The raw sugar market has experienced a 4.6% decrease over the past week, now trading at 18.6 USD cents per pound, levels not seen since November 2022. This decline is attributed to easing supply concerns, suggesting a gradual price recovery. Brazil’s Center-South region, the primary global sugar supplier at the moment, is benefiting from favorable dry weather, which has bolstered production expectations.

According to cane crush and production numbers published by UNICA for the second half of April, CS Brazil’s production met expectations, showing a 61% increase compared to the same period last year. The crush was 34.6 MMT (+61.3% YoY), with TRS at 115.6 kg/TC (+2.8% YoY), and the sugar mix at 48.4% (+4.8pp YoY), reaching a sugar production of 1.8 MMT (+84.2% YoY) and ethanol of 1.5 Mcbm (+51.8% YoY).

Production forecasts for the 2024/25 season are being revised upwards, with several mills in the region reporting stable to higher output compared to last year. The elevated sugar mix in late April and a strong vessel lineup for May indicate that demand is being effectively met. This positive production outlook suggests that the market will remain well-supplied.

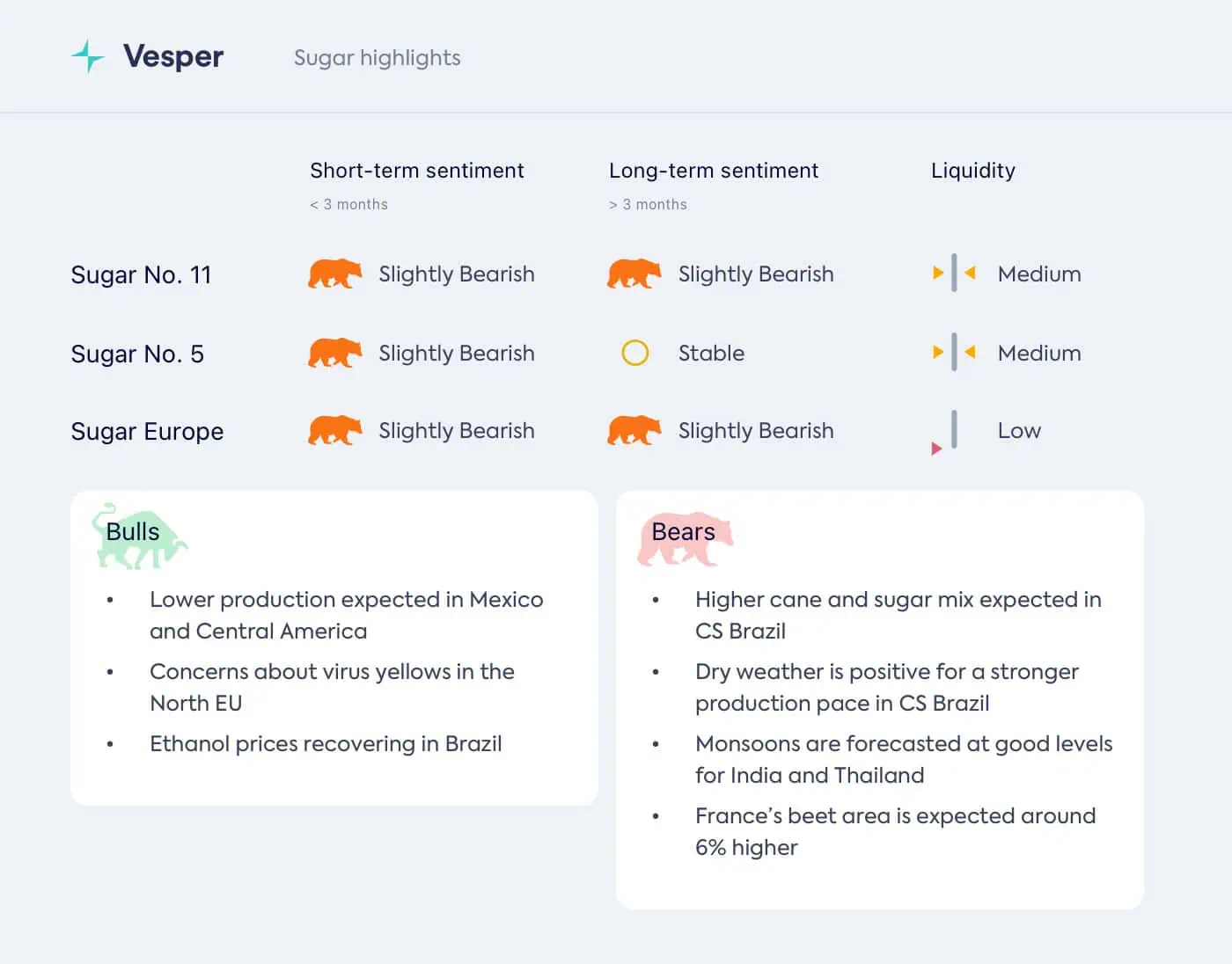

For an in-depth analysis of the global sugar market, please refer to our free market highlights.