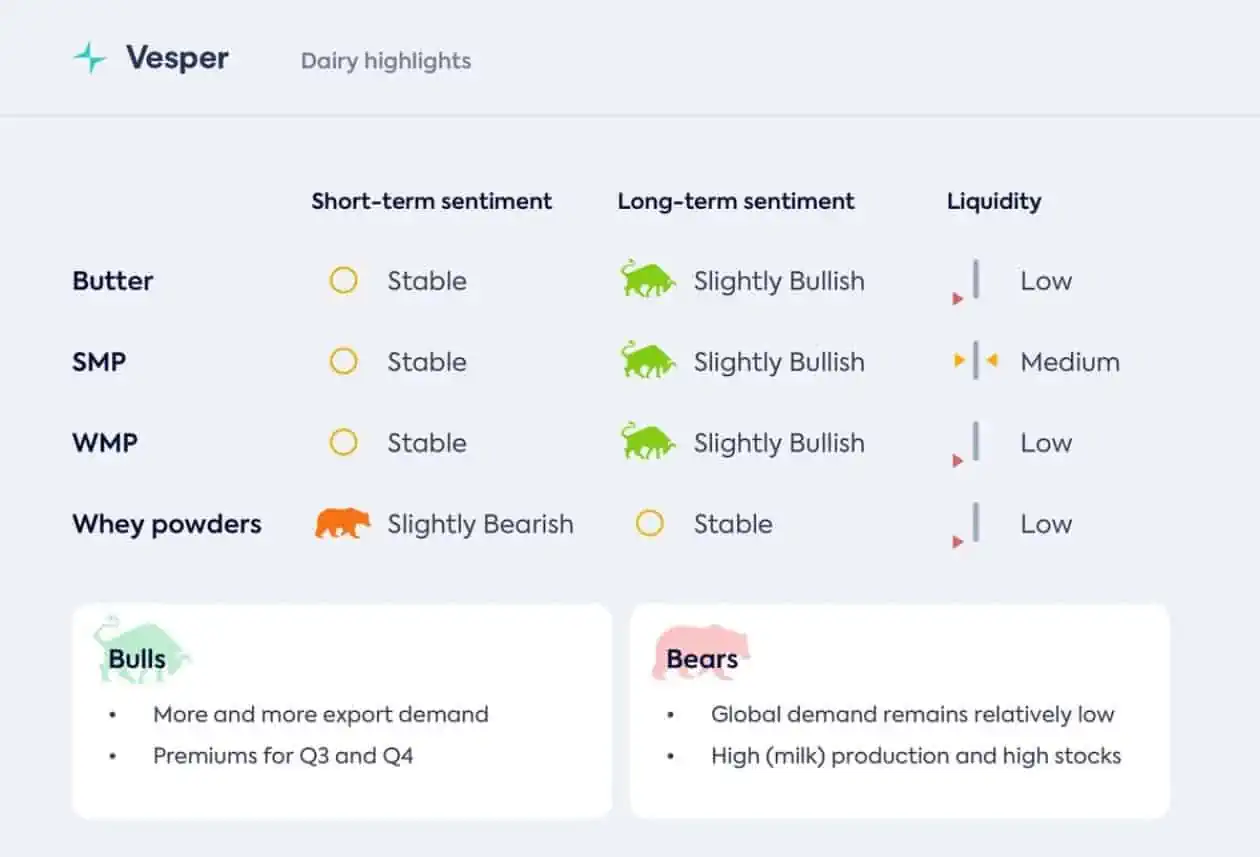

Buyers and sellers are continuing to look at Q3 with different views, which leads to an illiquid market.

Sellers are in no need to sell, as they have found enough outlets over the past months to prevent today’s stock levels from overflowing. This doesn’t mean that there is nothing to sell, which there is, as you can see in the volumes sold in tenders for example. It mostly means that there is no need to drop prices too much to get products moving. No pressure to sell leads to higher prices, which translates to premiums for Q3 and on.

Buyers on the other hand, are still hesitant due to the globally lower consumption of many end-products that contain dairy. Locking in products at today’s valuations is very interesting compared to the last 2 years, but buying too much remains a big risk, no matter the price. It seems that a premium is accepted by buyers, but mostly because they are buying less due to the lower-than-normal consumption.

Hidden gem: Swiftly make dairy calculations such as measuring the price of protein with Vesper’s free tools.

Start a free trial to access the full weekly Vesper Highlights on the Butter and Whey market.