European cream is testing its limits, and wow, the effect on the dairy market is remarkable. On Tuesday, European cream prices broke through the €10,000 per metric tonne (mt) mark, setting off a ripple effect across the dairy sector. This increase has forced butter prices to skyrocket again this week, creating a whirlwind of market activity.

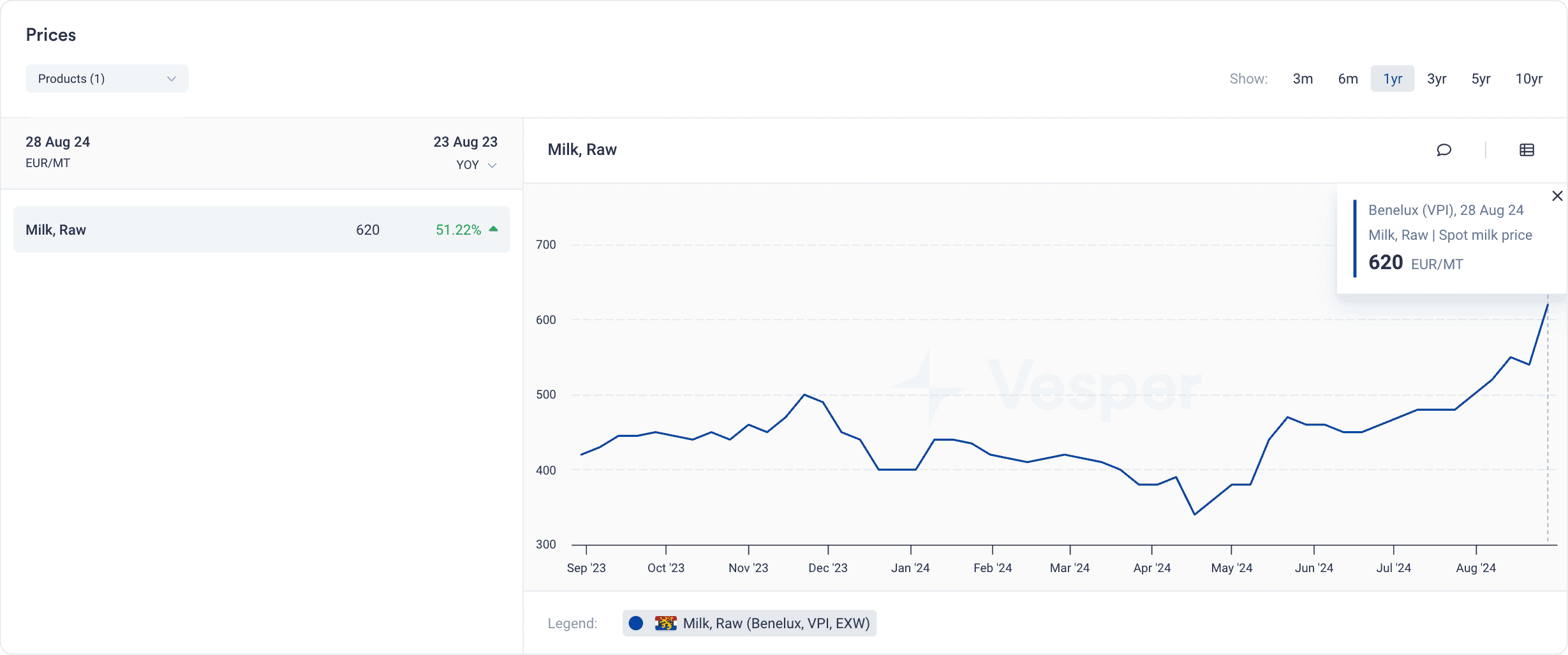

The staggering increase in cream prices is pushing butter to all-time highs, sparking fear among buyers of butterfat, instilling caution among traders, and making producers hesitant to sell forward. Most significantly, this price spike is driving up spot and farm-gate milk prices at a rapid pace. As an illustration, the spot milk price in Benelux on 28 August 2024 reached 620 EUR/MT, marking a significant year-over-year increase of 51.22% compared to the price on 23 August 2023, as shown in the figure below.

Figure 1: Raw Milk Prices for Benelux according to the Vesper Price Index in EUR/mt

The market is currently experiencing a volatile mix of factors that has created an extraordinarily nervous atmosphere in the European dairy sector, where higher prices seem unavoidable.

The latest EU Vesper Price Index, dated 28 August 2024, places the price of butter at €7,800 per mt, equivalent to $8,718 per mt or $3.95 per pound, on an ex-works (EXW) basis. Meanwhile, in Oceania, butter prices are recorded at €5,994 or $6,700 per mt ($3.04 per lb), and the US VPI butter price is at €6,272 or $7,010 per mt ($3.18 per lb) EXW.

Despite their dissatisfaction with the current pricing, butter buyers are scrambling to secure their Q4 positions and have little choice but to accept the higher costs. On the other side, manufacturers and traders are exercising extreme caution with their offers, knowing that even a few minutes of delay could lead to further price hikes.

Given the current cream prices of €10,000 per mt or higher, butter prices should theoretically be at least €8,500 per mt. However, butter prices are still lagging behind cream prices and are in the process of catching up. The futures market reflects this trend, with European butter futures for October and November already trading at €8,050 per mt. The outlook for the liquid dairy market remains bullish, as the seasonal decrease in fresh dairy liquid supply has not been matched by a corresponding drop in demand.

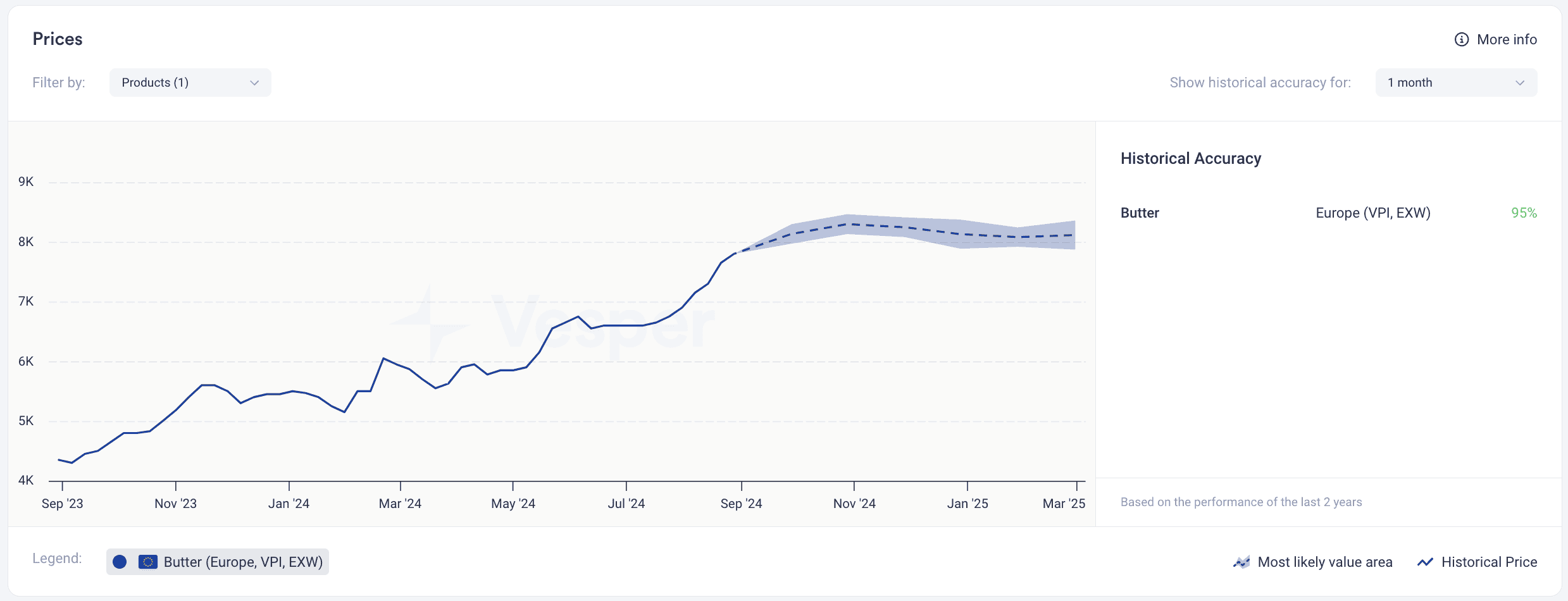

According to Vesper’s pricing forecasts, European butter prices are expected to continue their upward trajectory in the coming months, see Figure below.

Figure 2: European Butter price forecast according to Vesper’s AI-forecasting model in EUR/mt

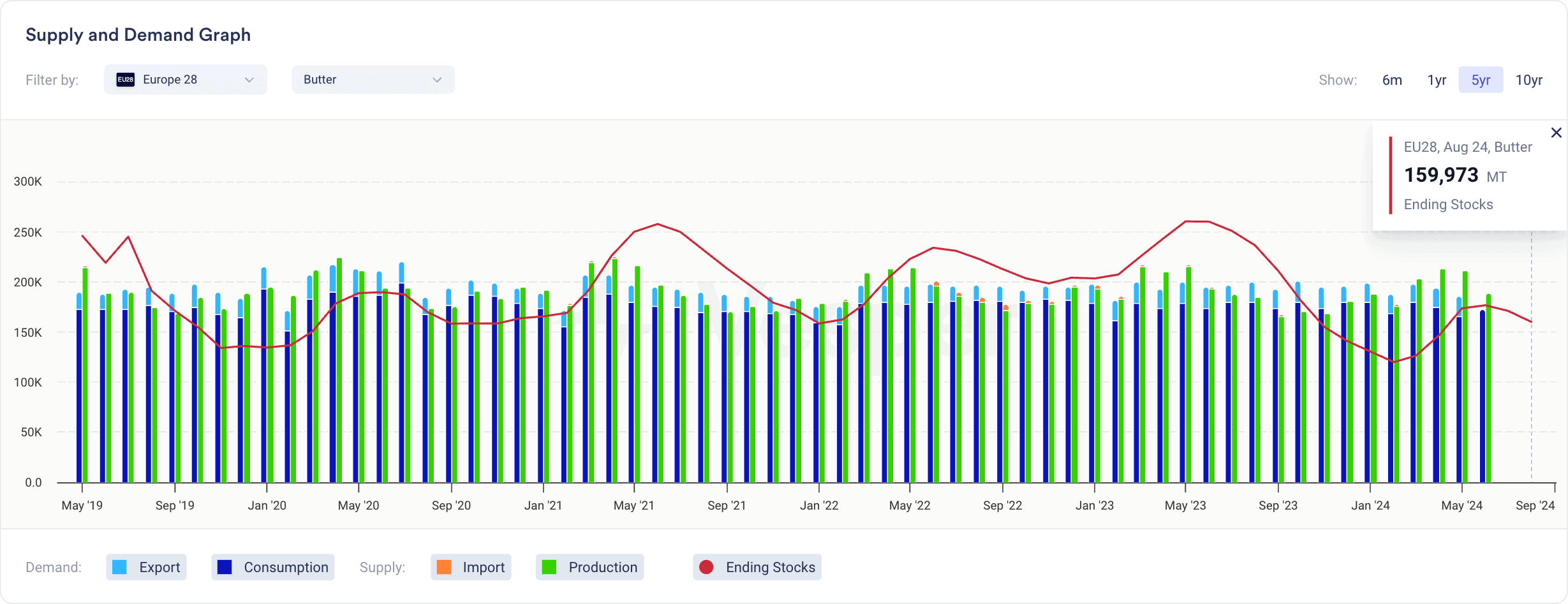

The market is expected to remain tight due to the high cost of cream and a shortage of butter stocks. Currently, European butter stocks are at a historically low level of 159,973 MT, see Figure below. We’ve recently updated the EU28 butter stock figures to include a more accurate calculation. For further details on how Vesper calculates ending stocks, please book a demo.

A significant shift may only occur with the onset of the new milk season, but even that remains uncertain. In the meantime, the US and NZ markets likely keep moving sideways at high levels.

For more insights on the global butter and cream market, download Vesper’s full market analyses here.