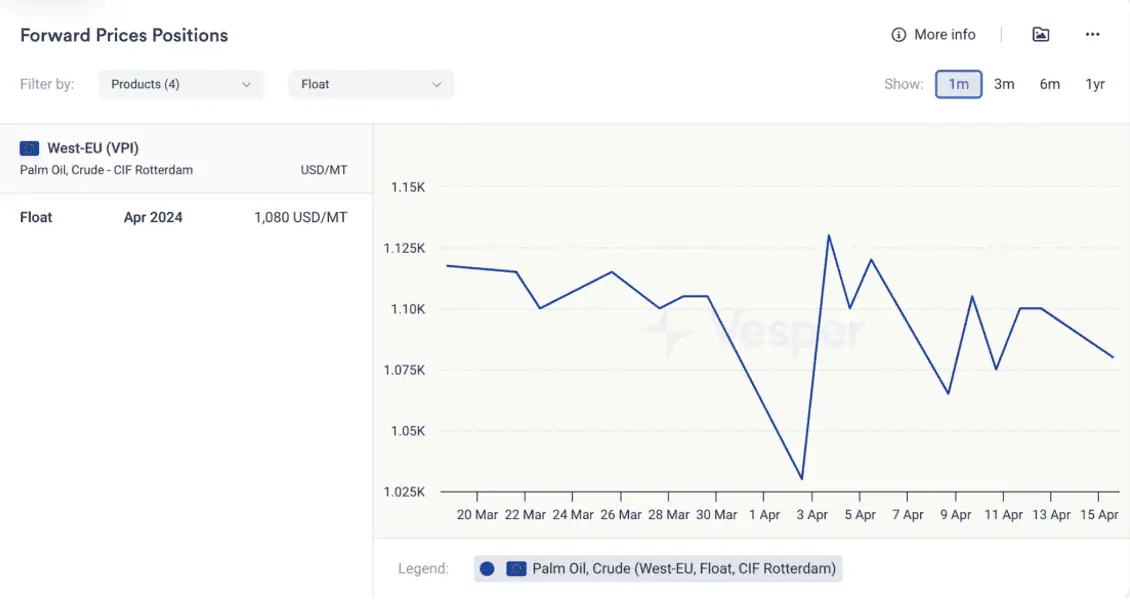

An industry source from the EU indicates that the uptick in European forward pricing could be linked to instances of short covering, see Figure 1.

Figure 1: Forward Prices for Crude Palm Oil from West-EU (Float, CIF Rotterdam) in USD/mt

The Vesper West EU Forward Price Index for Crude Palm Oil reported an increase to €976 | $1040 per mt (Cost, Insurance, and Freight (CIF) to Rotterdam for June) on April 15, 2024, from €955 | $1035 per mt on April 8, 2024. Similarly, the forward price for Crude Palm Kernel Oil rose to €1221 | $1300 per mt (CIF Rotterdam for delivery in June-July) from €1185 | $1285 per mt.

High prices in the Palm Oil market have led to a shift in demand towards more competitively priced alternatives. Sunflower Oil, in particular, has grown in popularity recently as a cost-effective substitute. India has switched to less expensive Sunflower Oil to meet its vegetable oil needs, and there is also increased interest from China and North Africa.

Russian Sunflower Oil is appealing to Indian buyers at approximately €916 | $975 per metric ton (Cost and Freight to India), which is higher than the anticipated price of €902 | $960, as shown in Figure 2. Additionally, the Vesper West EU Forward Price Index for Crude Sunflower Oil as of April 15, 2024, has risen to €930 | $990 per metric ton (Free On Board at six ports as per FOSFA 52 standards), for delivery in May-June, up from €899 | $975 per metric ton on April 8, 2024.

Figure 2: Partner price for Crude Sunflower Oil from India (CFR India) in USD/mt

The growing appeal of Sunflower Oil from Ukraine and Russia is contributing to the current downward trend in the prices of other vegetable oils. This trend is partly due to the anticipated abundant supply of rapeseed from Europe.

However, as Sunflower Oil becomes increasingly popular, processors are anticipating potential shortages. Consequently, they are not eager to sell their stock quickly, a source from the Black Sea region informed Vesper.

Download our latest highlights for free to discover more prices and trends happening within the palm and sunflower oil market.