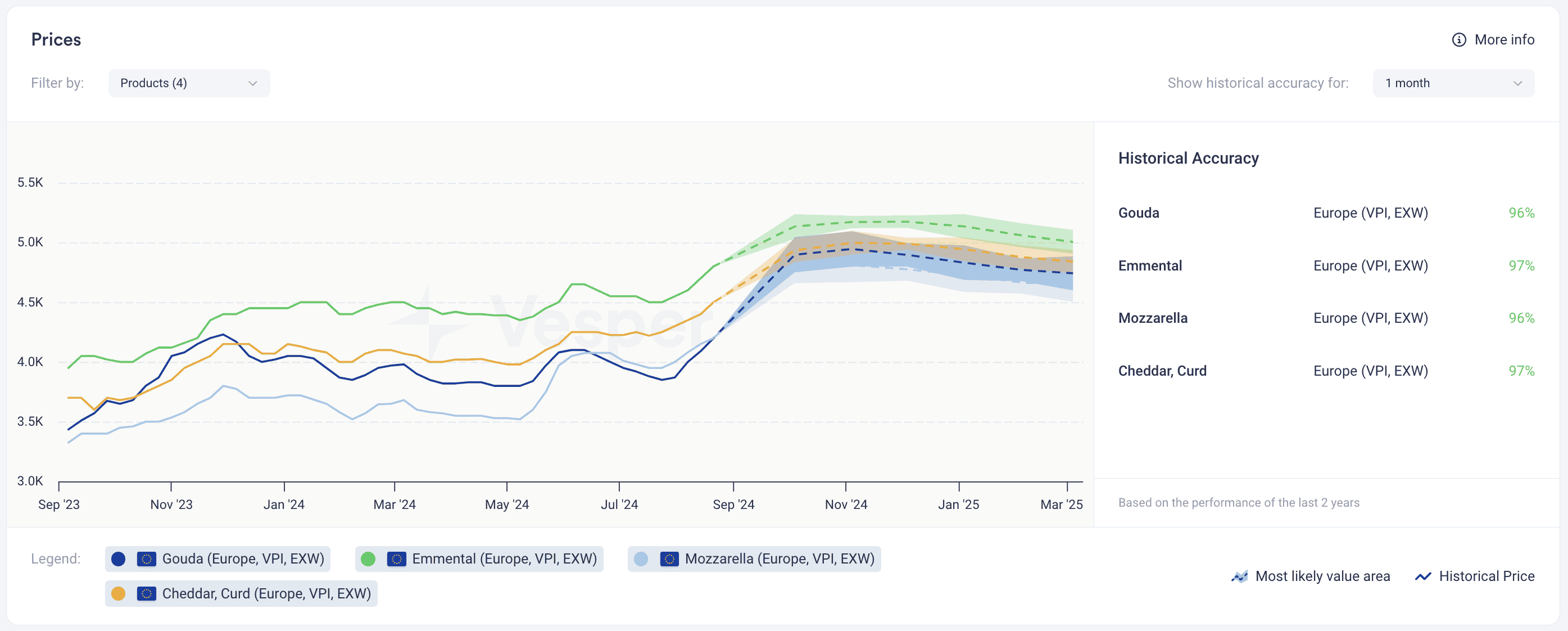

After a rapid surge in cheese prices over the past few weeks, the market has now stabilized, prompting questions about whether current price levels are sustainable. This reaction is understandable following such a sharp increase, but it’s important to note that cheese prices were previously undervalued. According to yesterday’s Vesper Price Index, an independent price benchmark, the latest prices are as follows:

- Cheddar, Curd: The Vesper Price Index for this week (04/09/2024) increased to €4,750 | $5,247/mt ($2.38/lb) EXW.

- Emmental: The Index rose to €5,000 | $5,524/mt ($2.51/lb) EXW.

- Gouda: Prices increased to €4,650 | $5,137/mt ($2.33/lb) EXW.

- Mozzarella: In Europe, the price rose to €4,600 | $5,082/mt ($2.31/lb) EXW, while in the US, it’s at €4,350 | $4,806/mt ($2.18/lb) EXW.

As prices fluctuate, several different price points have emerged for each product. Producers are aiming for the highest possible prices due to limited stock availability. Meanwhile, traders are quoting cheese prices based on theoretical values derived from protein and fat prices, which currently suggests lower prices than what sellers are asking. Buyers are also varied: some have already locked in prices, anticipating the rise, while others are still hoping to purchase at July’s prices—a challenging task in the current market.

The level of stock held by traders will influence price trends in the coming weeks. The question remains whether there are just enough stocks to profit from the recent price increases or if there is enough to start pressuring manufacturers.

According to Vesper’s AI-driven price forecasts, all cheese prices are expected to rise until the start of October, after which a downward trend is anticipated, see Figure below.

Given the forecasted rise in cheese prices until the start of October, one possible option for buyers who have not yet secured their supply is to consider locking in their purchases now to potentially avoid higher prices in the near term. However, if you have flexibility and can afford to wait, there might be an opportunity to benefit from a predicted price decline at the end of the year. This strategy comes with risks, such as the possibility of missing out on current stock availability or further market volatility. It’s important to carefully weigh this decision against the urgency of your needs and market conditions.

Follow Vesper’s forecast here.