The agricultural commodities market is a dynamic and complex industry that is influenced by numerous factors, including supply-demand dynamics, global trade policies, and weather patterns. To navigate this intricate landscape effectively, traders are turning to artificial intelligence (AI) for insights, informed decisions, and optimized strategies. Vesper, a cutting-edge AI platform, offers powerful tools to revolutionize agricultural commodity trading. In this article, we’ll explore three key ways in which Vesper leverages AI to improve trading in this sector.

1. Data-driven predictive analytics:

AI excels at analyzing vast amounts of data quickly and accurately. Vesper employs advanced algorithms and machine learning techniques to process historical and real-time data on global market trends, crop yields, weather patterns, and more. This enables AI algorithms to identify patterns and correlations that might elude human analysis, leading to more accurate predictions about future market movements.

For example, Vesper’s AI-powered predictive analytics can forecast future supply and demand dynamics for specific commodities based on historical weather data, crop yields, and market prices. Traders can use these predictions to optimize their strategies, such as determining the best timing for buying or selling a commodity. Leveraging AI-driven predictive analytics empowers traders to enhance their decision-making processes and improve profitability.

2. News monitoring:

In today’s interconnected world, news and social media play a vital role in shaping market sentiment and influencing commodity prices. Vesper acknowledges this significance and diligently monitors thousands of news sources to curate articles relevant to its users. By doing so, Vesper ensures that its users remain up-to-date with the latest events without the need to browse multiple news outlets.

Additionally, Vesper leverages AI to transcend language barriers and provide access to worldwide regional news. Its innovative translation technology allows users to stay informed about developments from various corners of the globe, including sources in Malaysia, Brazil, and beyond. This comprehensive approach to news delivery empowers users with a broader perspective on international affairs and their potential impact on the market and commodity trends.

3. AI-driven buying strategies:

Effective risk management is essential for success in agricultural commodity trading. Vesper recognizes this and employs the power of AI to provide cutting-edge solutions. Central to Vesper’s approach are market predictions and crucial market data that empower traders to make informed decisions when managing risks associated with agricultural commodity trading.

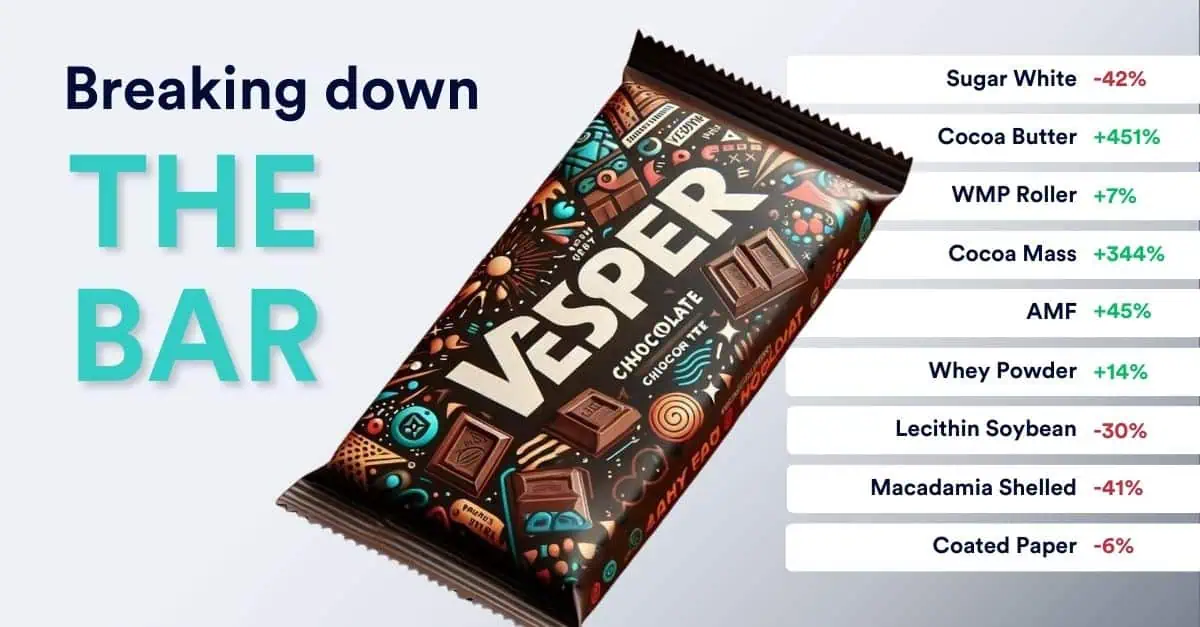

The Trading Agent project by Vesper exemplifies an exceptional application of AI in risk management. This project revolves around AI-driven buying strategies, powered by Reinforcement Learning trading agents. These intelligent algorithms learn from past data, adapt to changing market conditions, and optimize buying decisions to enhance profitability while minimizing losses.

To bring it all together

With the agricultural commodities market becoming increasingly complex and volatile, AI-powered tools by Vesper are crucial for traders to gain a competitive edge. By harnessing data-driven predictive analytics, sentiment analysis, and AI-driven risk management, traders can make informed decisions, identify profitable opportunities, and effectively manage risks. Vesper’s comprehensive suite of AI tools equips traders with invaluable insights, enabling them to navigate the complexities of agricultural commodity trading with confidence. Embracing AI technology empowers traders to optimize strategies, enhance profitability, and stay ahead in this dynamic market.

Want to learn more about how we use AI in forecasting? Read more here.