July CIF Rotterdam price for Crude Palm Oil went up a little, while the FOB Santa Marta, Columbia weakened w-o-w, see Figure 1.

Figure 1: Palm oil price for July: FOB Columbia and CIF Rotterdam (USD/mt)

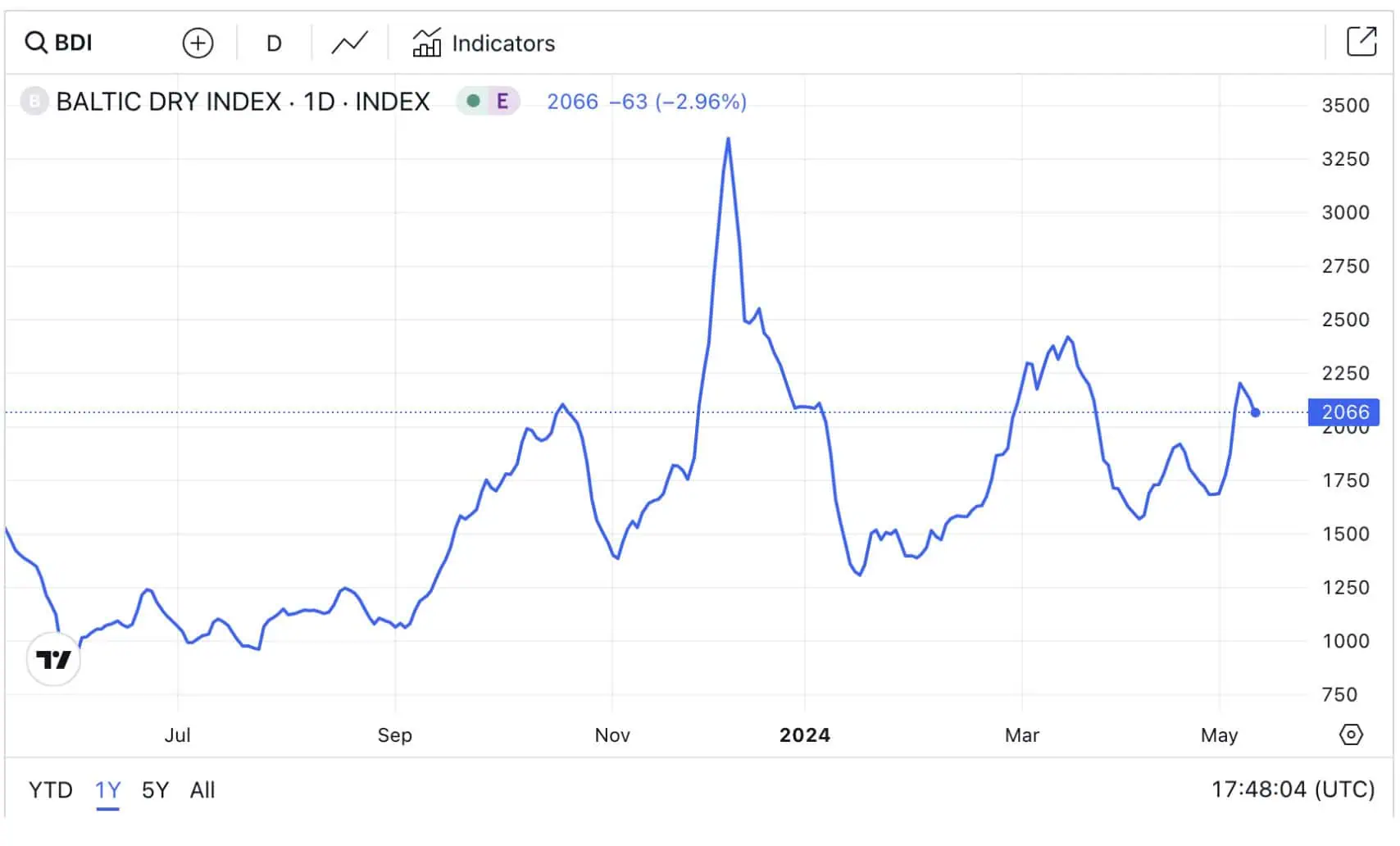

Market participants reported better production in LATAM and a higher number of offers for Europe. At the same time, the Baltic Dry Bulk index increased in May (see Figure 2), indicating higher overall freight rates for dry bulk vessels.

Figure 2: Baltic Dry Bulk Index, Source: Trading Economics

Some market participants suspect that higher freight and improved production pushed LATAM exporters to lower FOB prices while CIF Rotterdam prices stayed robust.

As per the latest MPOB report, Malaysian palm oil production increased by +7.86% in April to 1.501 mmt, exports decreased by 6.97% to 1.234 mmt, ending stocks increased by 1.85% to 1.744 mt.

Vessel line-up data for May showed slower exports of palm oil from Malaysia and increased exports from Indonesia. Exports from Malaysia look slow in May, while exports from Indonesia are picking up Malaysia 1-10 May vs. 1-10 Apr palm oil export (in mt): SGS – 263,369 vs. 370,162 (-28.85%) Vesper Indonesia palm oil vessel line up for 1-9 May vs 1-9 April (mt): 371,721 vs. 245,844 (+51%).

The Asian indexes experienced a slight decrease due to the bearish MPOB report, see Figure 3.

Explore our latest highlights for a comprehensive view of the global palm oil market and emerging trends in the wider vegetable oil sector:

➡️ CBOT soy oil benchmark jumped on the talks sparked by a Bloomberg article that the U.S. can hike duties for the imports of Chinese Used Cooking Oil (UCO).

➡️ Rapeseed oil received support from increased soybean oil and UCO (Used Cooking Oil) prices.

➡️ Sunflower oil prices increased on stronger soybean oil, elevated sunflower seed prices, and fewer offers on FOB Ukraine.

➡️ Rotterdam coconut oil prices increased mirroring the wider veg oil complex.

➡️ Spanish refined olive oil prices strengthened on bullish S&D data published by the Spanish government.