The EU biodiesel complex has weakened since the previous report (see Chart 1). The Vesper West-EU Price Index for RME (2024-01-30) decreased by 3.1% to €1048 | $1135 / mt (FOB ARA) from €1081 | $1177 / mt on 2024-01-23. The Vesper West-EU Price Index for UCOME (2024-01-30) decreased by 1.5% to €1157 | $1253 / mt (FOB ARA) from €1173 | $1277 / mt on 2024-01-23. The Vesper West-EU Price Index for FAME (2024-01-30) decreased by 3.3% to €965 | $1045 / mt (FOB ARA) from €998 | $1087 / mt on 2024-01-23.

Figure 1: Vesper Spot Outright Biodiesel Prices (USD/mt)

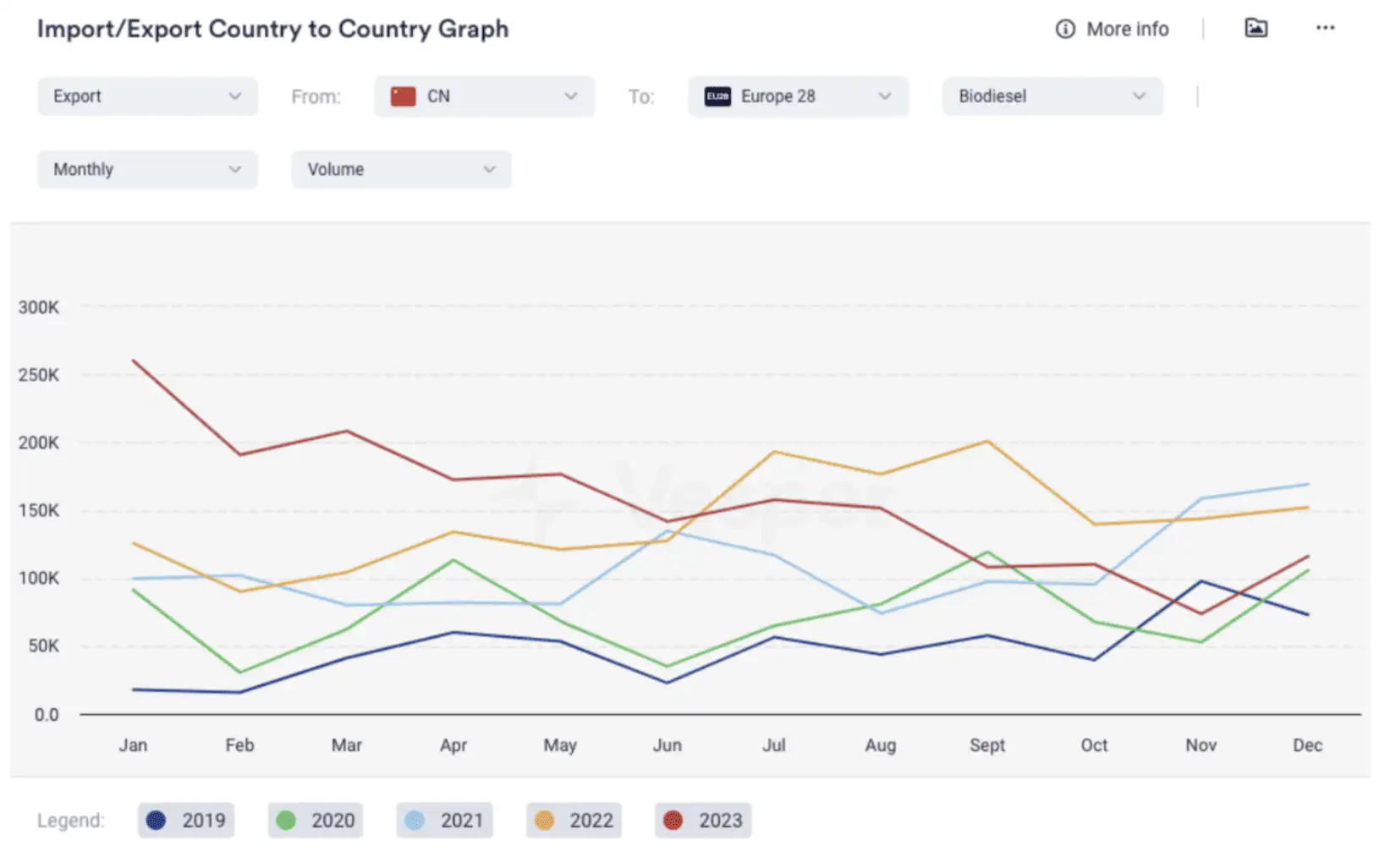

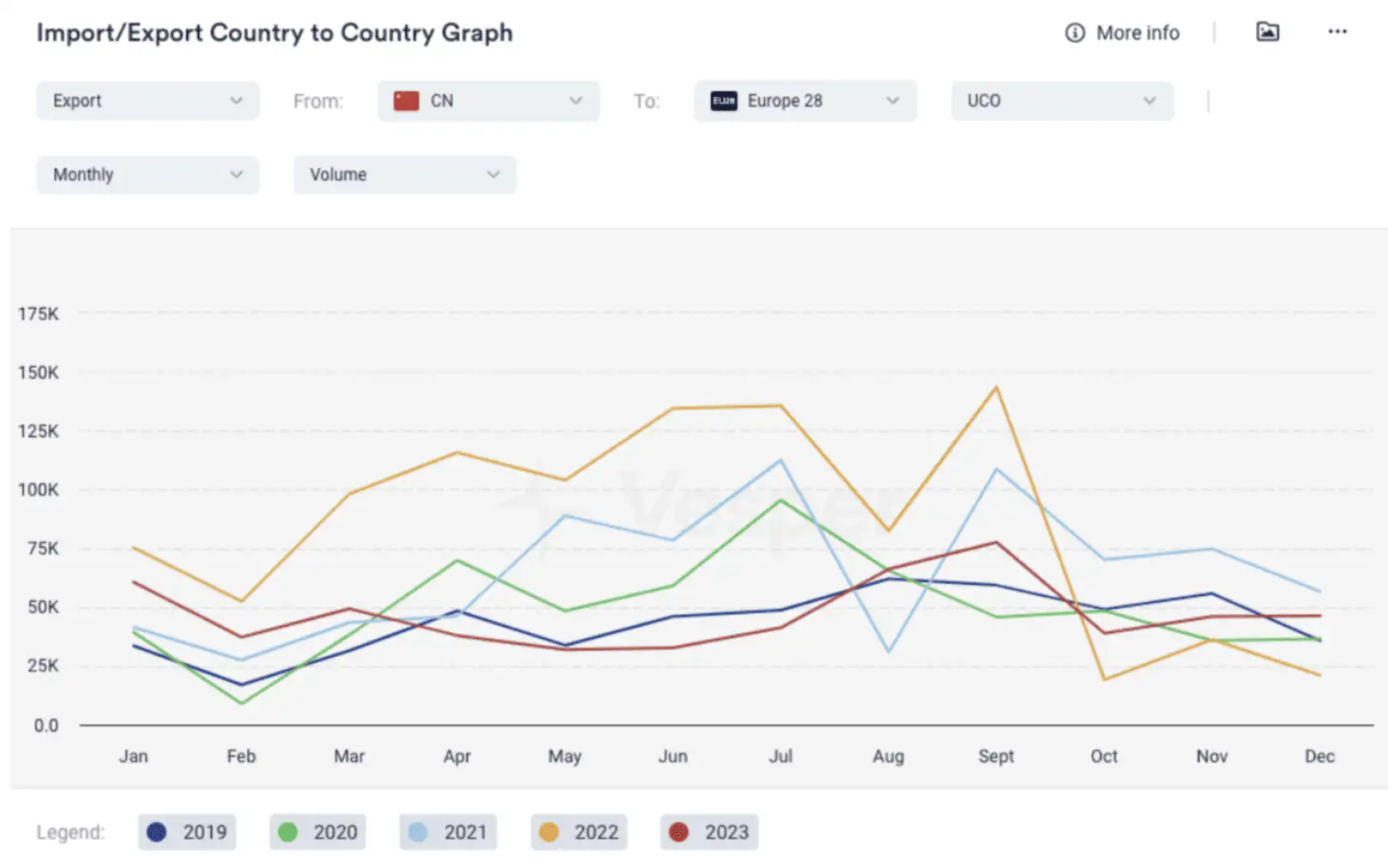

European market participants have informed Vesper of a sluggish demand for biodiesel currently, coinciding with an increase in feedstock prices. This increase in feedstock costs is attributed to heightened shipping expenses and longer delivery times caused by the Red Sea crisis. Additionally, there are rumors circulating about significant Chinese FAME contracts being finalized, which may further exert pressure on prices and constrain liquidity within the EU. Notably, in December, China’s biodiesel exports to the EU amounted to 116,000 metric tons, with used cooking oil (UCO) exports reaching 46,282 metric tons, see Figure 2 and 3.

Figure 2: China’s biodiesel exports into EU (mt)

Figure 3: China’s UCO exports into EU (mt)

Market insiders also noted that the reduction in mandates by Nordic countries has placed a cap on the growth of HVO prices. Furthermore, the market is actively discussing a potential antidumping duties that the EU could introduce against the Chinese biodiesels.

Read more highlights on the biodiesel market, by downloading our latest Vesper Highlights here.