Navigating the complexities of the commodities market can be a daunting task. In the previous article, we have written about factors affecting commodity prices. Now, to simplify your journey, we have curated a list of the top 10 best commodity tools that are setting new standards in 2024. Let’s explore them in detail.

Jump straight to them:

- Vesper

- USDA Economic Research Service

- World Bank

- Bloomberg

- OPEC

- Trading Economics

- Reuters

- S&P Global Platts

- CME Group

- Investopedia

*These tools are not ordered in a specific order.

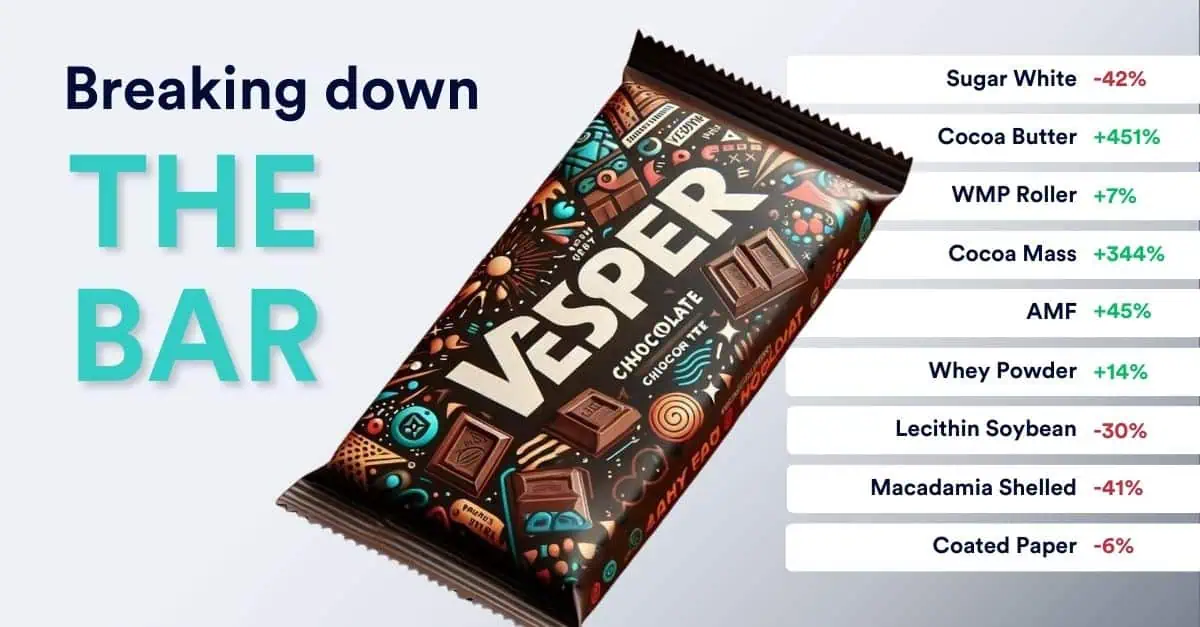

1. Vesper: A Leader in Commodity Intelligence

Vesper is revolutionising the commodity intelligence sphere. From daily commodity price points to long-term forecasts and from dairy to vegetable oils, from packaging to coffee, Vesper offers extensive data coverage across multiple commodity types.

Pros:

- Global Data: Proprietary insights that offer a global perspective.

- Multi-Commodity Coverage: Comprehensive data across various commodities.

- Rapid Growth: An emerging leader in the field.

Cons:

- Subscription-Based: Quality insights come at a premium.

- Varied Depth: Unequal focus across commodities.

- Non-Trading Platform: Offers commodity data and insights only, no direct trading functionalities.

2. USDA Economic Research Service: The Benchmark for Agricultural Data

When it comes to agricultural commodities, the USDA Economic Research Service is unparalleled in the breadth and depth of its data. From crop yields to economic outlooks, this tool offers valuable, regularly updated insights.

Pros:

- Credible Source: Government-backed data that ensures legitimacy.

- Comprehensive Coverage: Full spectrum of agricultural commodities.

- Regular Updates: Keeps you current with market trends.

Cons:

- U.S.-Centric: Focused predominantly on the U.S. market.

- Academic Language: May require focused attention to absorb the data.

- Potential Update Lag: Not always real-time.

3. World Bank Commodities Price Data: Global Market Insights

The World Bank’s Commodities Price Data tool offers exhaustive global price data on a multitude of commodities. It’s an invaluable resource for anyone seeking to comprehend commodity price trends and global economic indicators.

Pros:

- Global Scope: Data sets that offer a worldwide view.

- Reliable: Sourced from a trusted institution.

- In-Depth Analysis: Far more than surface-level information.

Cons:

- Real-Time Data Gap: May not always provide up-to-the-second updates.

- Complex UI: Has a steep learning curve.

- Data Overload: Comprehensive, but overwhelming.

4. Bloomberg: Comprehensive Commodity Coverage

Bloomberg offers a 360-degree view of commodity markets, from breaking news to deep analytical articles. It serves as a versatile tool for gaining a holistic understanding of the commodities market.

Pros:

- Credible Source: A well-established name in financial journalism.

- Extensive Coverage: All-encompassing view of commodity markets.

- Real-Time Updates: Timely news and data.

Cons:

- Subscription Required: Premium service with associated costs.

- Data Overload: Can be overwhelming.

- General Focus: Broad but not specialized.

5. OPEC Monthly Oil Market Report: Specialised Oil Insights

Tailored for stakeholders in the oil sector, the OPEC Monthly Oil Market Report offers intricate insights into oil production, consumption, and pricing.

Pros:

- Focused Coverage: If oil is your focus, this is your go-to.

- Regular Updates: Timely reports to keep you informed.

- Expert Analysis: Well-reasoned market outlooks.

Cons:

- Oil-Specific: Exclusive to the oil market.

- Political Influence: Aligned with OPEC’s stances.

- Not Real-Time: Comprehensive but not instantaneous.

6. Trading Economics: Global Indicators and Forecasts

Trading Economics offers access to an impressive range of historical data, forecasts, and news, covering 20 million economic indicators from 196 countries. It’s an essential tool for anyone dealing with commodities.

Pros:

- Global Data: Extensive data spanning across countries and commodities.

- Customisable Dashboards: Create dashboards tailored to your specific needs.

- High-Frequency Updates: Real-time data available for subscribers.

Cons:

- Subscription-Based: Access to some advanced features comes at a cost.

- Data Complexity: A wealth of data that can be overwhelming for new users.

- Learning Curve: Takes some time to master the platform.

7. Reuters: Trusted News and Market Data

Reuters stands as a reputable source for timely news, commodity prices, and market analytics. It’s an invaluable tool for professionals looking for a pulse on the commodity market.

Pros:

- Reputable Source: Highly credible news and data source.

- Wide Coverage: Comprehensive look at commodities from agricultural to energy sectors.

- Real-Time Updates: Instant access to market-moving news and data.

Cons:

- Subscription Model: Premium insights are behind a paywall.

- Broad Focus: Comprehensive but not specialised.

- User Interface: Can be complex for newcomers.

8. S&P Global Platts: In-Depth Energy Data

For anyone dealing with energy commodities, S&P Global Platts provides valuable insights into pricing, analytics, and industry news.

Pros:

- Specialised Data: Focused primarily on energy commodities.

- Credibility: Recognised authority in the energy sector.

- Comprehensive Analysis: Detailed market reports and insights.

Cons:

- High Cost: Subscription fees can be substantial.

- Limited Scope: Energy-focused, leaving out other commodity types.

- Depth of Data: Extensive information may require time to sift through.

9. CME Group: Futures and Options Trading Platform

CME Group provides a trading platform for a variety of futures and options, including those related to commodities. It’s particularly useful for those who are actively trading.

Pros:

- Trading Opportunities: Direct access to trading in commodity markets.

- Market Insights: Offers useful analytics and market data.

- Diverse Portfolio: Covers a wide range of commodities.

Cons:

- Trading Complexity: Not for beginners; requires a solid understanding of futures and options.

- Costs: Trading fees and potential for financial loss.

- U.S.-Centric: Primarily focused on the U.S. commodities market.

10. Investopedia: Educational Resource on Commodities

Investopedia serves as an educational platform offering articles, tutorials, and educational tools focused on commodities, making it great for those new to the sector.

Pros:

- Educational Content: Ideal for beginners and those looking to expand their knowledge.

- Free Resource: No cost for most of the educational content.

- Broad Coverage: Information available on a range of commodities.

Cons:

- Not a Data Source: More educational than data-intensive.

- No Trading: No direct trading capabilities.

- Basic Information: May lack the depth required by professionals.

Conclusion

You now have a comprehensive list of the top commodity tools for 2024. Equipped with these platforms, you’re well-poised to navigate the intricate world of commodities with enhanced clarity and insight.