In this exclusive interview, with Philipp Goetz, we focus on what’s happening in today’s and futures dairy market from the farming side of things – the impact of farming practices on the global dairy market.

Philipp Goetz is Head of Sales and Business Development at International Farm Comparison Network (IFCN). With more than 130 dairy related companies that cooperate with IFCN, the IFCN helps to better understand the dairy world by providing globally comparable dairy economic data and even forecasts since 2000.

The uniqueness of IFCN lies in its typical farm approach, which involves gathering and comparing data from over 176 dairy farms across more than 50 countries. This method allows for a comprehensive understanding of how to achieve a competitive advantage by pinpointing the most significant cost drivers and analyzing feeding systems worldwide.

Join us as we sit down with Philipp Goetz, exploring the current state of farming practices and its impact on the dairy market, globally.

1. How long does it take before farm-gate milk prices react to milk production output?

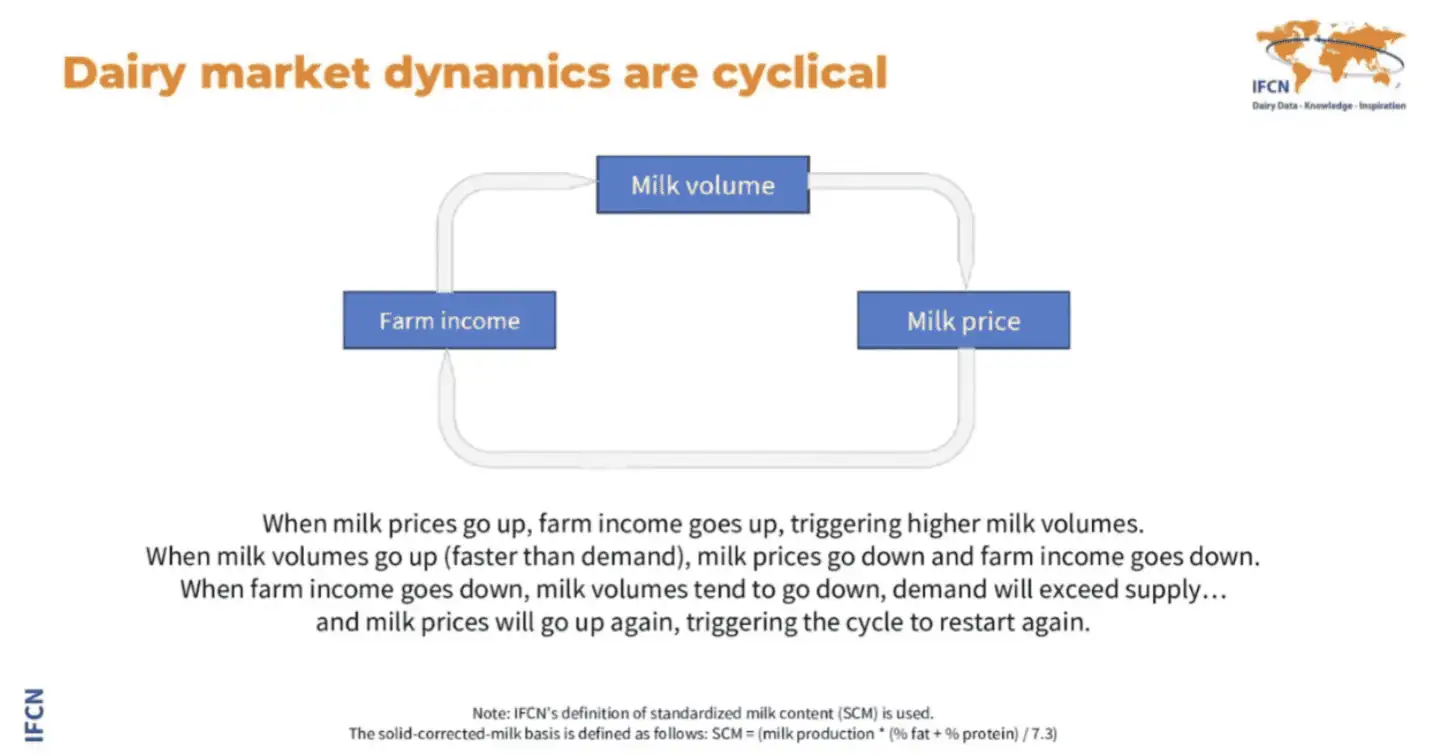

The dairy market operates in cycles that influence pricing and production, see Figure 1. Recently, we’ve observed a pattern where increases in milk prices, noted during 2022 and early 2023, have led to higher incomes for dairy farmers. This, in turn, prompted them to produce more milk, resulting in a supply that outpaced demand and subsequently caused a decrease in milk prices and farmer incomes. As incomes fell, milk production also declined, eventually leading to a situation where demand surpasses supply, thus initiating another cycle of rising milk prices and repeating the process. It’s important to note that these events do not occur simultaneously; there is typically a lag of 15 to 17 months between cycles, meaning it takes around 30 months to complete one full cycle due to these delays.

Reflecting on the recent cycle that started when milk was priced at 60 cents over a year ago, we are currently midway through this cycle. Past trends suggest a certain predictability, yet the future remains uncertain. We can, however, anticipate that the cycle may continue with only minor deviations, based on historical data.

Figure 1: The cycle of dairy market dynamics

2. Can you give us more insights into milk price and milk production trends of 2023?

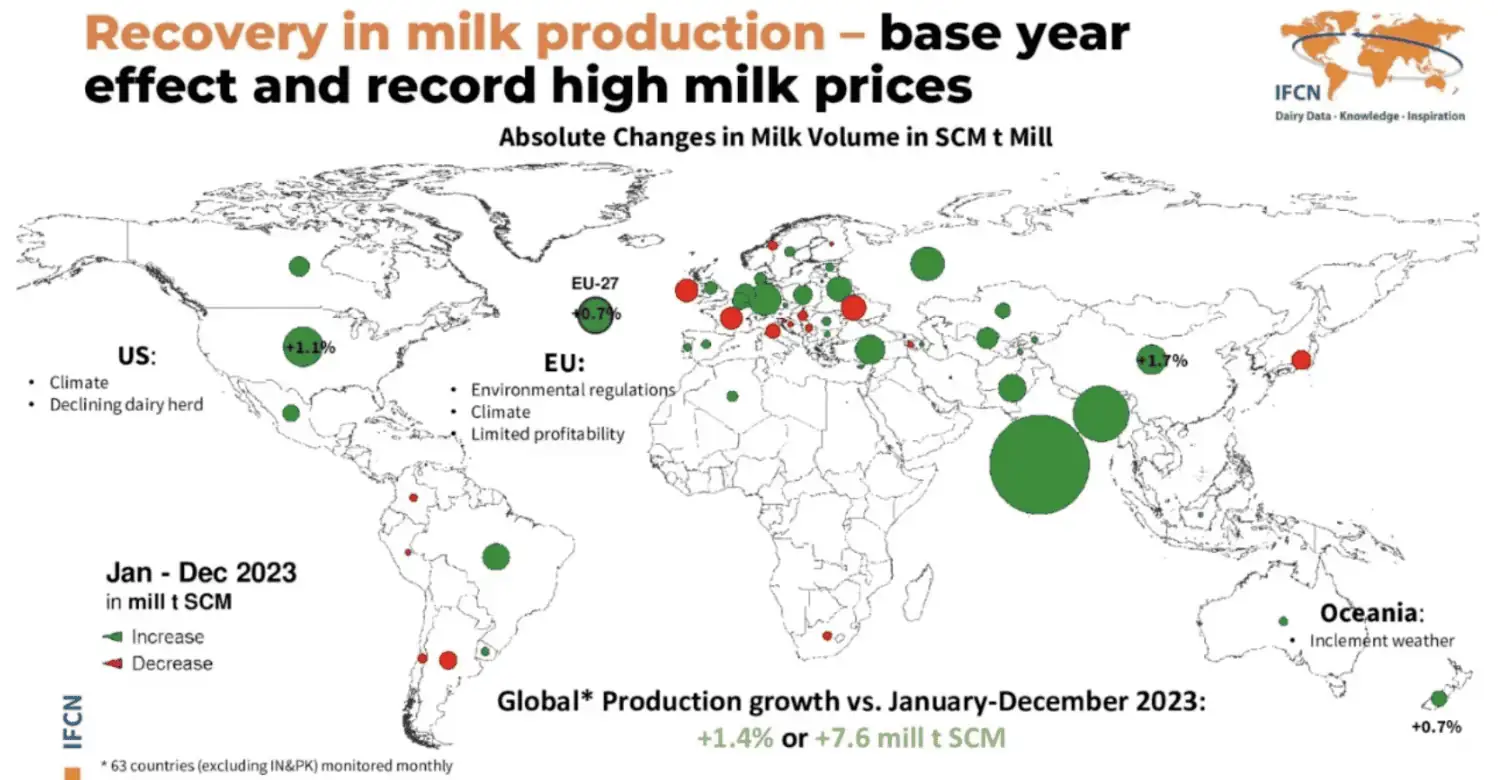

In 2023, the global milk market experienced notable trends in both milk prices and production levels, influenced by a variety of factors. Overall, global milk production increased by 1.4% compared to 2022, adding approximately 7.6 million tonnes of solid corrected milk, see Figure 2. This rate of increase is somewhat lower than historical averages. The context of 2022, a year characterized by weaker milk production globally, plays a critical role in understanding this growth. The production had only seen a marginal increase of 0.3% in 2022, which was below the usual expectations. Typically, growth rates around 3% would be anticipated to compensate for such downturns, hence the remarkable price surges observed.

The price dynamics of 2023 reflected the interplay between supply and demand. With the production rebound contributing to a supply growth that exceeded demand, milk prices initially fell. This was a reversal from the soaring prices seen previously, which were partly a response to the constrained supply in 2022 and the anticipation of recovery. As the year progressed, milk prices started to show signs of stabilization, and in some regions, even slight increases were noted. This variation in price trends suggests a nuanced picture, with regional differences playing a significant role in the overall landscape.

Figure 2: Milk production trends in 2023

3. What is the difference in cost of milk production per continent and what region is the most competitive?

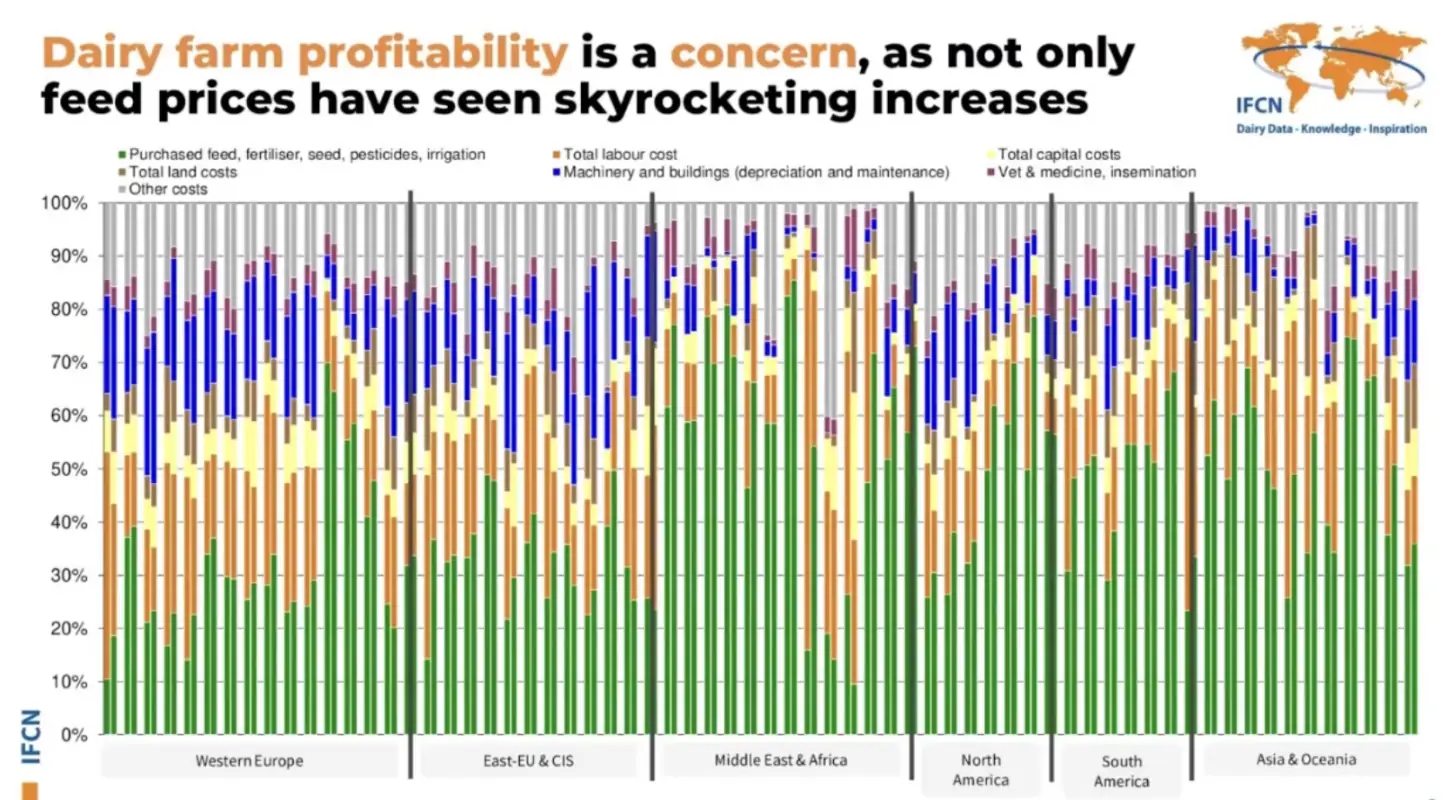

The cost of milk production varies significantly across continents, primarily due to differences in input costs such as feed, fertilizer, seed, pesticides, and irrigation. These input costs constitute a major portion of the overall cost of producing milk. On a global scale, the cost contribution of these inputs can vary widely, with feed and related inputs typically accounting for a significant portion of production costs.

On average, inputs like feed, fertilizer, seed, pesticides, and irrigation can account for up to 70% of the cost in regions where these costs are highest, see Figure 3. However, across the globe, these costs generally represent about 40% to 60% of the total cost of milk production. This wide range indicates the variability in production efficiency, input prices, and farming practices across different regions.

Figure 3: Breakdown of cost prices

The recent years have seen a notable increase in the costs associated with milk production, a trend significantly influenced by geopolitical events, notably the conflict between Russia and Ukraine. This situation has led to heightened prices for critical agricultural inputs like feed and fertilizers, compounded by surges in energy costs due to sanctions and trade disruptions. As a consequence, the financial burden on farmers has escalated more swiftly than the rise in milk prices. This discrepancy became especially pronounced in 2023, a period during which milk prices started to stabilize or decrease, even as input costs remained elevated.

This dynamic underscores the importance of closely monitoring and understanding the factors driving these cost increases. It is crucial for stakeholders in the dairy industry to anticipate how much milk will be produced in the upcoming months, considering the current economic pressures. This understanding will help in managing supply, stabilizing prices, and planning for the future.

A historical review from 2010 to 2023, with projections into 2024, reveals a consistent trend of rising production costs across the global dairy industry. The years from 2020 to 2023, in particular, have witnessed a marked escalation in these costs, affecting nearly every country involved in milk production. This trend highlights the broader economic challenges faced by the dairy sector, including the need to navigate fluctuating market conditions, manage increasing production costs, and maintain profitability in a competitive global marketplace.

The dairy industry has witnessed several key trends affecting production costs and competitive dynamics among leading milk-producing countries. Notably, Germany and the United States have reached similar levels of production costs, a convergence not observed before. This alignment reduces the competitive edge previously held by either country due to cost advantages, signifying a shift towards more uniform global production expenses.

Moreover, a significant development has been observed in the competitive landscape between Argentina and New Zealand. Historically, both countries employed comparable grazing-based farming systems, which offered Argentina a competitive edge in milk production. However, recent trends indicate that New Zealand has regained its status as one of the most competitive regions for milk production. This resurgence in competitiveness comes despite the introduction of stricter environmental regulations, which often increase operational costs. New Zealand’s ability to maintain a competitive edge underscores the effectiveness and efficiency of its dairy production system.

The continuing competitiveness of New Zealand’s dairy sector, even in the face of regulatory pressures, highlights the intrinsic value and sustainability of grazing-based farming systems. It serves as a crucial indicator of the viability of such systems to produce milk cost-effectively while adhering to environmental standards. This competitive advantage is particularly significant given the crucial role of dairy in addressing global nutritional needs. Dairy products are recognized for their superior nutritional value compared to milk alternatives, making the continued and efficient production of milk essential for combating undernutrition worldwide.

4. Given that Ireland extensively uses pasture for dairy farming instead of relying heavily on purchased feed, does this mean that the cost of milk production in Ireland is lower compared to the average in Europe?

Yes, Ireland’s reliance on pasture-based feeding for dairy production does contribute to lower milk production costs when compared to the European average. The utilization of pasture as the primary feed source is less cost-intensive compared to systems that rely heavily on purchased feed. This advantage stems from the natural grass growth conditions in Ireland, which are favorable for most of the year, reducing the need for expensive feed inputs.

This approach not only reduces feed expenses but also aligns with sustainable agricultural practices, offering environmental benefits alongside economic advantages.

5. What will the cost of milk production look like for 2024?

For 2024, it is anticipated that the cost of milk production may experience a slight decrease, particularly in Western regions such as Europe and the US. This expected reduction is attributed to the cooling down of feed, fertilizer, and energy prices. However, other challenges persist, including regulatory uncertainties and the issues surrounding labor costs and availability. The difficulty in attracting labor to dairy farms remains significant, compounded by the younger generation’s reluctance to engage in farming as a 24/7 occupation and the challenges of recruiting skilled individuals for increasingly digitalized farm operations.

Despite advancements in digital technology, the agricultural sector faces hurdles in attracting IT professionals who might prefer employment with larger tech companies over agricultural IT roles that may require visits to farms for troubleshooting and understanding on-ground issues. This situation is expected to influence the future landscape of dairy farming, potentially leading to further consolidation within the industry.

Although a cooling in production costs is predicted, levels are likely to remain elevated, comparable to those observed between 2013 and 2016, but not as high as in 2023. For countries like New Zealand and Argentina, which already operate at lower production costs, stability is expected in 2024. Conversely, China, noted for having one of the highest milk production costs globally, also commands some of the highest milk prices, positioning it in a unique market situation somewhat insulated from global trends. This suggests that while some regions may see a slight easing in production costs, the overall picture will vary significantly across different countries, influenced by local factors and global economic conditions.

6. It’s commonly mentioned that for many European farms, especially the larger ones, a milk price above 35 cents per unit typically indicates profitability. However, with ongoing inflation, is it realistic to expect this figure to remain a valid benchmark for profitability?

Due to inflation and the various factors previously discussed, such as rising input costs and regulatory changes, the baseline cost of milk production has fundamentally shifted. Where 35 cents (or euros/dollars) was once considered a profitable threshold for farmers, the new reality has adjusted this figure upwards to the 45-50 cents (or euros/dollars) range. This adjustment reflects the comprehensive increase in production costs across the board.

We are now transitioning into a new era where the previous cost benchmarks are no longer viable. The past standards for profitability in dairy farming have been overtaken by current economic pressures, marking a significant shift in the industry’s financial landscape. Charts and historical data illustrate that while a cost level of around 35 cents might have been sufficient for profitability in previous years, current costs ranging from 40 to 50 cents mean that the old benchmark is now below the break-even point for most farmers.

7. How did farm income develop in the past challenging times?

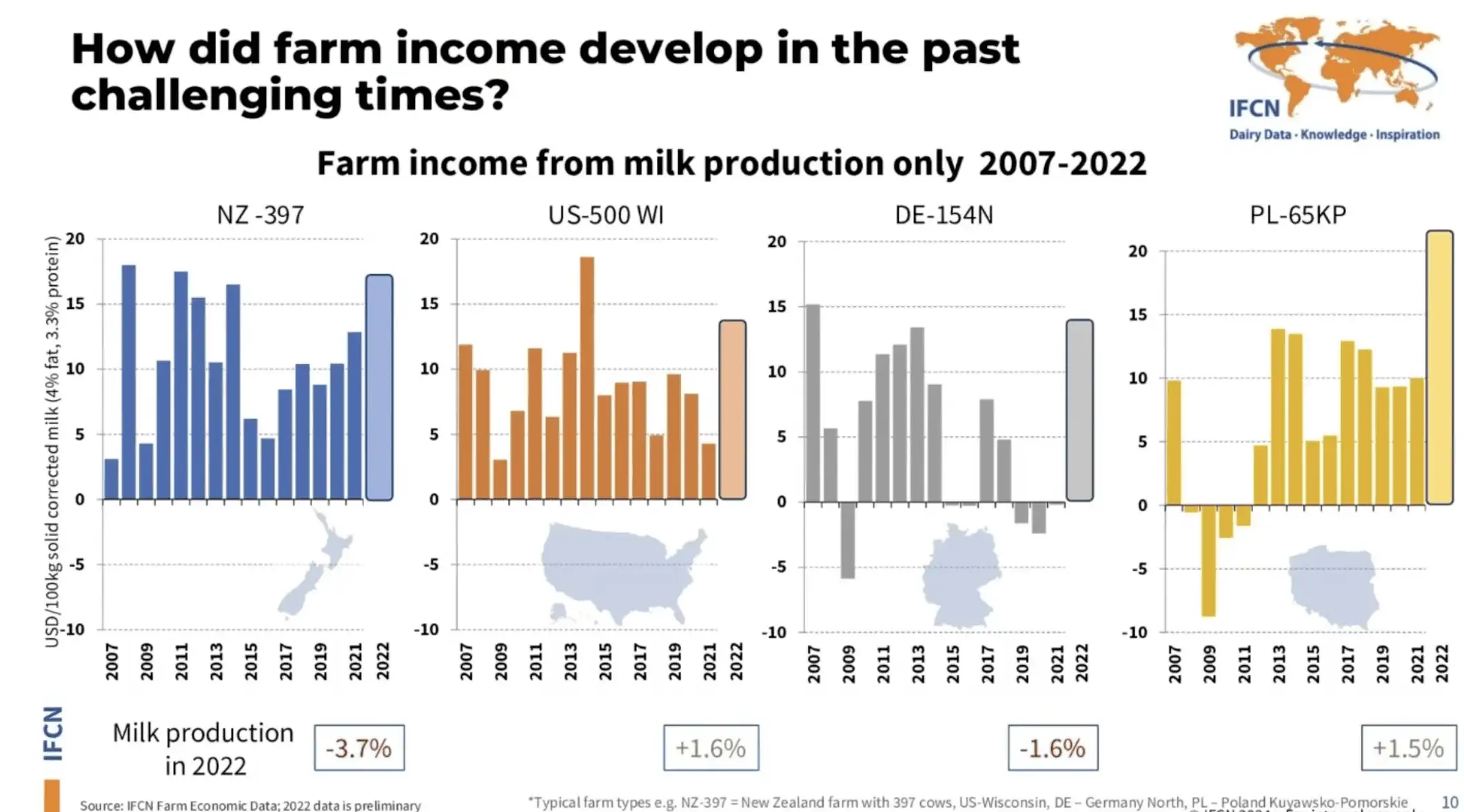

We’ve observed that farm income does indeed correlate with various factors, including market trends and environmental conditions, as evidenced by our latest data up to 2022, see Figure 5. For instance, in New Zealand, 2022 and 2023 were profitable years for farms, though there was a noted decrease in production due to the country’s heavy reliance on weather conditions—a key factor affecting their dairy sector.

Figure 5: Farm income from milk production only 2007-2022

In contrast, the United States showed an increase in farm income from milk production, with milk production itself rising by 1.6%. However, in 2023, this growth has moderated to lower levels. It’s worth mentioning that, despite general perceptions of declining milk production in the US, when we adjust for milk quality—specifically referring to solid corrected milk with 4% fat and 3.3% protein content—there hasn’t been a decrease in milk production for nearly a decade. This is because the increasing fat and protein content in milk compensates for any reduction in volume, highlighting a significant aspect of dairy production dynamics in the US.

8. We see yield, solar and margins are doing quite well for most farmers. Does this indicate that there is some hope on the horizon?

The development of farm income varies by region, with the US currently showing promising trends. In contrast, Europe presents a more nuanced picture. While yields and the content of fat and protein have seen improvements, particularly in Eastern Europe, there’s a potential challenge on the horizon concerning organic milk production. The shift towards organic practices might slow the pace of yield and quality enhancements, as organic farming does not always align with increases in these areas.

Eastern Europe, however, offers a bright spot with significant room for growth. Here, ongoing farm consolidation and the presence of smaller-scale farms present opportunities for substantial increases in production and efficiency. This suggests a potential realignment within the European dairy sector, with a noticeable shift in production dynamism from Western to Eastern Europe. Such a transition could redefine the landscape of milk production across the continent, influenced by organic farming trends and the varying pace of farm development and consolidation.

9. How does a farm’s financial performance affect its milk production capacity?

Despite farm income being a crucial metric, recent protests in countries like Germany and Poland highlight deeper issues. Financial resilience is vital for the long-term viability of dairy farms. For instance, comparing a German farm with 160 cows to a New Zealand farm with 384 cows reveals that, barring a few exceptions, the German farm has struggled to achieve a positive financial performance necessary for long-term investments.

This difficulty in securing investments complicates efforts to find successors and manage operations, especially in the face of challenges like fuel subsidies. Such factors, combined with regulatory and bureaucratic hurdles, underscore the complex relationship between a farm’s financial health and its ability to sustain or increase milk production volumes.

10. How do rising interest rates affect dairy farmers currently and looking ahead?

The topic of interest rates is particularly relevant for dairy farmers, given the varying levels of liabilities across farms in different countries and sizes. For instance, a Danish farm with 213 cows faces liabilities of about $15,000 per cow. Should interest rates stabilize at 5%, this scenario would significantly increase the cost of milk production for this farm by approximately $7 per hundred kilograms of milk. Consequently, farmers would need to generate an additional $7 in income per hundred kilograms of milk sold to offset the financial impact of these higher interest rates.

This financial pressure is especially problematic for farms with high liabilities. Without an increase in milk prices, the strain of rising interest rates could potentially lead to a global milk shortage. Moreover, the challenge of managing higher costs may deter the younger generation from entering the dairy industry or taking over existing operations, further complicating the issue of succession on farms.

As such, dairy farms are facing considerable strain due to high liabilities and the prospect of continuing high interest rates. If milk prices do not adjust upwards to reflect these increased costs, we could see a shift towards higher average milk prices globally, potentially making prices around 60 cents not an outlier but the new norm.

Key messages

- Enjoy Good Economics – past years

The increase in milk price exceeded the increase in production costs and many dairy farmers especially in the Northern Hemisphere generated a higher farm income than in previous years. - Adjust farm Economics – 2023

However, costs will stay at a high level, whereas the milk price significantly decreases this year. Farmers need to adjust their costs and the influence of some cost factors – feed, machinery, capital costs – are crucial. - Apart from economics – future years

In order to stay competitive and in business in the future, not only economic performance, but resilience and sustainability get paramount.

Interested in more dairy industry insights? At our dairy cafe, a free bi-weekly webinar, we frequently invite industry experts to take the stage and talk about their expertise within the global dairy market.

> Sign up for free.