On Friday, the European Commission announced the imposition of provisional antidumping duties on Chinese imports of biodiesel and renewable diesel, excluding Sustainable Aviation Fuel SAF. These duties, ranging from 12.8% to 36.4%, will apply to FAME and HVO products and will be enforced in four weeks. All major biodiesel producers are included in this measure. These duties will last for six months, with the investigation concluding in February 2025, at which time the Commission may decide to impose the duties for a period of five years.

Following the announcement of E.U. antidumping duties on Chinese biodiesel last week, premiums for key products rose, particularly for RME, due to firm biodiesel prices and declining LSGO. RME premiums increased by $46/mt, UCOME by $15/mt, and FAME 0 by $10/mt. HVO outright prices also saw a rise, with HVO (UCO) up $19/mt, HVO (tallow) up $20/mt, and HVO (Vegetable) up $19/mt.

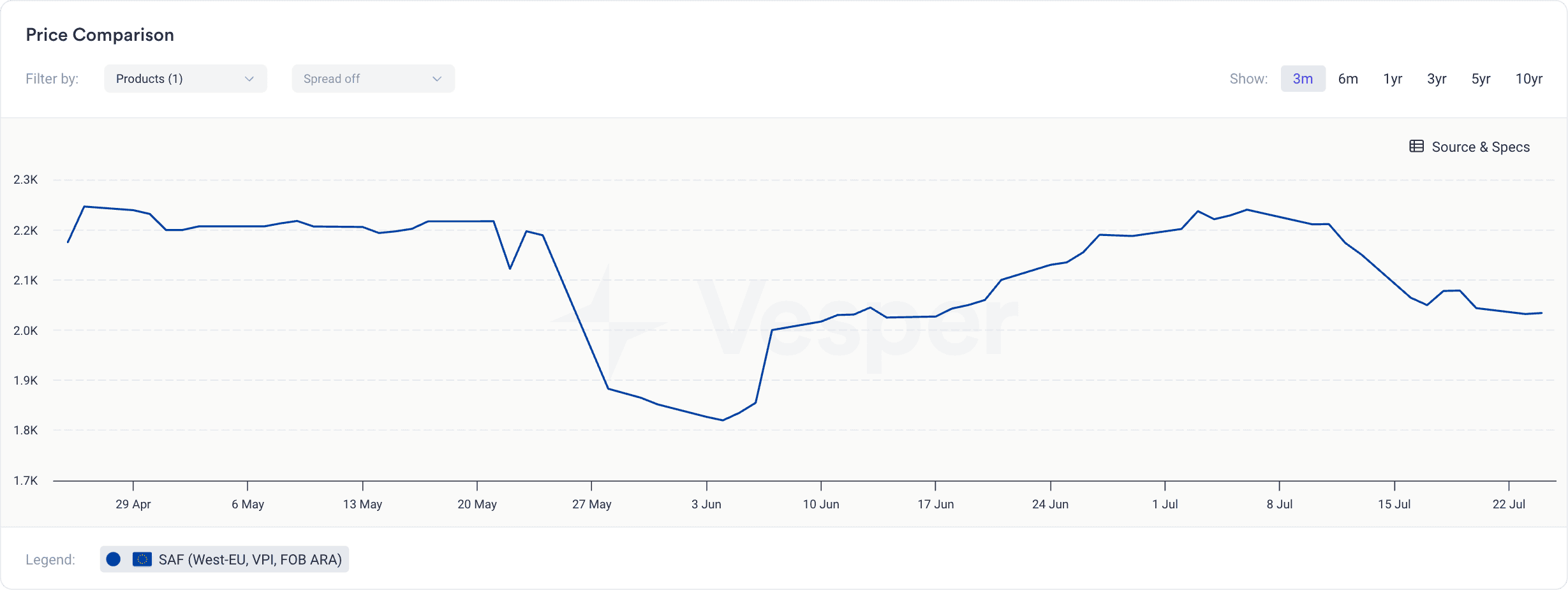

In contrast, the price of SAF dropped by $46/mt following the E.U. Commission’s announcement that SAF would likely be exempt from these antidumping measures. The European Biodiesel Board (EBB) expressed disappointment that SAF was excluded from the antidumping list, warning that dumping could occur in this sector as well. The EBB plans to lobby for SAF’s inclusion in the antidumping measures.

Figure 1: Price for SAF in USD/mt

Market participants presume that SAF was excluded by the E.U. authorities due to concerns that the E.U. might not be able to produce enough SAF to meet the mandates, possibly not due to a lack of capacity but rather a potential shortage of feedstock. T&E mentioned in one of its reports: “Ryanair alone would need all the UCO in Europe to run just 12.5% of its flights on UCO – its voluntary target for 2030. Global SAF targets in 2030 would require at least twice the UCO that can be collected in the U.S., Europe, and China combined,” the study finds.

Meanwhile, the Chinese government’s intention to introduce SAF mandates, combined with the fact that SAF is the only biodiesel China can export to the E.U. without facing antidumping duties, positions SAF as a strategic product. Vesper has learned that a few SAF plants in China will start producing in the coming months.