The recent “Liberation Day” tariffs are creating significant competitive shifts across commodity markets, particularly for US palm oil imports.

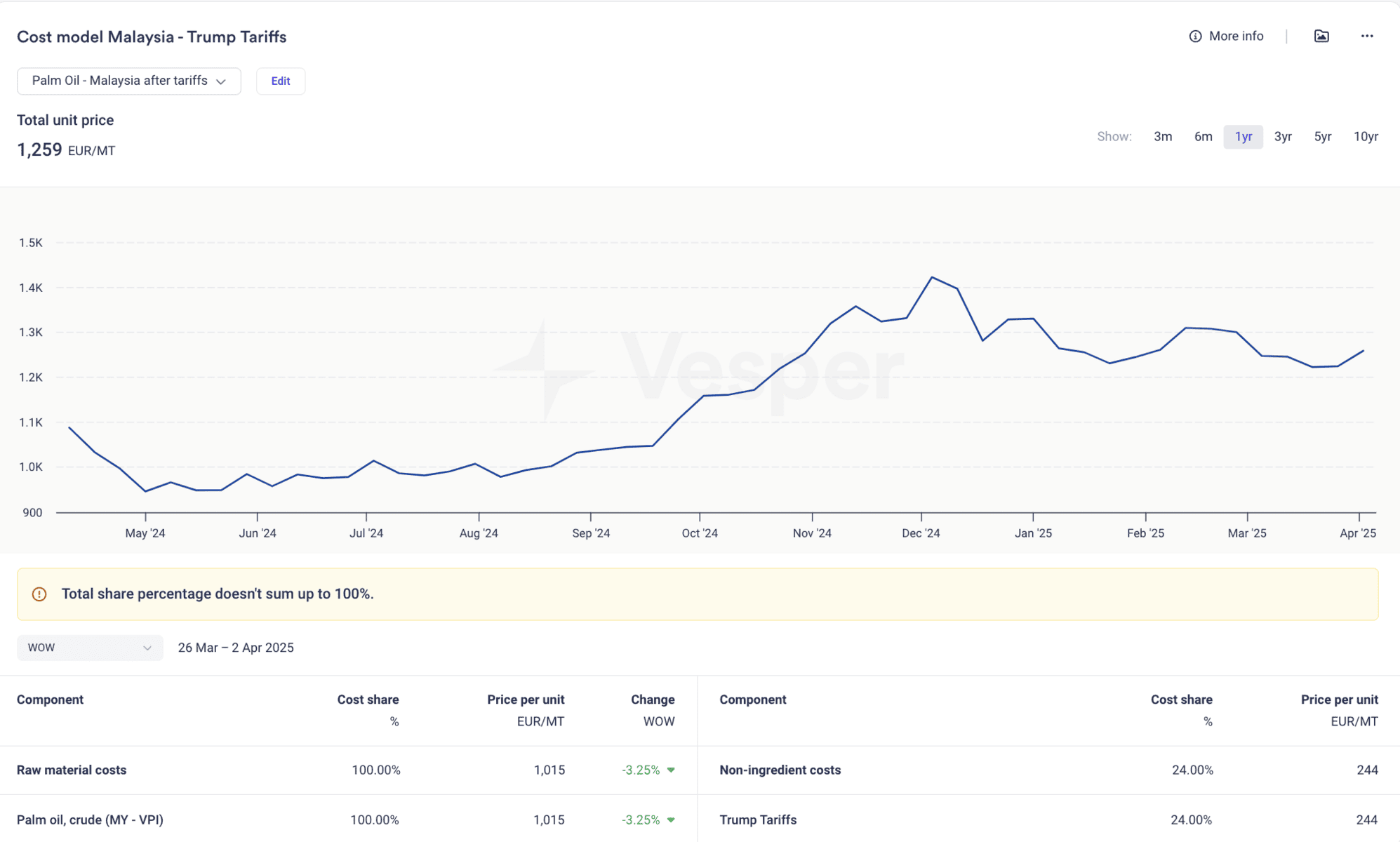

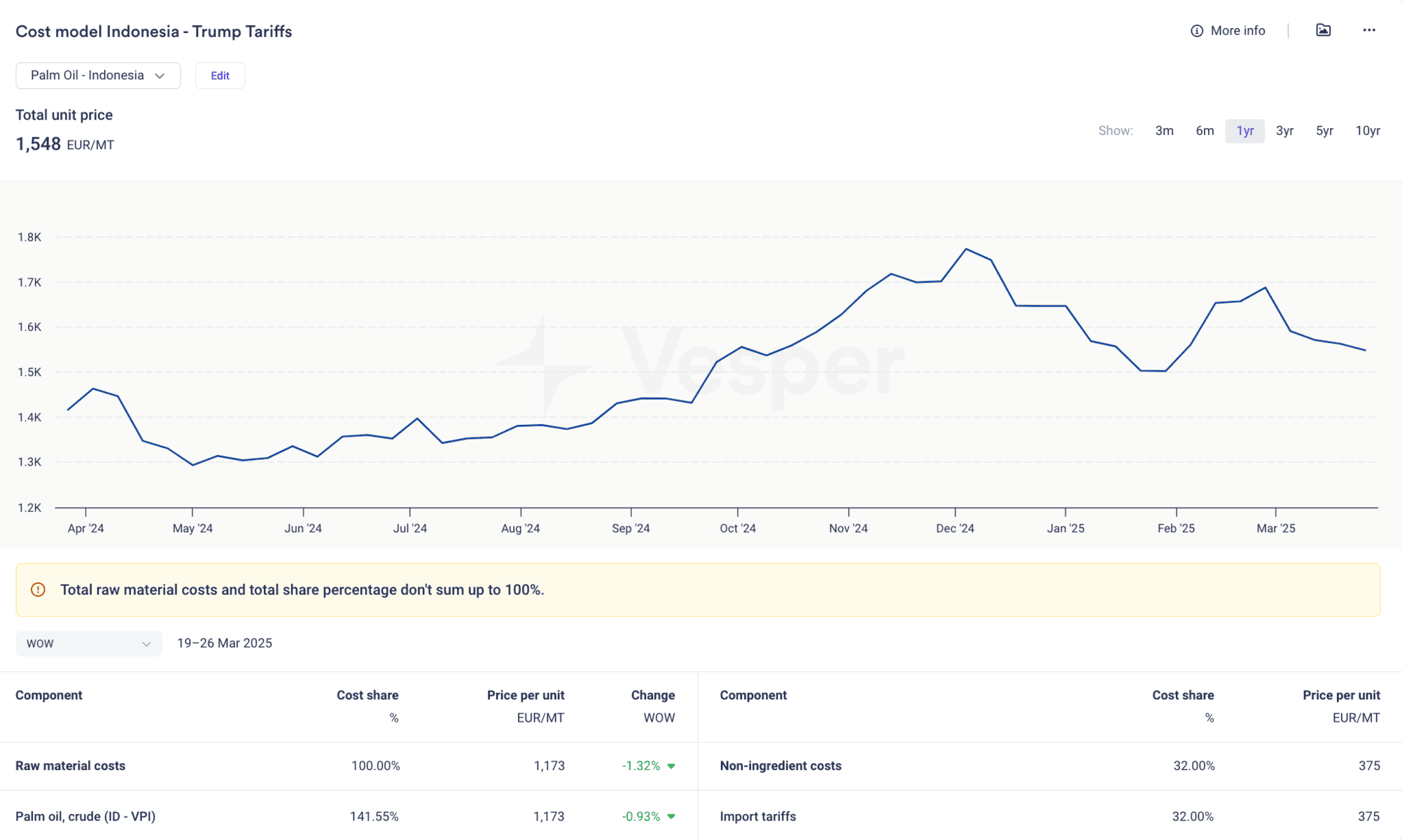

As shown in the graph below, Malaysian palm oil has traded at an 80-100 euro/MT discount to Indonesian supply over recent months, according to Vesper’s proprietary VPI benchmarks. This pricing spread visualization show how regional pricing dynamics were already favoring Malaysian origins even before tariff considerations.

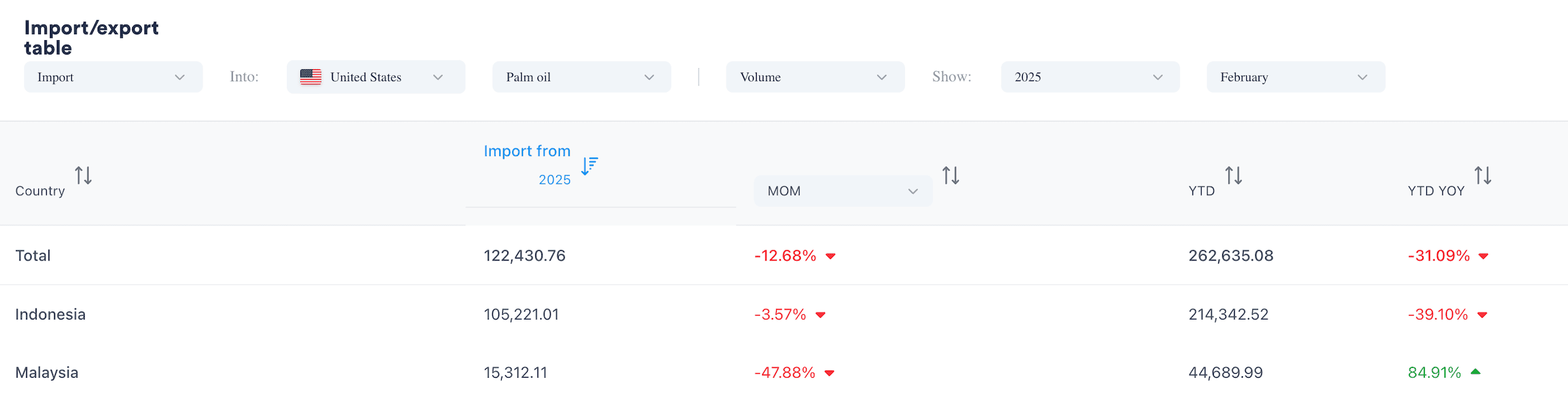

Despite this price advantage, our import/export data (see table below) reveals that Indonesia remains the dominant exporter to the US market, though Malaysia has gradually gained market share. The visualization highlights that US purchases represent nearly 10% of total Indonesian palm oil exports, making any tariff-driven shifts particularly significant for Indonesian suppliers.

Trump’s April 2nd announcement created an unexpected twist in this competitive landscape. The differing tariff rates applied to Malaysia versus Indonesia, as displayed on the now-infamous cardboard sign, will dramatically amplify existing price differentials.

Our new cost modeling functionality (figure below) demonstrates how the current 84 euro/MT spread will widen to approximately 290 euro/MT once tariffs are fully implemented. This visualization clearly shows how the new tariff structure fundamentally reshapes procurement economics between these competing origins.

For procurement professionals navigating this shifting landscape, a systematic approach is essential. The step-by-step protocol illustrated in our analysis involves:

- Referencing Vesper’s VPI benchmarks to establish accurate baseline pricing

- Analyzing our global trade data to determine historic price-driven supply shifts

- Utilizing Vesper’s cost modeling feature to calculate precise landed costs with new tariffs.