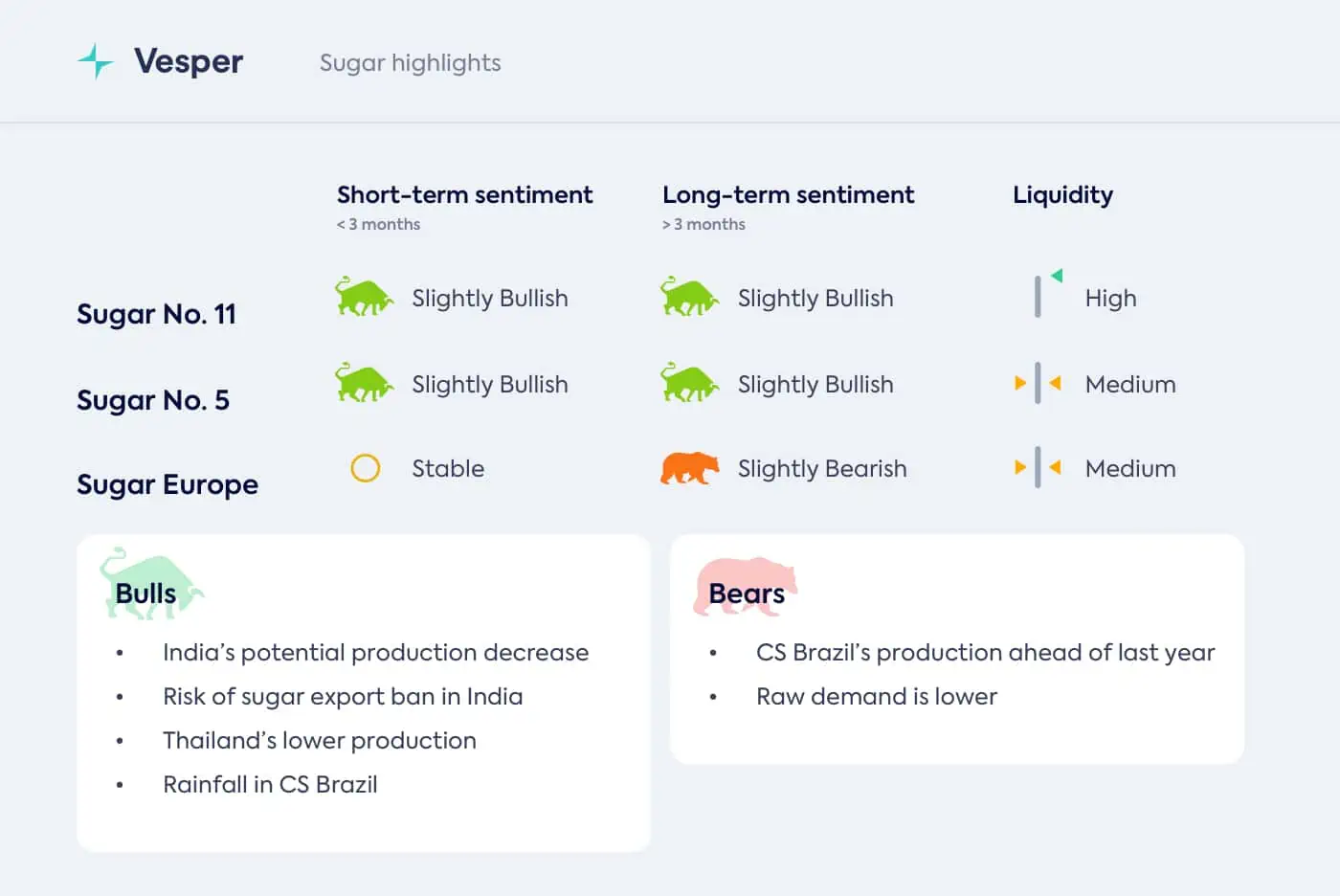

Concerns about sugar availability in early 2024 have driven market prices upwards. The primary factors behind this surge are the adverse monsoon conditions in India and Thailand, exacerbated by the effects of El Niño. India is bracing for its weakest monsoon rains in nearly a decade, with projections indicating a rain deficit of around 8%—the most severe since 2015. Additionally, the potential impact of El Niño raises the risk of rains arriving in CS Brazil in November, which could further delay production and sugar availability to the global market.

Tip: Take a look at our free to use sugar calculators, to for example calculate the import parity for raw.

The market’s robust stance is fueled by speculations that India might halt sugar exports in the upcoming season. Furthermore, recent rainfall in key sugarcane-producing states in Brazil is anticipated to decelerate cane crushing and, consequently, sugar output during late August and early September. This combination of factors, including the looming El Niño threat in Brazil, is contributing to the upward trajectory of sugar prices.

Would you like to access the full market highlights on sugar? Access the platform here.