Sugar shortages and energy prices have driven the price of white sugar to historical highs.

Due to the market understanding that there will not be enough sugar available in the EU market, prices reached historical highs. The average price at the starting point of the negotiation period in April was around 486 EUR per metric tonne, and spot prices are now around 1,199 EUR per metric tonne, according to Vesper’s Price Comparison widget, meaning import parity is open.

The import parity pricing and sugar shortages have made it more attractive for buyers to source outside of Europe. Gabrielle Del’Arco, Market Insights Analyst Sugar at Vesper, noticed some buyers have diverged from their regular suppliers and started importing (raw) sugar from other countries, as they could not buy all the sugar they needed. “Some buyers from Spain and Italy are hoping to import sugar from Algeria in the new year when their sugar export ban is expected to be lifted. While others are looking to import sugar from overseas like Brazil, Guatemala, and Colombia”, says Gabrielle.

Surging prices

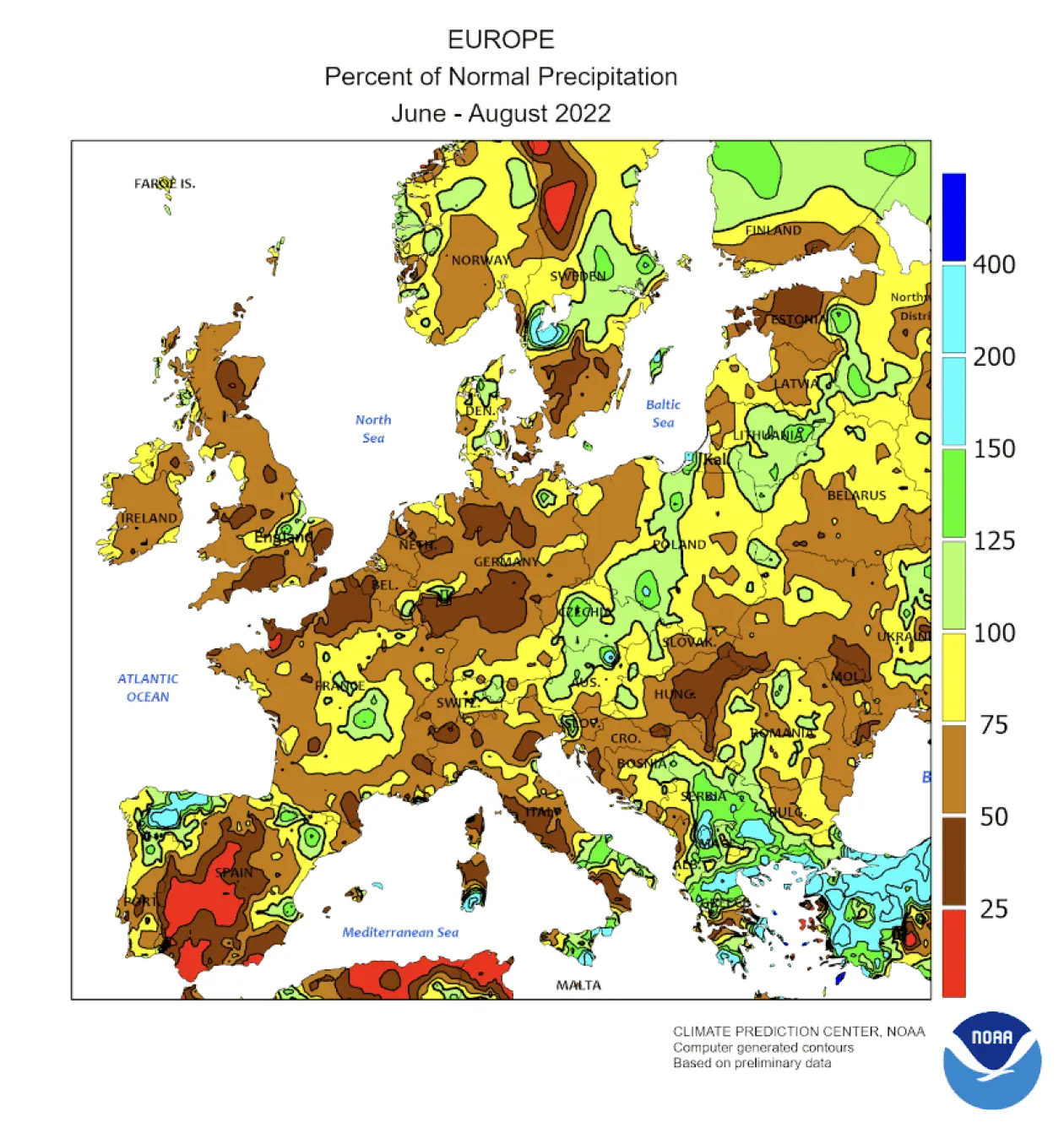

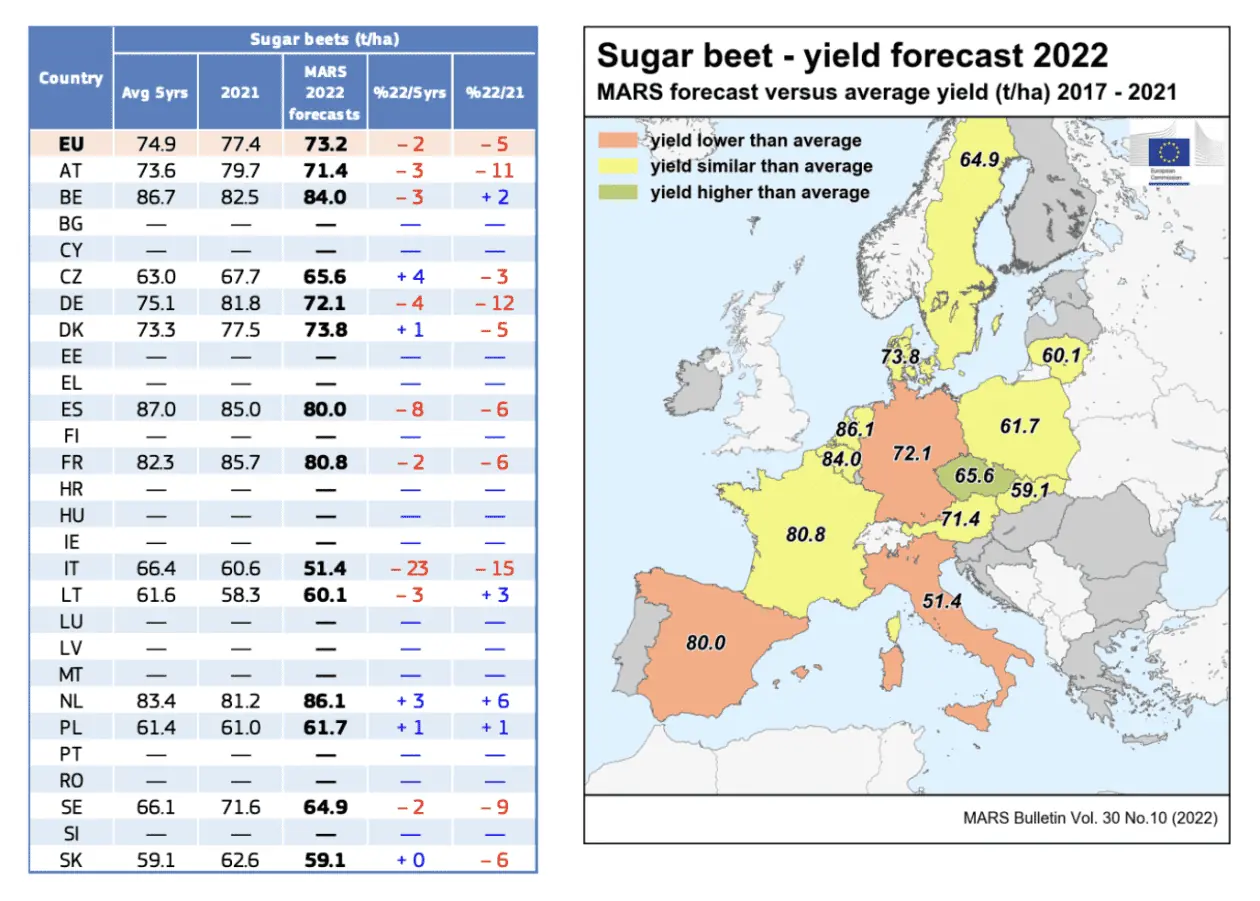

Natural gas prices remain the primary concern in the European sugar market, as sugar production is among the most energy-intensive industries – mills rely on it to run at full capacity. In one year, the costs of sugar production have more than doubled, as the average household energy prices in the EU went up from 19.19 Euro cents per kWh to 35.85 Euro cents in October 2022, according to Energie-Control Austria, MEKH and VaasaETT. With rising production costs, sugar prices have soared because of the prolonged drought across the EU, making the conditions far from ideal for crop growth. As you can see in the Percent of Normal Precipitation overview by the National Oceanic and Atmospheric Administration, some countries have been more subjected to drought than others.

Quick side note: Try our free tools to make calculations related to the sugar industry.

Even though precipitation has increased in Europe, it was already too late to significantly benefit summer crops in countries like Germany, Spain and Italy.

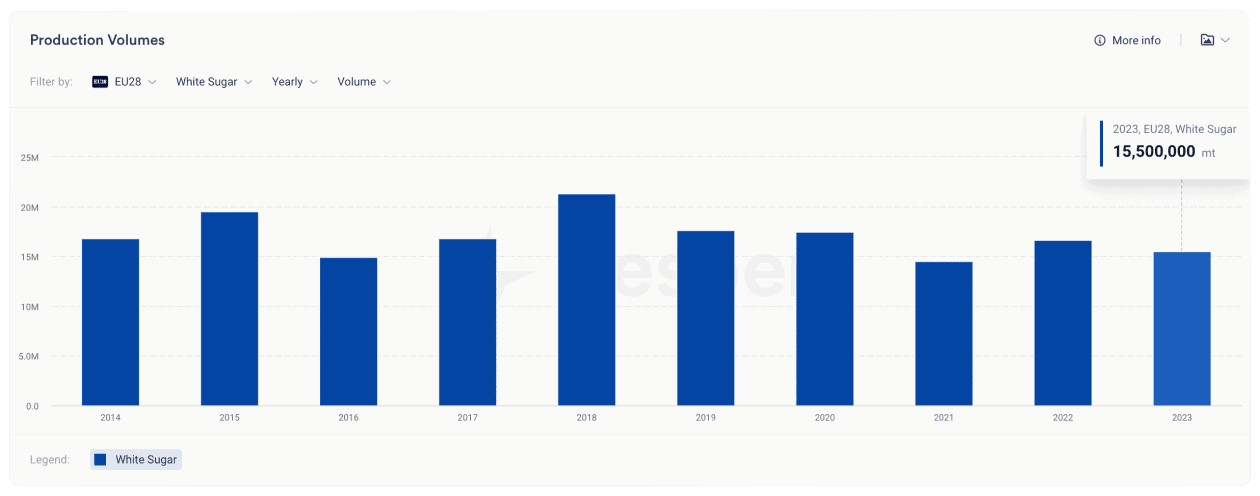

The influences of poor weather conditions on crop yields are also reflected in Vesper’s Production Volumes Widget below. According to the Production Volumes widget, production is estimated to drop from 16,600.000 metric tonnes (21/22 crop) to 15,500,000 metric tonnes (22/23 crop). Because of the lower production expected overall in the EU, the market is estimating higher volumes of imports (around +200 kt on year), from 2,2 MMT in 21/22 crop to 2,4 MMT in 22/23, according to the European Commission forecast.

Alternatives overseas

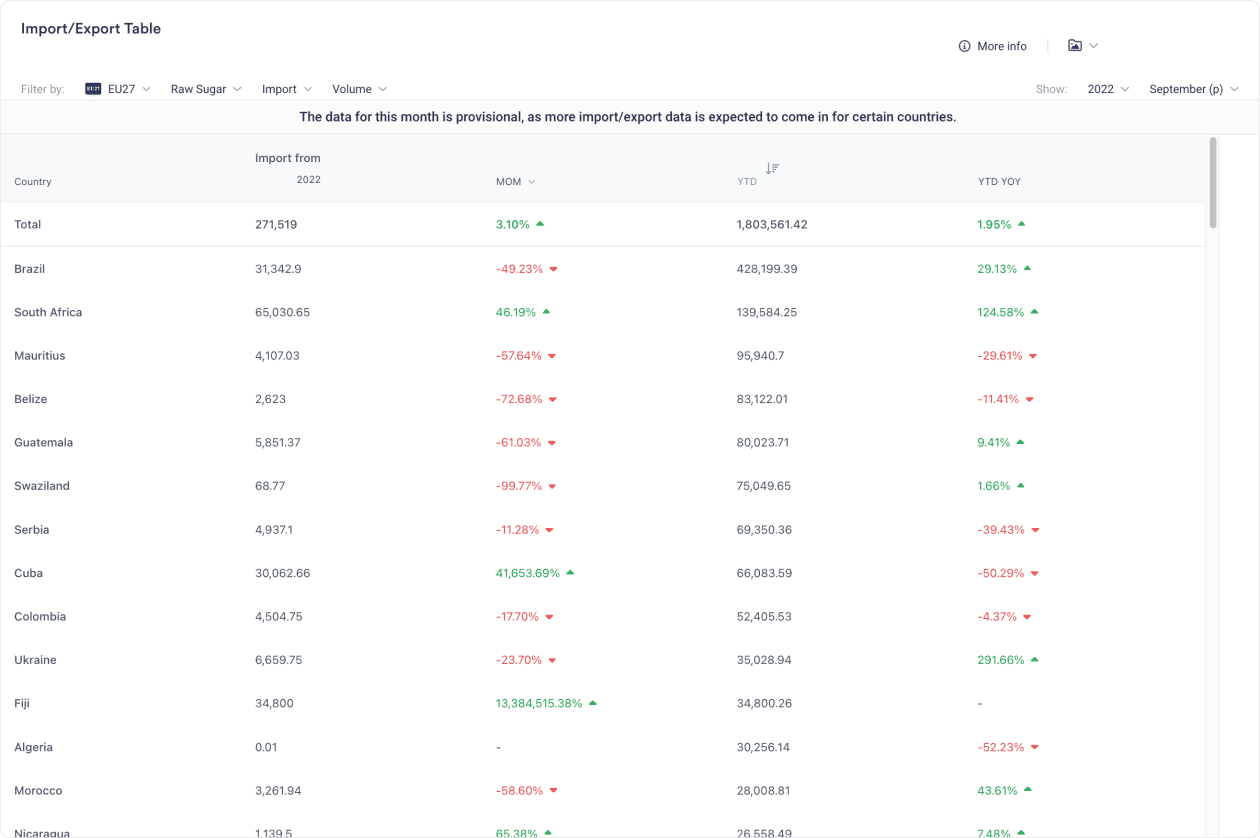

Over the past years, Europe has imported most of its raw sugar from Brazil (390 kt from Jan to Sep 2022, +17.7% compared to the same period of last year), South Africa (109,6 kt from Jan to Sep 2022, +76.3% compared to the same period of last year), and Mauritius (92 kt Jan to Sep 2022, -31.94% compared to the same period of last year), according to Vesper’s import/export table below.

In the past couple of months, we have seen South Africa move up to be the top sugar exporter to EU 27. Our data shows that buyers often stay loyal to a handful of suppliers, and trading lanes are hardly bound to change, even in the face of sugar shortages. So let’s look at the biggest supplying countries to see if they can help with the sugar shortages in Europe.

South Africa has become the number one supplying country due to a healthy 22/23 crop that was positively affected by the return of normal weather conditions, combined with an industry effort to increase production. Their total sugar output is expected to grow from 1,9 MMT in 21/22 to 2,0 MMT in 22/23, indicating a higher supply to the world market.

A very positive trend compared to Mauritius. Mauritius’ exports are 31.94% lower than last year’s, as they are expected to produce around 240 kt of sugar. This is 9% lower than last year’s 21/22 crop (270 kt).

Brazil still needs to prove whether it can make up for the low sugar production in 21/22 caused by La Niña which dropped from 38,5 MMT in 20/21 to 31,96 MMT to date. Brazil is on the right track, as their production is +0,3% compared to the same period of 21/22. Market expectations estimate a total sugar production of 34,5 MMT by the end of the season, but this all depends on how long the mills will run and if the weather allows it.

All in all, it is not guaranteed that there is enough sugar for Europe in the world market – Brazil is behind in production, Mauritius does not have much availability, and Algeria still has an export ban. South Africa is exporting more than it usually is, but it’s hard to say how much more can be shipped to Europe. Buyers need to keep following the production in Brazil and Algeria’s export ban to understand more about next year’s sugar availability.